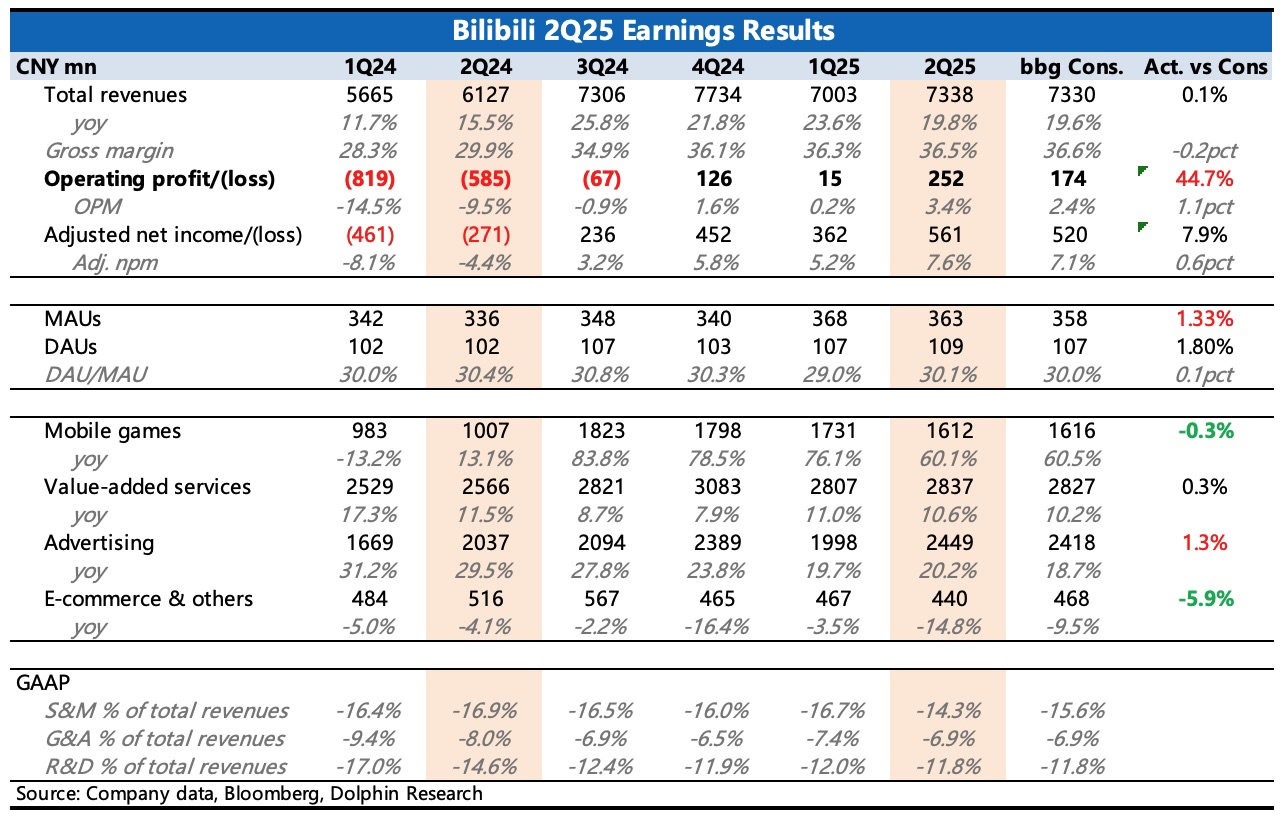

Bilibili 2Q25 Quick Interpretation: Bilibili's Q2 performance was generally acceptable. Except for the slightly underperforming IP e-commerce, the revenue side basically met expectations (optimistic funds might have higher expectations for games), and the profit side significantly exceeded expectations due to lower sales expenses, resulting in core operating profit being much higher than expected.

1. Mid-to-high growth expectations for games: Q2 was still benefiting from the base effect of 'Three Strategies', hence the 60% growth rate, which is in line with the company's previous guidance.

However, the second quarter originally had season updates and anniversary celebrations overlapping, so some optimistic funds might have had much higher expectations.

From the deferred revenue perspective, Q2 was 4.24 billion, a 10% increase quarter-on-quarter. Although the growth rate was not as high as when 'Three Strategies' was first launched last year, it was slightly better than the fluctuations in the same season in previous years without any blockbuster new games.

2. Steady growth in advertising: Q2 advertising growth rate was 20%, which is basically in line with the company's guidance, mainly driven by performance advertising.

At the previous Investor Day, the company emphasized the empowerment and optimization of its advertising recommendation system by AI (AI-driven advertising grew by 140% year-on-year). In addition, Dolphin Research believes it is also related to the release of inventory itself.

3. Continued expansion of user ecosystem: Q2 user metrics were also good, with monthly active users growing by 8% year-on-year, and user stickiness (DAU/MAU) remaining at around 30%. The average daily usage time per user during the period was 105 minutes, continuing to grow year-on-year.

4. Restrained marketing, improved operational efficiency: There were no new games during the period, but the anniversary celebration of 'Three Strategies' also required some promotion. Marketing expenses in Q2 continued to decline quarter-on-quarter and remained flat year-on-year, spending less than market expectations.

This ultimately led to profit release exceeding expectations, with GAAP core operating profit reaching 250 million, and a profit margin of 3.4%.

In the company's tracked metrics, Non-GAAP operating profit was 540 million, with a profit margin of 7.3%, also exceeding consensus expectations. $Bilibili(BILI.US)$BILIBILI-W(09626.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.