$POP MART(09992.HK) Learned a lot from the excellent value investing teacher today.

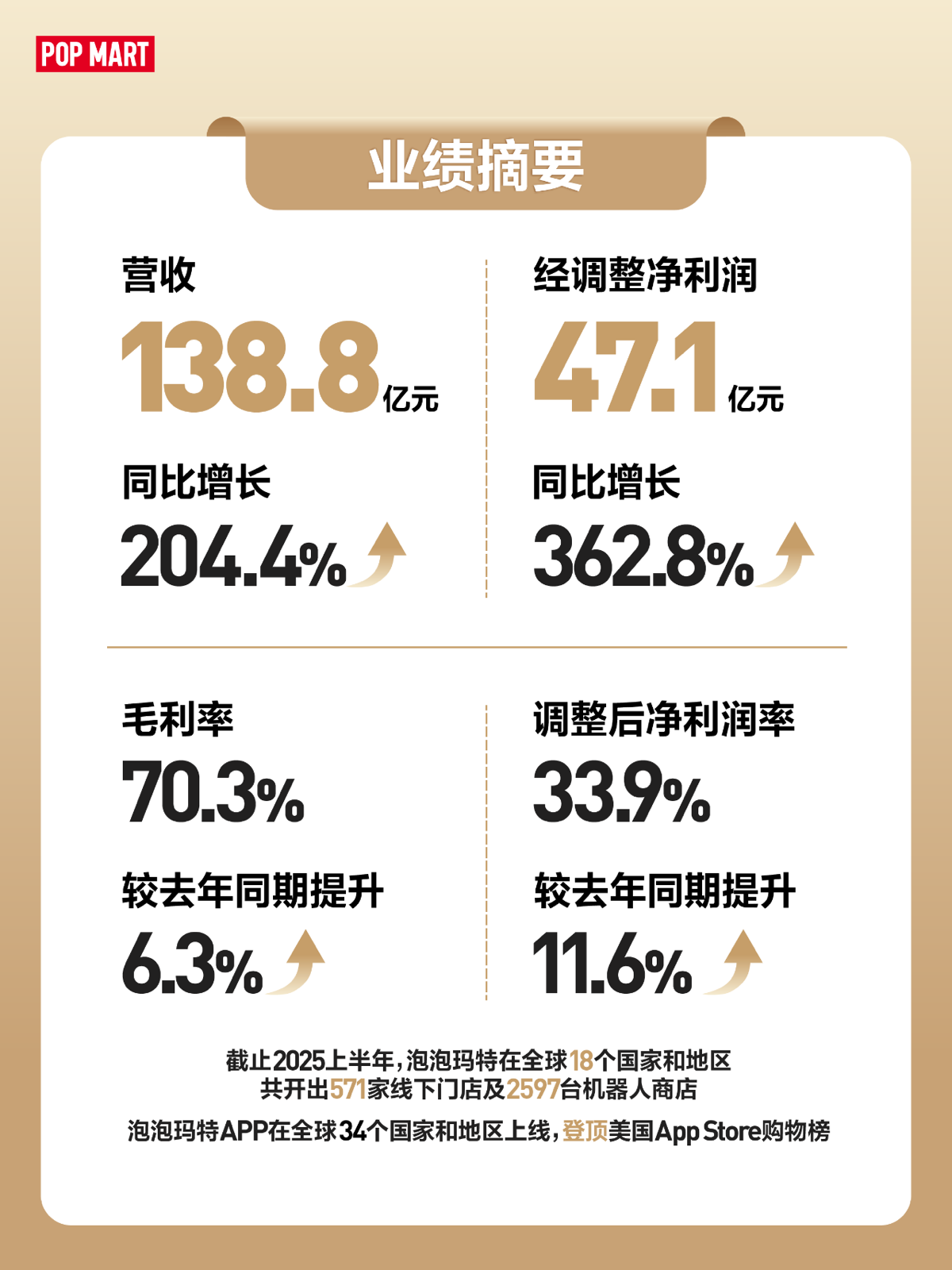

📈 Key points from Pop Mart's financial report: EPS increased by 11.6%

Core formula for stock price drivers: Stock price = EPS * P/E ratio

EPS: Earnings per share formula: EPS = Net income attributable to common shareholders / Weighted average number of common shares outstanding. Meaning: Represents the net profit created by each common share. It is the most direct per-share indicator of a company's profitability. Those interested in the correlation between ROE/EPS/stock price can research it themselves. In business, ROE was previously favored as it represents the return on investment and profit margin. For corresponding professional terms in listed companies, interested parties can research them.

