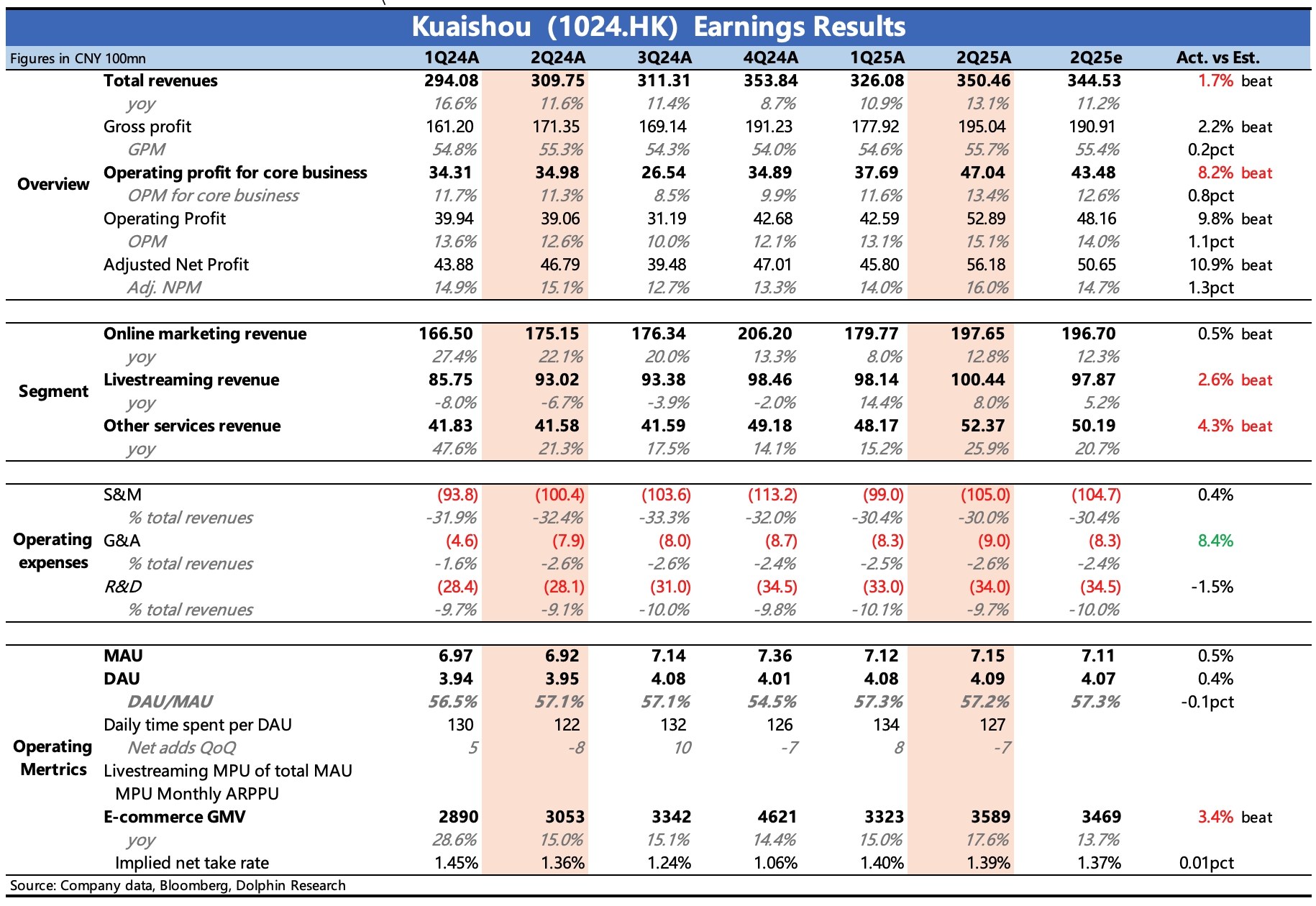

Kuaishou 2Q25 Quick Interpretation: The Q2 performance was overall satisfactory, with e-commerce and live streaming slightly exceeding expectations. Meanwhile, the increase in expenses continued to optimize, driving further improvement in operational efficiency. Beyond business, Kuaishou also announced its first special dividend.

1. The core driving the stock price increase since June— Keling, with Q2 revenue of 250 million, a quarter-on-quarter growth of 60%. As the market closely tracks this, there is not much deviation in expectations. The recent stock price adjustment, aside from pre-earnings risk aversion, is mainly due to dissatisfaction with Keling's short-term revenue growth.

Therefore, with the current traditional main business performing satisfactorily, the focus remains on the management's description of Keling's future dynamics, annual, and long-term operational goals during the conference call. At the very least, the original annual targets of 500 million and 750 million need to be further raised.

2. E-commerce exceeds expectations: In the main business, the standout performer was the e-commerce segment. Q2 GMV grew nearly 18% year-on-year, surpassing the previous low double-digit guidance and market expectations. E-commerce transactions were primarily driven by per capita spending, which increased approximately 15% year-on-year.

During the 618 period, with specific promotional activities, the proportion of general shelf e-commerce rose to 32%, with the daily active merchants in the mall scenario increasing by 30% year-on-year. Ultimately, with little change in commission rates quarter-on-quarter, overall e-commerce revenue (excluding Keling) grew by 20%, better than the market's expected 15% growth.

3. Advertising meets expectations, trend warming: Advertising grew by 13%, meeting consensus expectations, though slightly below some leading institutions' forecasts, possibly due to adjustments considering the industry's 618 performance.

Overall, advertising has bottomed out and is warming up as management indicated (AI + base slowing). Recently, Kuaishou added a food delivery entry, interpreted by the market as joining the food delivery battle. However, it is actually a partnership with Meituan, essentially still a traffic monetization business. Therefore, we expect continued acceleration in warming up in the second half of the year driven by AI, e-commerce food delivery, and a low base.

4. Operational efficiency continues to improve: Although in absolute terms, operating expenses were basically in line with expectations, considering the revenue exceeded expectations, actual operational efficiency improved. Ultimately, the core main business's operating profit was 4.7 billion, nearly 400 million higher than expected, primarily contributed by the revenue exceeding portion. The core operating profit margin was 13.4%, with the potential to approach 20% in the medium to long term.

5. Surprise dividend: There was a surprise in shareholder returns this time. In addition to the normal buyback (scale decreased compared to Q1), a first special dividend totaling 2 billion HKD (0.46 HKD/share) was announced, expected to be distributed in October. As a result, this year's buyback + dividend totals approximately 7.5 billion HKD, corresponding to the current market value of 310 billion HKD, with a shareholder return rate of about 2.5%.$KUAISHOU-W(01024.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.