Baidu 2Q25 Quick Interpretation: Q2 performance slightly exceeded expectations under conservative guidance, mainly reflected in cloud and profitability.

It should be noted that the current performance is largely priced into the current stock price. However, due to short-term pressures influenced by the company's proactive strategy, how the subsequent strategic direction and advertising expectations are guided will be more critical to the valuation trajectory.

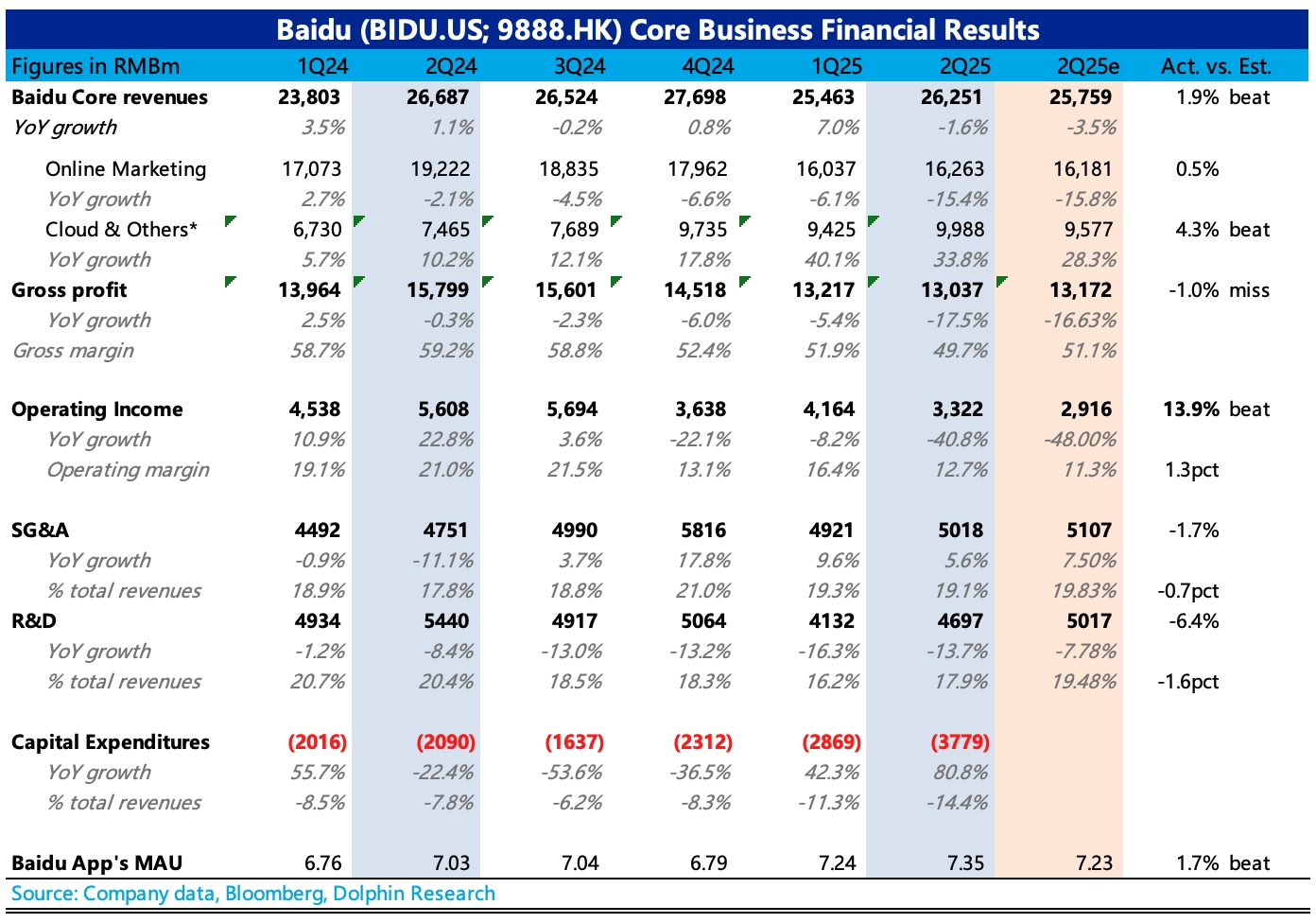

1. Pressure in Advertising Expectations: Q2 advertising revenue declined by 15.4%, which is basically in line with the company's guidance and market expectations.

The reasons for the decline, besides the inherent competitive impact, are mainly due to the aggressive increase in AI search result penetration (from 35% in April to 64% in July), while simultaneously slowing down the commercialization pace to ensure user experience (Q2 Baidu App MAU continued to increase by 11 million, reaching 735 million, possibly due to some positive pull from AI experience).

Additionally, there is an internal offset impact of approximately 300-400 million from YY advertising expenses (affecting about 2 percentage points of advertising growth). According to the strategic pace previously provided by the company, the monetization pressure brought by the AI search transformation will continue into Q3, with attempts to seek AI search monetization expected in Q4.

The market's expectations for Q3 have already declined, and the main focus is on whether Q4 will slow down and recover normally, which can be observed in the subsequent conference call.

2. The Highlight Remains AI Cloud: Q2 saw a 34% year-on-year growth in other revenues including cloud and smart hardware, with approximately 800 million in YY's single-quarter live broadcast revenue included. Excluding this, the growth rate is 23%.

Further breakdown suggests that AI cloud growth should be slightly above the market expectation of 25%, though not as impressive as Q1. Specific data will also be disclosed in the conference call, which is a key factor supporting valuation for Baidu under current advertising pressure, and it is recommended to closely monitor this.

Additionally, this quarter saw significant activity from Apollo Go, mainly targeting overseas markets, with collaborations with Uber and Lyft in Asia, the Middle East, and Europe, expecting to deploy thousands of Apollo Go autonomous vehicles in the coming years. However, performance impact is not expected until at least next year.

3. Profitability Exceeded Expectations: The poor performance of advertising, the main profit contributor, had a very noticeable drag on current profits, but not as bad as the market feared.

Q2 operating profit declined by 41% year-on-year. The decline was mainly reflected in gross profit (including the dual impact of revenue decline and increased AI costs), while operating expenses were actually restrained in Q2.

Sales expenses grew by 2%, possibly related to promotional expenses for AI product launches in the second quarter, while R&D expenses continued to decrease by 14%, mainly due to optimization of traditional R&D staff under AI efficiency improvements.

4. Buybacks Reduced Again: The sudden increase in buybacks in Q1 gave Dolphin Research a small expectation, but the buyback momentum slowed again in Q2, with the scale of buybacks this quarter being only half of Q1. During the performance pressure period, whether buybacks can support valuation confidence is also very important. $Baidu(BIDU.US) $BIDU-SW(09888.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.