Top 10 Influencers in 2025

Top 10 Influencers in 2025拼多多-2025 年第二季度

Data:

This document is the unaudited financial results report for the second quarter of 2025 for Pinduoduo Holdings.

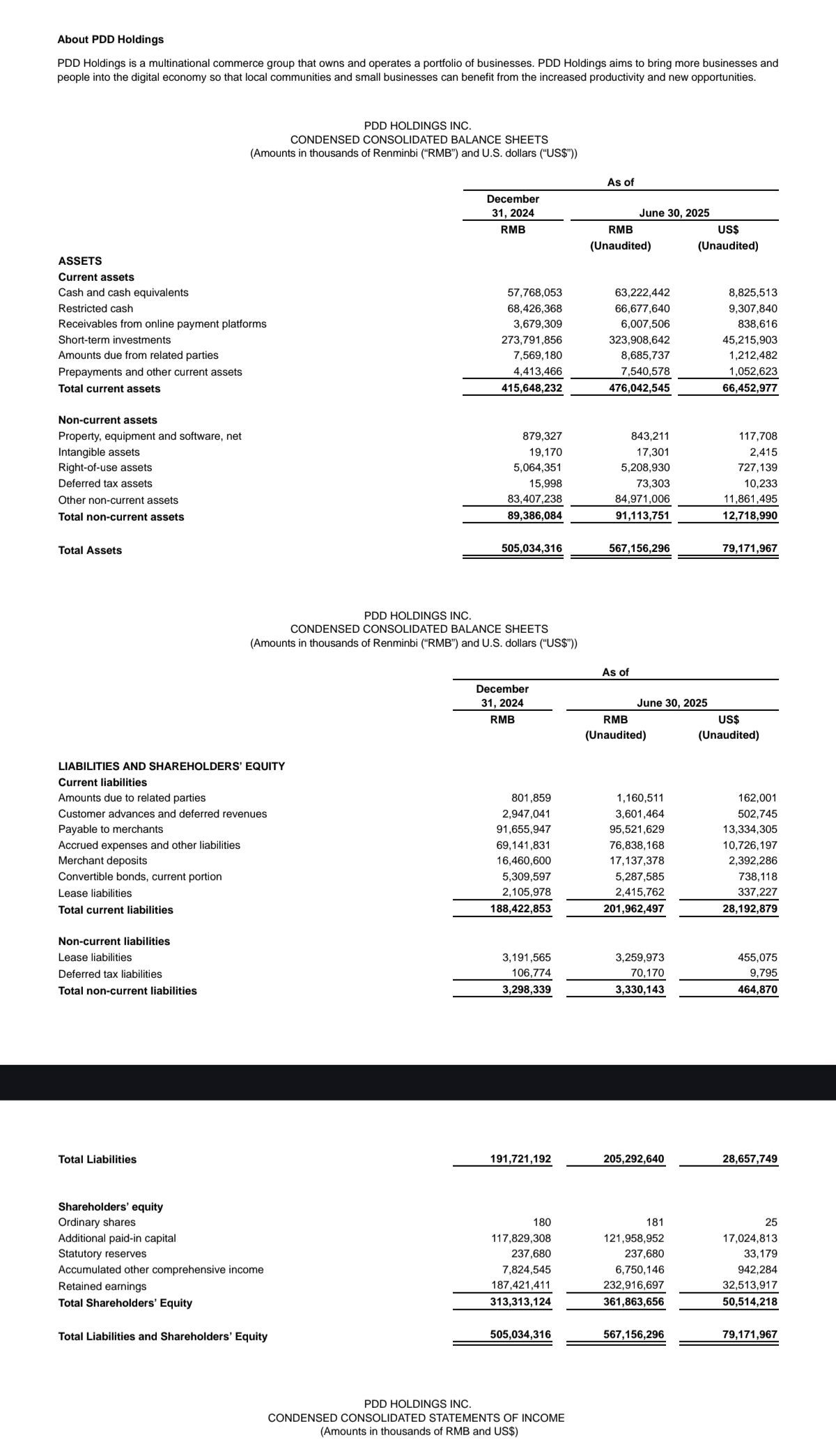

1. Overview of Key Financial Data

(Q2 2025 vs. Q2 2024)

- Total Revenue: RMB 103.985 billion / RMB 97.060 billion / +7%

- Operating Profit: RMB 25.793 billion / RMB 32.565 billion / -21%

- Net Profit: RMB 30.754 billion / RMB 32.009 billion / -4%

- Non-GAAP Net Profit: RMB 32.708 billion / RMB 34.432 billion / -5%

- Earnings per ADS: RMB 20.75 / RMB 21.61 / -4%

- Operating Cash Flow: RMB 21.642 billion / RMB 43.793 billion / -51%

2. Revenue Structure Analysis

· Online Marketing Services and Others: RMB 55.703 billion (+13%)

· Transaction Services: RMB 48.282 billion (flat)

Growth was primarily driven by online marketing services, while transaction services showed weak growth.

3. Cost and Expense Analysis

· Operating Costs: RMB 45.859 billion (+36%)

Mainly due to increased fulfillment expenses, bandwidth and server costs, and payment processing fees.

· Operating Expenses: RMB 32.333 billion (+5%)

· Sales and Marketing Expenses: RMB 27.210 billion (+4%)

· R&D Expenses: RMB 3.591 billion (+23%)

· General and Administrative Expenses: RMB 1.532 billion (-17%)

4. Cash Flow and Balance Sheet Highlights

· Cash and Short-term Investments: As of June 30, 2025, RMB 387.1 billion (approximately $54 billion), an increase from the end of 2024.

· Other Non-current Assets: RMB 85 billion, mainly including time deposits and held-to-maturity debt securities.

· Operating cash flow declined significantly, primarily due to lower net profit and changes in working capital.

5. Key Management Statements

· Chen Lei (Chairman and Co-CEO): Emphasized investments in merchant support, focusing on long-term ecosystem health.

· Zhao Jiazhen (Executive Director and Co-CEO): Mentioned comprehensive merchant support measures.

· Liu Jun (Vice President of Finance): Acknowledged slower revenue growth, intense competition, and short-term profit pressure.

6. Non-GAAP Adjustments

Non-GAAP operating profit and net profit both declined by approximately 21% and 5% year-over-year.

7. Summary

· Revenue growth slowed, competition intensified;

· Profitability under pressure, costs and expenses grew faster than revenue;

· Cash flow weakened, but cash reserves remain strong;

· Company strategy shifts to long-term investments, sacrificing short-term profits for ecosystem health.

The frenzy in the comments proves one thing: no one reads earnings reports; the market is all about luck and sentiment.

$PDD(PDD.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.