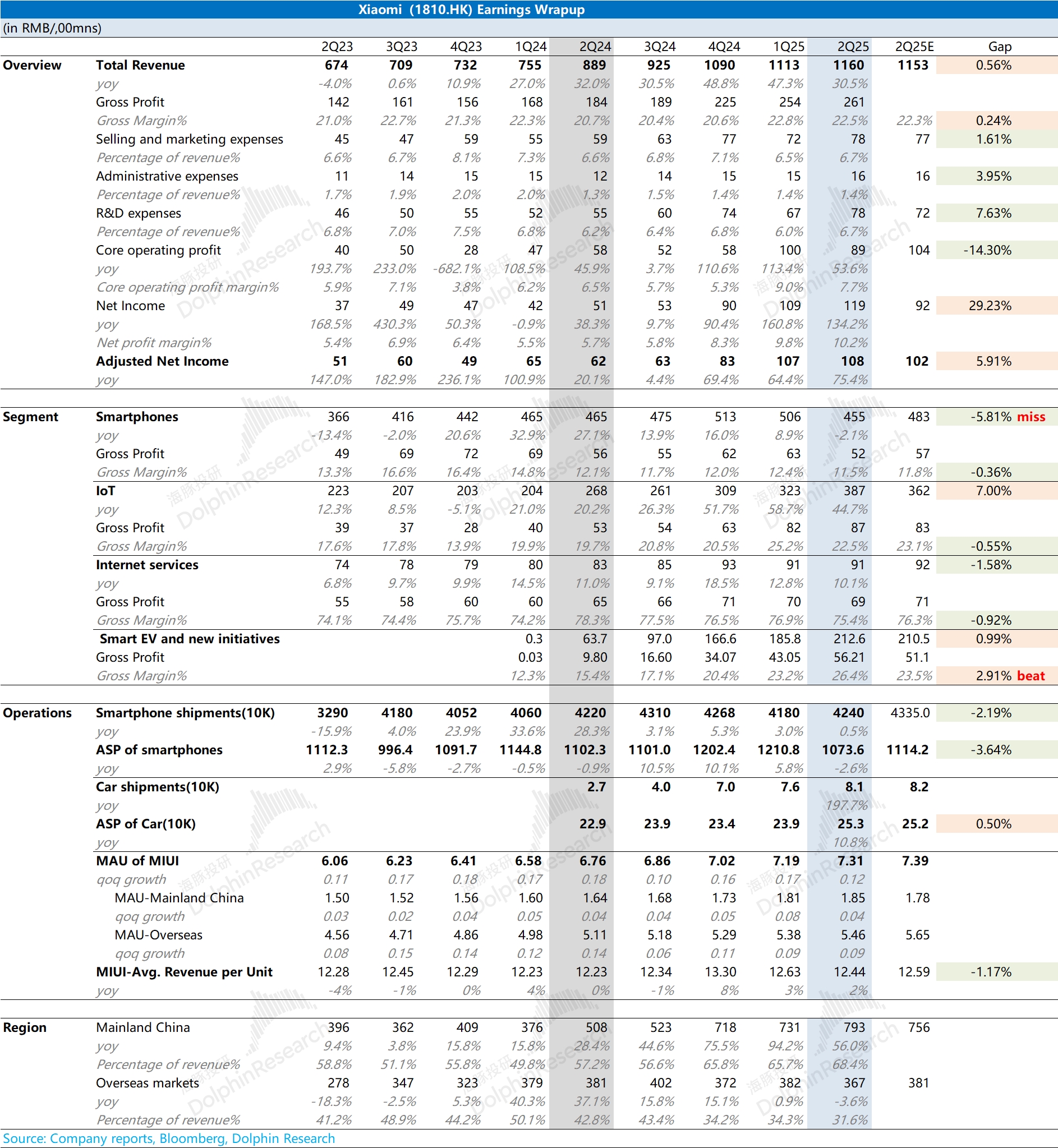

Xiaomi 2Q25 Quick Interpretation: Smartphones Fall Back into Slump, Automotive Remains Hot. The company's revenue and profit for this quarter appear stable, but a closer look at each business reveals a 'tale of two extremes.'

Specific breakdown by business:

a) Cold Smartphone Business: The company's smartphone business revenue declined again this quarter. Even with the support of state subsidies, although shipment volume increased year-on-year, the significant drop in average selling price directly led to the first decline in the company's smartphone business in the past seven quarters;

b) Hot Automotive Business: The launch of the YU7 this quarter has once again fueled Xiaomi's automotive segment. Even though the second-phase factory has started mass production, the production cycles for the SU7 and YU7 have not shortened. The SU7 requires a production cycle of over 9 months, while the YU7 requires a wait of more than 1 year.

Under the influence of increased average selling price and economies of scale, the gross margin of the company's automotive business this quarter has risen to 26.4%. With the acceleration of mass production in the second-phase factory in the second half of the year, Dolphin Research anticipates that Xiaomi's automotive business is likely to achieve profitability in the latter half of the year.

On one hand, considering the slowdown in the growth of the IoT business, Xiaomi's traditional hardware business is increasingly less influenced by the support of state subsidies, while downstream market demand remains relatively weak. Therefore, this will also affect market expectations for a recovery in Xiaomi's traditional business in the second half of the year.

On the other hand, the strong performance of the automotive business can still instill confidence in the market. Although constrained by capacity bottlenecks, there is no sign of a shortened production cycle for Xiaomi's automotive segment.

As the factory expands production, under the influence of economies of scale, Xiaomi's automotive gross margin is expected to continue to rise, accelerating the push towards profitability in the automotive business. For detailed information and related judgments, please stay tuned for Dolphin Research's subsequent earnings report commentary and conference call minutes.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.