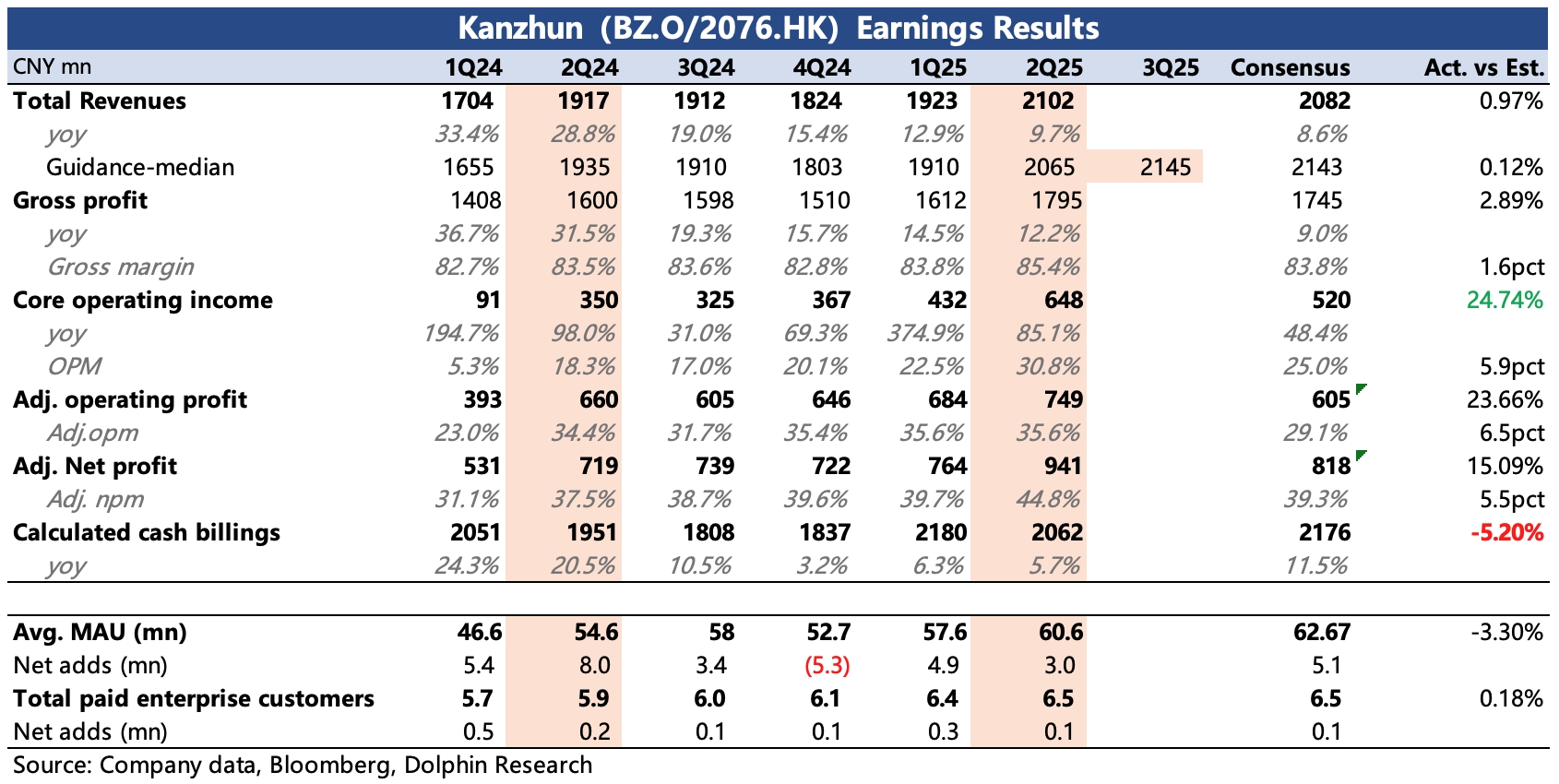

BZ 2Q25 Quick Interpretation: The Q2 performance had both positives and negatives. The positives include profit exceeding expectations, dividends, and a new buyback plan, while the negatives are weaker cash flow and Q3 revenue guidance that is essentially inline.

According to Dolphin Research, this mixed result reflects the current situation of 'high environmental pressure' and 'BOSS Zhipin having more relative advantages.'

1. Has the cash flow recovery trend halted?: Although Q2 revenue met expectations, cash flow was less than 2.1 billion, with a year-on-year growth of only 5.7%, which is not only below expectations but also seems to contradict the company's guidance of 'bottoming out in Q4 last year and recovering quarter by quarter.'

Dolphin Research believes that the misalignment of the spring recruitment due to the difference in the timing of the Spring Festival (earlier in 2025 than in 2024) might be one factor. Additionally, the impact of tariffs in April might have had a delayed reaction (in May, the company believed tariffs had no impact on foreign trade enterprise recruitment). It is recommended to pay attention to related statements in the conference call.

2. Guidance is also mediocre?: The company's guidance for Q3 total revenue is 2.13-2.16 billion, implying a growth rate of 11-13%, which is basically in line with expectations, but the improvement trend between quarters (Q3 compared to Q2) is not as apparent as the market expected.

Dolphin Research believes that, combined with Sensor Tower data (significant year-on-year growth in cash flow in June and July), BOSS Zhipin's guidance leaves room for maneuver, which aligns with the management's consistently cautious and conservative style.

3. User growth not fast enough?: The overall MAU in Q2 exceeded 60 million, but the market seemed to expect more. However, Dolphin Research believes this is not a major issue.

Compared to absolute values, we focus more on market share. According to Questmobile data, BOSS Zhipin's user share continues to increase. Since May, Yupaopao Recruitment, characterized by direct phone chats and targeting the blue-collar market, has increased advertising in first- and second-tier markets, striving to penetrate the white-collar market.

Dolphin Research believes there is no need to worry too much for now. Whether in terms of recommendation algorithms or the completeness and matching degree of the supply and demand ecosystem in the white-collar industry, Yupaopao poses little competitive threat to BOSS Zhipin.

4. Profit exceeded expectations: The main highlight of Q2 is the profit. The operating profit of the core business was 650 million, with the profit margin rapidly increasing to 31%, an 8 percentage point increase quarter-on-quarter, significantly higher than the market consensus. The essence behind this is:

1) Reflecting BOSS Zhipin's economies of scale, with improved gross margin and reduced R&D expense ratio;

2) Reflecting BOSS Zhipin's competitive advantage, with a reduced sales expense ratio.

3) Reflecting BOSS Zhipin's internal management efficiency, with SBC down 24% year-on-year.

5. Annual dividend and new buyback: The advantage of the business model is manifested in the increasing cash on the books, reaching 2.2 billion USD by the end of Q2 (including short-term deposits and investments). This time, an annual dividend plan is initiated, with 80 million USD (0.168 USD/ADS) to be distributed in October, and last year's approved buyback is extended by one year to August 2026, with a buyback not exceeding 250 million USD during this period. $Kanzhun(BZ.US) $BOSS ZHIPIN-W(02076.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.