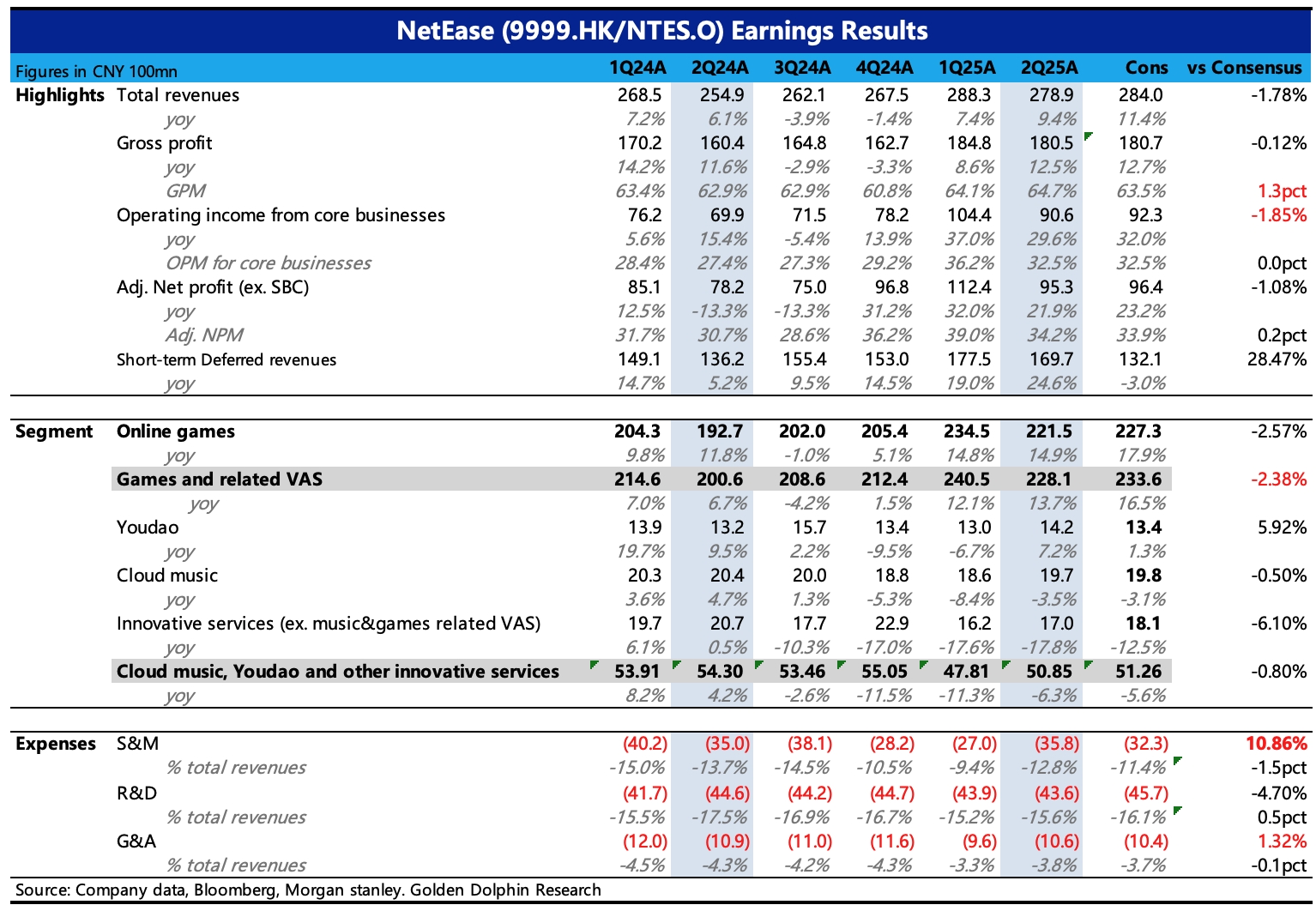

NetEase 2Q25 Quick Interpretation: Second-quarter performance slightly missed expectations, with the main discrepancies in gaming and selling expenses. The performance itself is not bad, but after last quarter's significant outperformance, the market has been continuously raising expectations for NetEase.

Additionally, with the improvement in the revenue of 'Eggy Party' in July, the new high in monthly DAU of 'Fantasy Westward Journey', and the approval of the license for 'Diablo 6', as of yesterday, NetEase's valuation has recovered from 13x in Q1 to 16x (with the stock price at a high corresponding to 18x), a 27% increase, ranking among the top in major Chinese concept stocks.

When high expectations are unmet, and the pipeline of new games in the second half is lackluster (with no absolute blockbusters, and low market expectations for 'Destiny: Stars' due to concerns about the current oversupply of shooting games and intense competition), the market naturally feels disappointed with this not-so-impressive performance.

1. Gaming below expectations: Q2 growth was 13.7%, with core gaming growing by 15%. After Q1, market expectations were actually not low, with some optimistic forecasts seeing 16-17% growth.

The growth during the period mainly benefited from the incremental contributions of several new PC games such as 'Marvel Duel', 'Seven Days World', 'FragPunk', and the evergreen mobile game 'Identity V'. Deferred revenue was 17 billion, up 25% year-on-year (with a low base last year), down 4% quarter-on-quarter, which is a normal trend considering past seasonal changes.

2. Significant increase in marketing expenses: Another dissatisfaction may be the substantial increase in selling expenses. Since the internal anti-corruption review started in the second half of last year, Q4 and Q1 selling expenses were directly reduced by one-third year-on-year. The company stated that this was due to optimized promotion strategies, while emphasizing that marketing expenses would fluctuate significantly with game launch plans.

However, regardless of the real reason, the market originally expected this trend to last for a cycle, so the sudden increase before a full-year cycle was unexpected.

In the second quarter, NetEase still had some new games, but due to the relatively few mobile games with inherent popularity, the demand for promotion increased, and the impact of preheating for several game anniversary events in the second half of the year caused short-term fluctuations in spending.

Dolphin Research believes that the increase in marketing expenses should not be viewed too negatively. For a gaming company, only during the bottom cycle is it necessary to be particularly restrained with expenses. For a gaming company like NetEase with a multi-product matrix, short-term revenue gaps can be quickly filled through operational means.

Yesterday, Tencent's financial report also indicated that evergreen games have a high bottom-line and value re-exploration capability. However, in the competition between Tencent and NetEase, Tencent, with its channel advantage, still has the upper hand in ROI of investment.

Ultimately, under GAAP, core operating profit was 9.1 billion, up 30% year-on-year, but the profit margin was 32.5%, down more than 3 points quarter-on-quarter, which is larger than the usual seasonal fluctuations.

3. In other businesses, Youdao's revenue exceeded expectations, and Cloud Music met expectations, with subscription revenue growing steadily by 16%, and the gross margin optimization speed slowing at 36%. $NTES-S(09999.HK) $NetEase(NTES.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.