Pinduoduo 2Q25 Quick Interpretation: The most 'magical' Chinese concept stock, Pinduoduo, is here to deliver heart-pounding excitement again! At first glance, after a major setback in the first quarter, the second quarter marks a dazzling comeback, truly stunning!

Pre-tax profit is almost back to its peak, reaching as high as 35.5 billion in a single quarter, over 30 billion in the second quarter. The market can easily calculate an annual profit exceeding 120 billion, and even after tax, it surpasses 100 billion RMB. Considering the company's reliable execution and future growth expectations, a 15X PE ratio comfortably places it above 200 billion USD.

However, amidst the excitement, it is important to note that 10.4 billion of the pre-tax profit actually comes from interest income and investment returns. Dolphin Research specifically checked, and unlike other peers who invest recklessly when they have money, the company's investment strategy is very cautious. This portion of income is almost entirely derived from cash management tools, such as buying bonds.

Last quarter, possibly because bond investment returns had not matured, there was only 200 million RMB. This quarter, it was realized, thus boosting this part of the income to 10 billion RMB. In fact, averaging over two quarters, it's around 5 billion RMB per quarter, not much different from past quarters.

To elaborate: this interest income clearly demonstrates how wealthy an e-commerce company can be when it focuses on its main business, doesn't spend recklessly, and operates with unparalleled efficiency!

Calculating single-quarter interest income at 5 billion, it accounts for one-third of the main business profit. In other words, when Pinduoduo needs to distribute dividends, it won't lack funds at all.

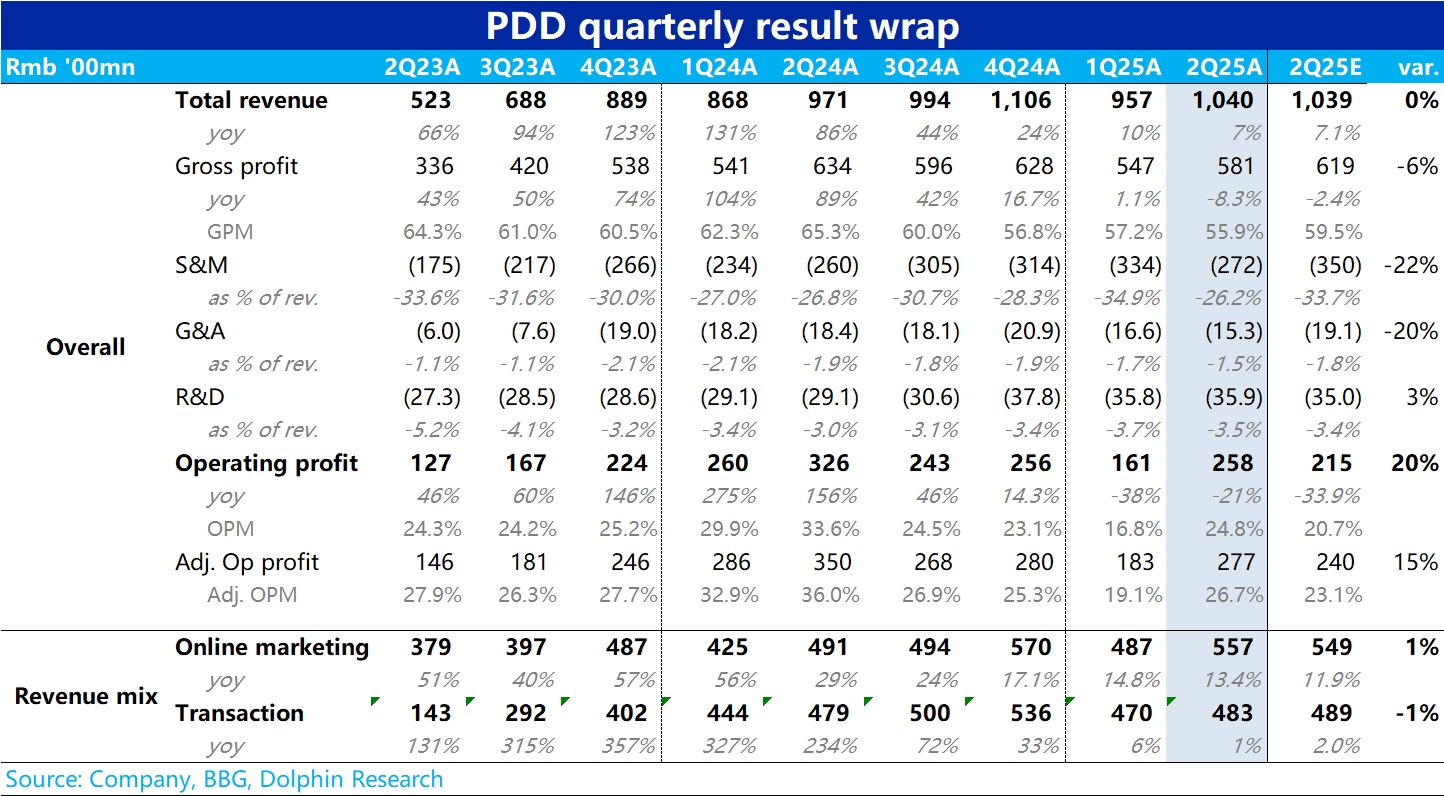

Excluding the impact of interest income, the actual operating profit is 26.8 billion, exceeding the market expectation of 21.5 billion, still significantly higher than expected, though the level of astonishment is much reduced.

Year-on-year, last year's operating profit was 32.6 billion, showing a noticeable decline. The reason is similar to the first quarter, likely due to the main site using substantial funds to compete with other e-commerce platforms more heavily influenced by state subsidies, to maintain Pinduoduo's user perception of the lowest prices online.

According to Dolphin Research, in the second quarter, subsidies were likely provided through smart subsidy coupons, and merchants had to pay to bid for the right to issue these smart subsidy coupons, making the distribution of subsidy coupons more efficient.

On the expenditure side, generous external marketing expenses remain relatively high, at 27.2 billion RMB for the quarter, with transaction-related income almost zero growth (with low subsidies like TEMU), higher than last year's 26 billion.

However, internal expenditures remain quite frugal: R&D saw almost zero growth quarter-on-quarter, even as everyone else invests in AI, and management expenses showed negative growth both year-on-year and quarter-on-quarter (mainly due to reduced stock option incentive expenses). Overall, internal expenditure still validates Pinduoduo as a highly reliable company in execution.

In terms of valuation, if the market currently believes that the company's profitability will be maintained as consumer subsidies gradually weaken and Pinduoduo adopts more intelligent subsidies, then the steady-state (without state subsidy impact) annual profit should indeed be above 120 billion RMB. With a nearly 15% growth rate in main advertising revenue, a 15X PE multiple should place the valuation at least around 220 billion USD.

Additionally, the company has zero interest-bearing debt, with cash reserves (cash + short-term investments) close to 55 billion USD. When the company starts a dividend mode, the valuation could potentially reach 300 billion USD (of course, this cannot be expected now, as the company needs to fully exhaust its growth story first).$PDD(PDD.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.