Power Poster

Power Poster Feed Explorer

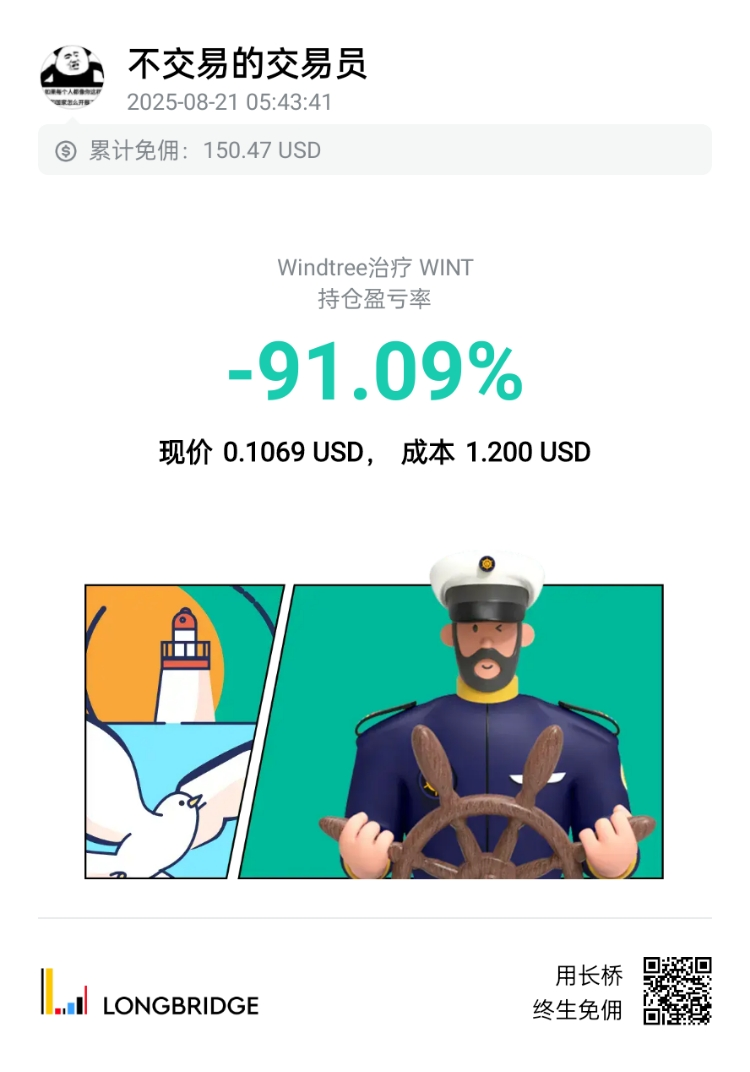

Feed Explorer$Windtree Therapeutics(WINT.US)

"Loss Review"

A trade that wasn't well thought out resulted in the most painful lesson in U.S. stocks, with a loss ratio comparable to that of expiration day options. Currently, this is the largest single trade in U.S. stocks.

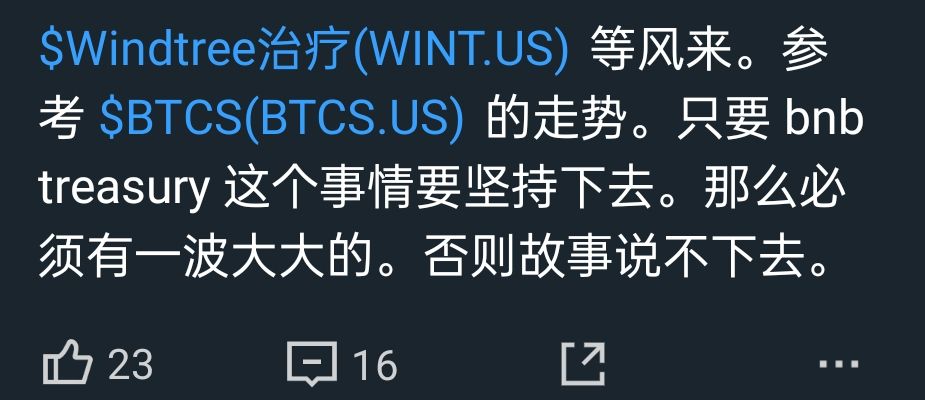

1. The only reason for buying was someone else's comment.

2. During a market surge, I had FOMO (fear of missing out) and impulsively bought in.

Looking back, this trade should never have been made.

1. It was a small-cap speculative stock with insufficient liquidity, and the risk was similar to that of Web3 meme coins—later turning into a PvP (player vs. player) scenario.

2. Technically, the daily chart showed a high-volume spike resembling the Guangzhou Tower, which was already a sign of distribution. Not a buying point.

3. It was a pre-market random order.

Reflecting on myself:

1. My trading system has obvious shortcomings in stop-loss—what type of stop-loss, and when to stop-loss? Whether in A-shares, H-shares, or U.S. stocks, I've been using the method of 'good entry points, no stop-loss.' But how to stop-loss if the entry point is bad?

2. How to control FOMO and the fear of big drops? For example, I didn't have the courage to buy the dip yesterday.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.