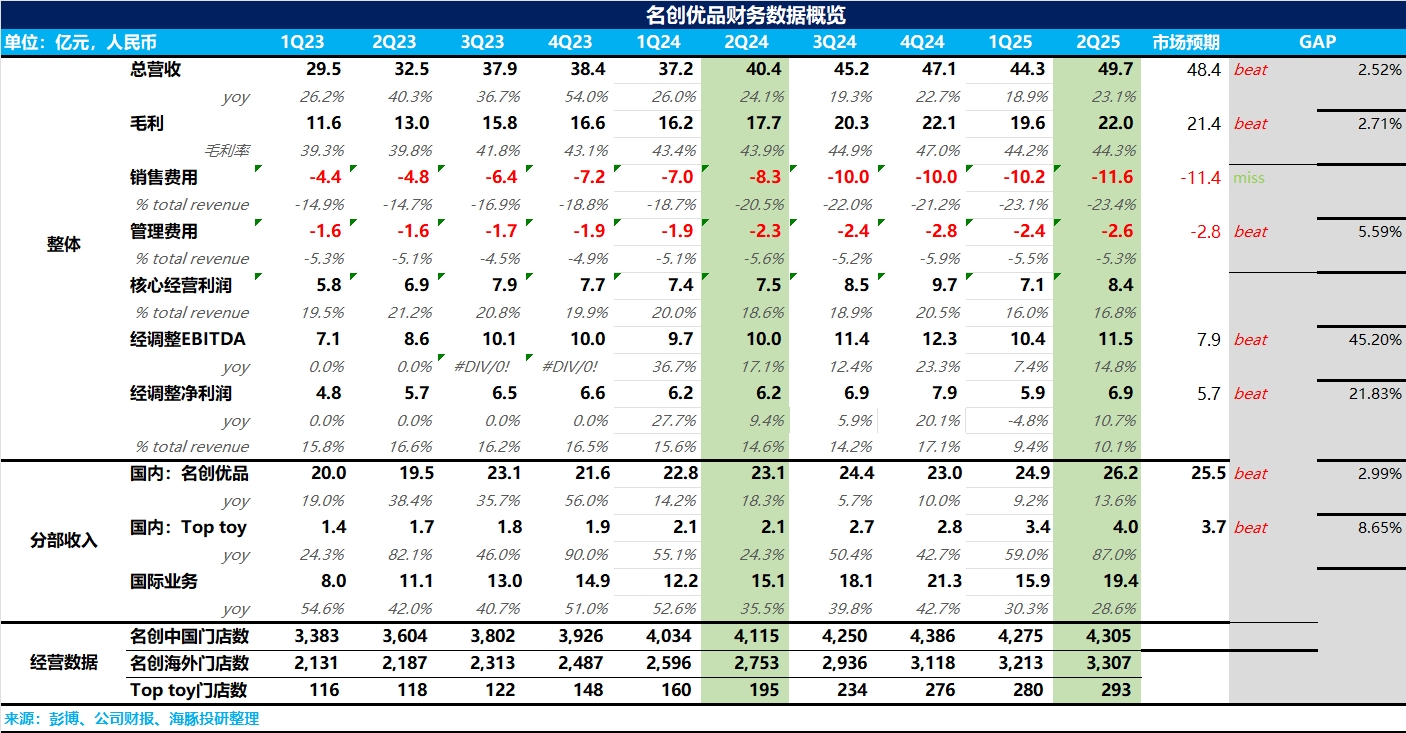

MINISO 2Q25 Quick Interpretation: Overall, MINISO's second-quarter performance was quite good. By closing inefficient small stores and converting small stores into larger ones, MINISO finally achieved positive same-store revenue growth at the group level in the second quarter.

Additionally, compared to the soaring selling expenses in the previous quarter, this quarter's selling expenses have somewhat contracted, and overall profit exceeded market expectations.

1. Revenue Exceeds Guidance Upper Limit: With the advancement of MINISO's "small store to large store" strategy, domestic same-store revenue turned positive, showing good performance. The most impressive aspect is that despite the accelerated store openings of TOP TOY, same-store growth remained in single digits, with revenue increasing by 87% to reach 400 million yuan.

However, the overseas business, still undergoing transformation, saw overall growth slow to below 30%, with same-store sales experiencing a low single-digit decline. Ultimately, the group achieved revenue of 4.97 billion yuan, a year-on-year increase of 23.1%, slightly exceeding market expectations.

2. Store Count Rebounds: In terms of store openings, after closing a large number of low-efficiency stores in lower-tier cities in the first quarter, the second quarter saw a rebound in store count, with growth mainly concentrated in third-tier and below cities.

Overseas, similar to the first quarter, the pace of store openings slowed, shifting from a dispersed layout to focusing on densely populated areas in the United States (California, Florida, New York, etc.) for cluster-style openings to improve logistics efficiency.

3. Core Operating Profit Exceeds Expectations: With the increase in the proportion of IP products and supply chain optimization, MINISO's Q2 gross margin slightly increased by 0.4 percentage points to 44.3%. Selling expenses, particularly IP licensing fees, were more restrained compared to the first quarter, ultimately achieving an adjusted net profit of 690 million yuan, exceeding market expectations. $Miniso(MNSO.US) $MNSO(09896.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.