XPeng 2Q25 Quick Interpretation: Overall, in terms of the second quarter performance itself, XPeng delivered a decent report.

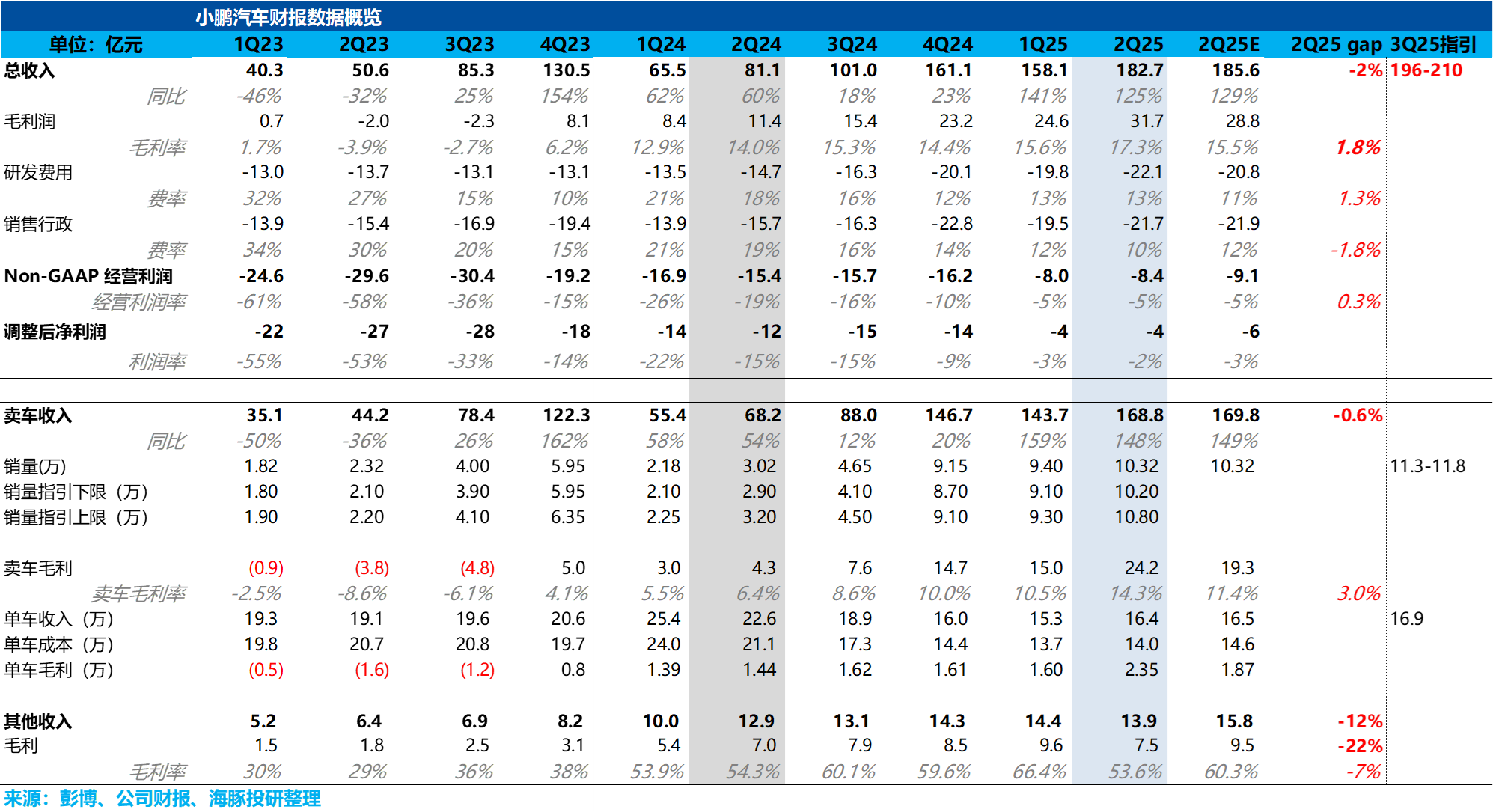

Total revenue reached 18.3 billion, slightly below the market expectation of 18.6 billion, mainly due to the quarter-on-quarter decline in service and other income, which was caused by the decrease in recognition of technical research and development service fee income this quarter.

Regarding the crucial car sales performance, the average selling price of cars this quarter was in line with market expectations, but the gross margin on car sales significantly exceeded market expectations, rising by 4 percentage points quarter-on-quarter to 14.3%, higher than the market expectation of 11.4%.

The main reasons for the higher-than-expected gross margin on car sales this quarter are: ① The proportion of high-priced models (such as the revamped G6/G9/X9) in the model structure increased by 17 percentage points quarter-on-quarter, while the proportion of the low-priced Mona M03 decreased by 12 percentage points quarter-on-quarter.

② The quarter-on-quarter increase in sales volume led to a reduction in per-unit amortized costs due to the release of scale effects.

However, for the third quarter expectations, XPeng's revenue and sales guidance are both below market expectations, with third-quarter sales guidance of 113,000-118,000 units, implying an average delivery of 38,000-40,000 units in August and September. Since XPeng's new P7 is expected to be launched in August, such lower-than-expected sales guidance may raise concerns in the market about the sales of XPeng's new P7. $XPeng(XPEV.US) $XPENG-W(09868.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.