🧸 Insights from the expert teacher on the financial report:

1. Overall, this report exceeded expectations.

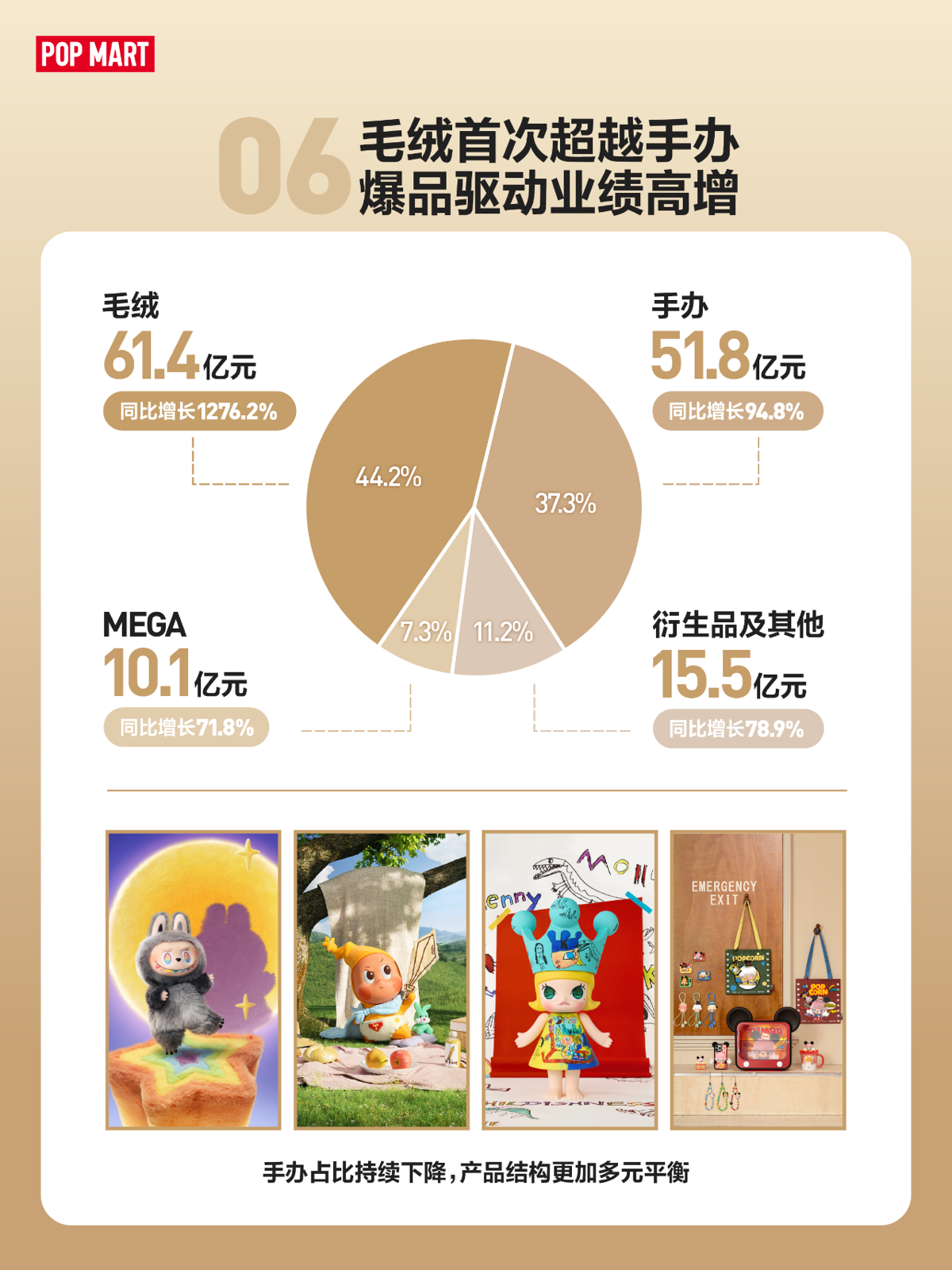

1. Margin 2. Labubu's proportion did not exceed 35%, which is very good.

Net profit margin increased by 11% year-on-year to 33.9%, which exceeded expectations.

Previously, foreign investors optimistically estimated around 32%, so this is above expectations.

❤️ Still holding for now, temporarily expecting to hold between 325-350. Mainly because there are no other value investing companies that I'm super interested in at the moment. Will continue to explore and look for excellent cash cow companies in the near future.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.