JD.com 2Q25 Quick Interpretation: As the earliest participant in the food delivery battle, which affects the entire Hang Seng Tech (also humorously called the 'Food Delivery Index'), JD.com has released its earnings. This time, the performance can be described as 'fragmented,' with both highlights and shortcomings being quite extreme.

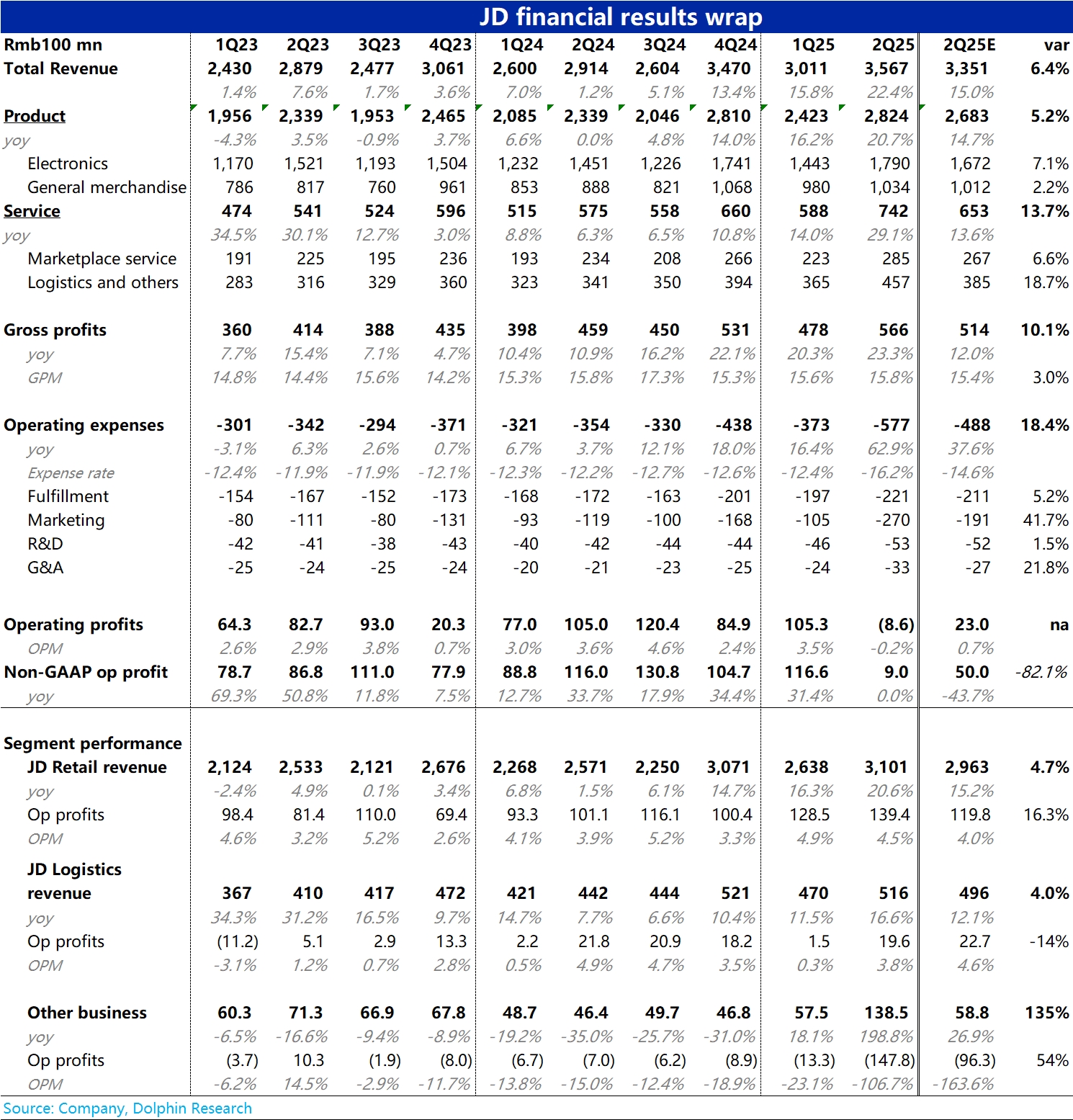

1) Firstly, in terms of big numbers, total revenue increased by 22% year-on-year, far exceeding the market expectation of 15%, mainly due to the strong growth of the main site mall business (+20%). The market's significant underestimation of new business revenue affected by food delivery is also one of the reasons. The growth side performed extremely well.

However, in terms of profit, although the main site business profit was stronger than expected, the losses from new businesses far exceeded expectations. The group's overall GAAP operating profit for this quarter was even -900 million, the profit side can be described as extremely poor. (The disclosed net profit greatly exceeded expectations mainly due to non-operating gains and zero tax impact this quarter, which is not very meaningful for reference).

2) Looking at the segments, the performance was also very fragmented. Firstly, the core main site business revenue & profit both beat expectations, showing strong performance.

Driven by state subsidies and possibly cross-selling with food delivery, main site revenue grew by 20%, far exceeding the expected 15%. Among them, electrical products were the main driving factor, with year-on-year growth rate significantly rising to 23% (matching industry trends), from which it can be inferred that state subsidies should still be the biggest support. The growth of general merchandise was relatively stable.

Additionally, most sell-side expectations before the earnings release predicted that due to increased investment in the 618 event, the main site's profit margin might only remain roughly flat year-on-year, but it actually rose by nearly 0.6 percentage points. Therefore, the main site's operating profit actually increased by nearly 38% year-on-year, exceeding expectations by nearly 2 billion.

3) However, the problem is the 'wild card' reflecting the impact of the food delivery surge — new business operating losses this quarter reached 14.8 billion (only 1.3 billion last quarter), even though sell-side expectations had already set a not-low loss of about 10 billion. This directly dragged the group's operating profit into negative territory.

Although losses caused by non-food delivery businesses may also have increased (JD.com is also making efforts in other new businesses), it roughly reflects that the actual losses from food delivery may have risen from the expected 9-10 billion to around 12 billion.

In summary, the performance of JD.com's original core e-commerce business is good, which is positive news for JD.com itself. However, for the 'Food Delivery Index' and other participants, the market is still likely underestimating the profit drag caused by this. It is a bad signal for the subsequent losses in food delivery in Meituan and Alibaba's earnings. $JD.com(JD.US) $JD-SW(09618.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.