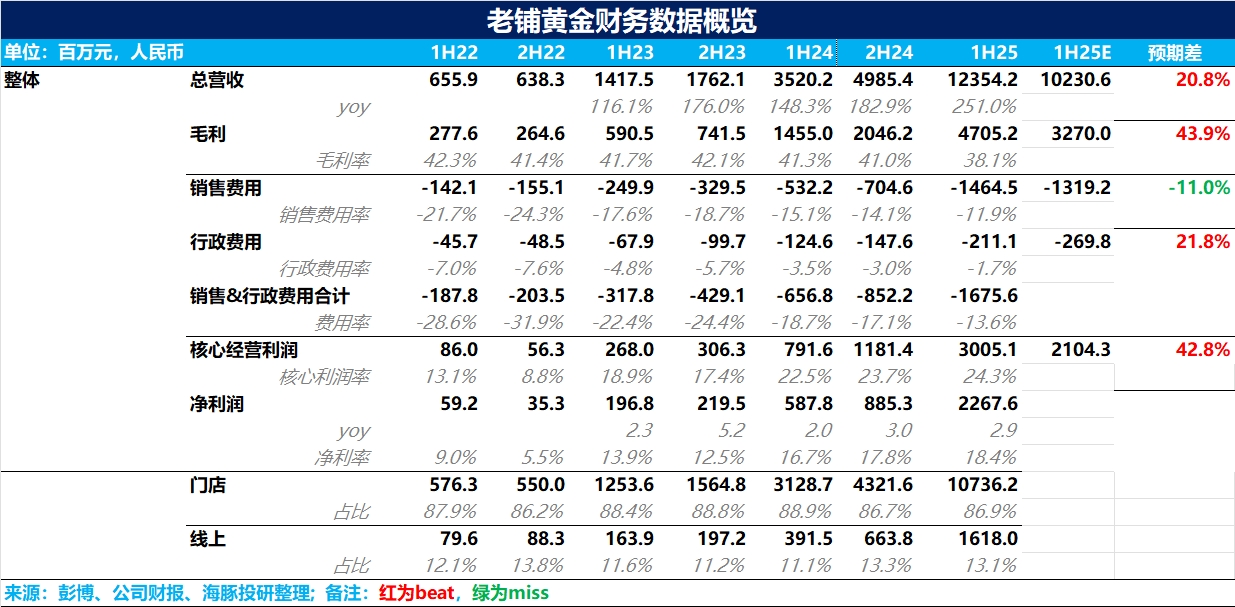

Lao Pu Gold 1H25 Quick Interpretation: Overall, Lao Pu's performance in the first half of the year was quite good, with both revenue and profit reaching the upper limit of the pre-announced growth forecast. Apart from sales expenses slightly exceeding market expectations, all other indicators generally surpassed expectations.

In terms of revenue, benefiting from the upward cycle of gold and the continuous enhancement of Lao Pu's brand power leading to customer base expansion and market penetration, Lao Pu's performance in the first half of the year remained in a state of accelerated growth, achieving revenue of 12.35 billion yuan, a year-on-year increase of 251%.

By channel, with Lao Pu's ongoing promotion and influence on social media platforms (Xiaohongshu, Douyin) in the first half of the year, the proportion of online platforms slightly increased by 2 percentage points to 13.1%, while offline stores remain the primary sales channel.

Regarding store opening pace, as of the first half of the year, Lao Pu opened 5 new stores, accelerating compared to the same period last year. Additionally, in June, Lao Pu opened its first overseas store in Singapore, marking the company's official start of global expansion.

In terms of product structure, although Lao Pu canceled the disclosure of the specific proportion of pure gold and pure gold inlaid categories, based on research information, the proportion of Lao Pu's high gross margin category, pure gold inlaid products, continues to increase.

Regarding gross margin, due to the surge in gold prices in the first half of the year, although Lao Pu raised prices once in February, the price increase range (between 5%-12%) was less than the increase in gold prices (around 24% in the first half of the year), resulting in a year-on-year decrease in gross margin by 3.2 percentage points to 38.1%.

On the expense side, with the release of operating leverage, both the sales expense ratio and management expense ratio significantly declined, ultimately achieving a net profit of 2.27 billion yuan, a year-on-year increase of 286%, with net profit margin increasing by 1.7 percentage points to 18.4%.

For detailed information and related judgments, please follow Dolphin Research's subsequent financial report commentary and conference call minutes. $LAOPU GOLD(06181.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.