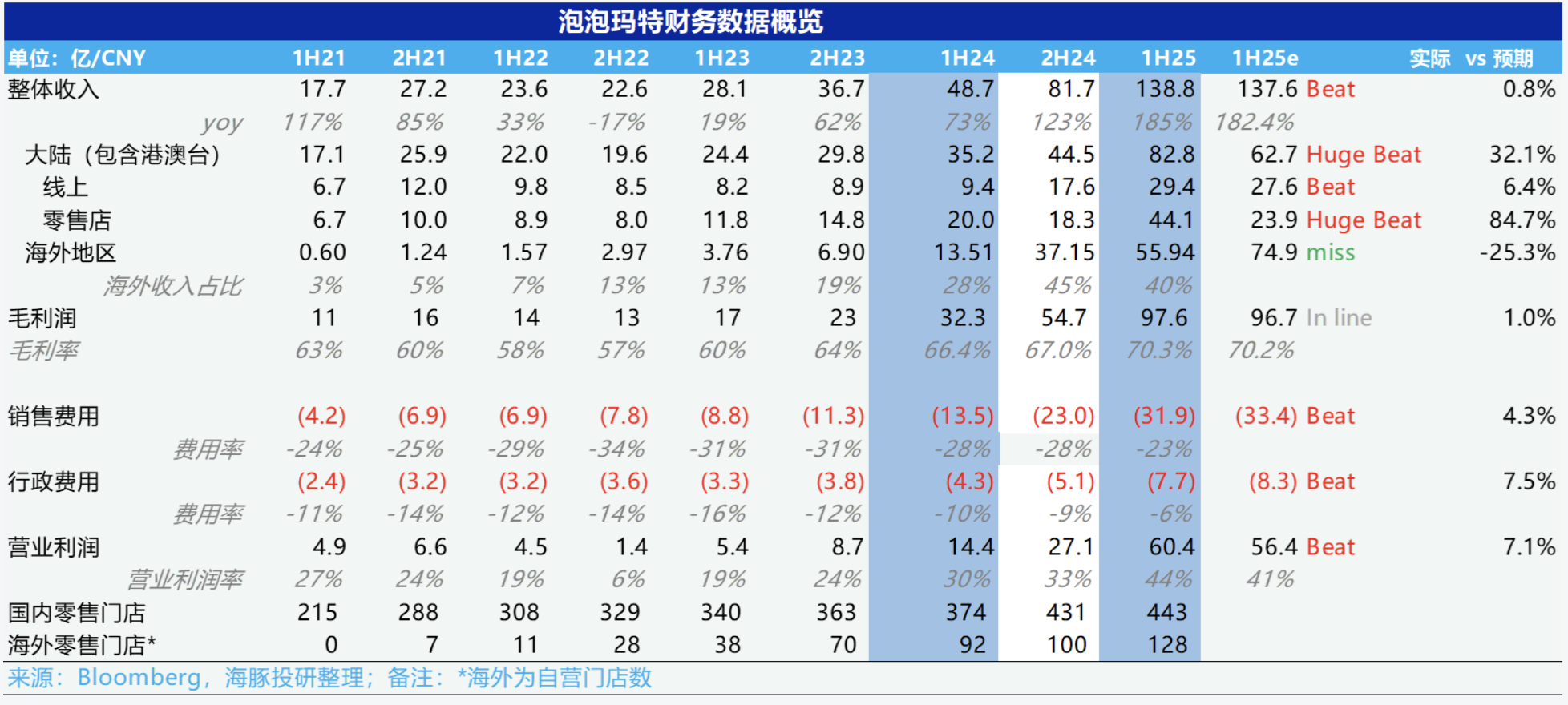

Pop Mart 25H1 Quick Interpretation: Overall, compared to the previously announced forecast, the revenue remained basically flat, with a key focus on the profit increasing by nearly 400% year-on-year (the forecast indicated no less than 350%), exceeding market expectations.

What surprised Dolphin Research was that despite LABUBU's explosive popularity overseas in the second quarter, the overall proportion of THE MONSTERS series only increased by 6% compared to the second half of last year, reaching 35%, indicating a relatively healthy IP matrix.

1. Domestic offline stores exceeded expectations. In 25H1, Pop Mart achieved a total revenue of 13.88 billion yuan, a year-on-year increase of 204%. Breaking it down, domestic revenue reached 8.28 billion yuan, a year-on-year increase of 135.2%, exceeding market expectations.

The core reason is that with the improvement of the company's brand awareness and the introduction of diversified product categories & IPs, the customer traffic in offline retail stores was significantly higher than the same period last year.

In overseas regions, due to the explosive popularity of LABUBU, market expectations were relatively high. However, the first half of the year is a low consumption season in developed countries such as Europe and the United States, so the performance was not as bright as expected.

2. The contribution of various IPs to performance is relatively healthy. Due to the explosive popularity of Labubu in developed countries such as Europe and the United States, THE MONSTERS series became one of the most popular IPs globally in the first half of the year, with its proportion further increasing to 35%.

In addition, other IPs maintained relatively strong vitality through image evolution and iteration, with a total of 13 IPs generating over 100 million yuan in revenue, indicating a relatively healthy overall IP matrix. Besides, the Xingxingren series became the company's fastest-growing IP, currently accounting for nearly 3%.

3. Plush toys have become the largest category. From a category perspective, the proportion of figurines represented by blind boxes continued to decline, replaced by the explosive growth of plush toys with higher gross margins. Besides the surge in sales of THE MONSTERS series, many other IPs under the company have gradually adopted plush toy designs, with the overall proportion soaring from less than 10% in the same period last year to 44%.

4. Gross profit margin reached a record high. Due to the increase in the proportion of high-margin overseas business and the company's supply chain optimization in the first half of the year, the gross profit margin of 25H1 reached 70%, a record high.

5. Operating leverage released, profit far exceeded expectations. In terms of sales expenses, due to the company's increased traffic on overseas online platforms (Ins, TikTok, etc.), the customer acquisition cost through these channels was much lower than traditional channels, resulting in a significant decrease in the sales expense ratio. The management expense ratio also significantly decreased due to the company's restrained investment and improved internal decision-making efficiency, ultimately leading to core operating profit exceeding market expectations. $POP MART(09992.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.