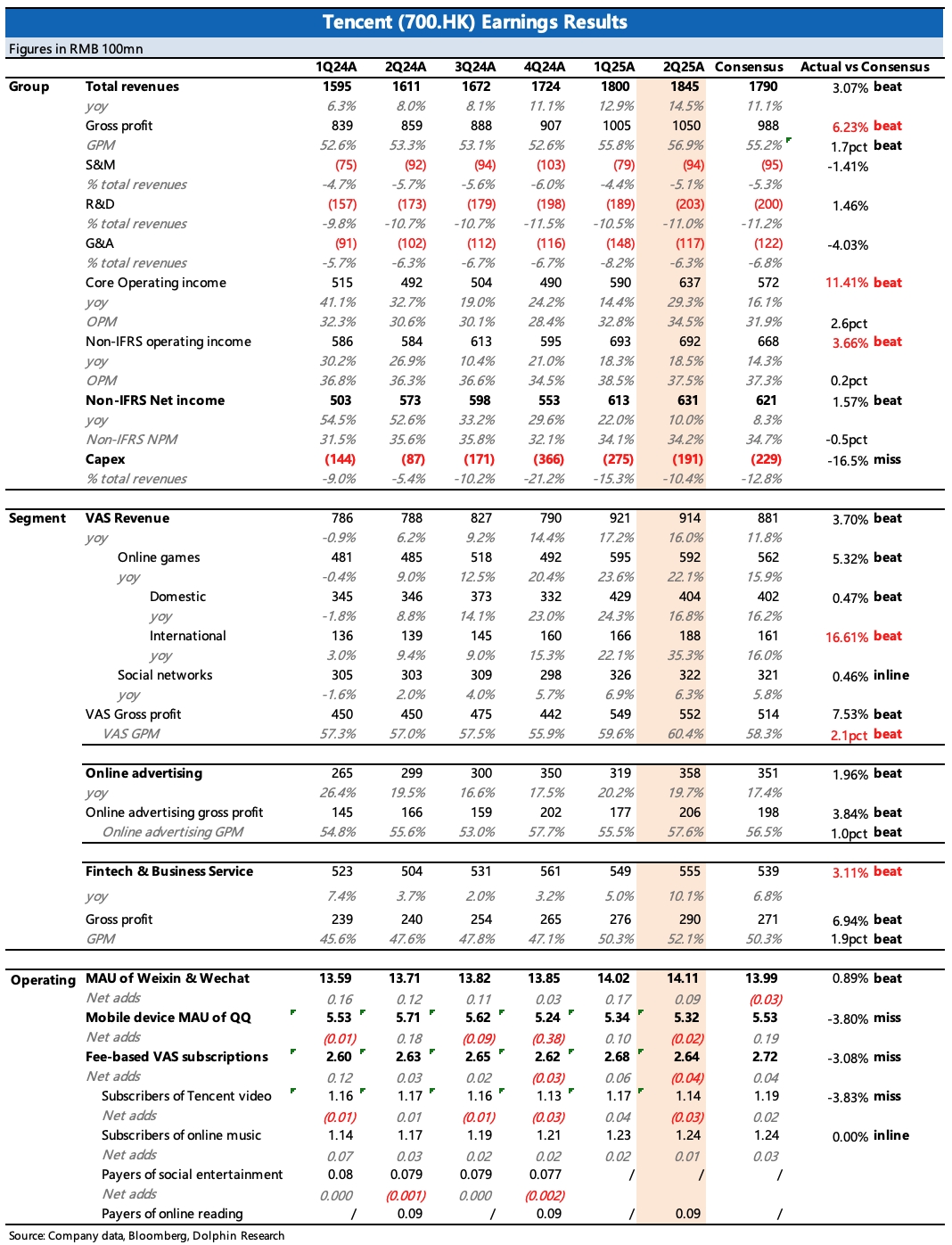

Tencent 2Q25 Quick Interpretation: The performance of the stock king remains stable beyond words, with the second quarter slightly exceeding expectations, mainly reflected in game growth and profitability improvement.

1. Overseas Games Impress: Q2 overall game growth was 22%, with domestic at 17% and overseas at 35% (33% under currency neutrality), exceeding expectations in overseas revenue.

On one hand, growth was driven by old games like Supercell's 'Clash Royale' and 'PUBG Mobile'; on the other hand, the new game 'Dune: Awakening' contributed incrementally.

Domestic games relied on new games like 'Delta Force', and evergreen titles like 'Honor of Kings' and 'Game for Peace' to withstand last year's base pressure.

The third quarter sees the launch of 'Valorant' mobile, expected to continue maintaining strong growth momentum.

2. Advertising Maintains High Growth: Q2 advertising growth rate was 19.7%, slightly exceeding expectations.

Since the monetization of video accounts, advertising revenue within Tencent's ecosystem has been on a rapid rise. In addition to the release of new inventory such as video account ads, mini-game ads, and search ads, AI has also enhanced the efficiency of advertising across the board.

The overall industry performance in the second quarter was average, mainly due to the 618 shopping festival falling short of expectations, but Tencent's growth rate was clearly leading.

3. Fintech Further Recovers: Q2 fintech and enterprise services combined growth rate rebounded to 10%, with the market originally having conservative expectations due to the overall sluggish consumer sector.

Dolphin Research believes that besides the boost from video account e-commerce commissions (with the establishment of the e-commerce product department in May, accelerating merchant onboarding) and Tencent Cloud (with growth expected at around 15%-20% due to internal computing power), the major fintech business has already resumed growth in the second quarter.

4. Controllable Expenses, Profitability Continues to Improve: With AI increasing capital expenditure for a year, the market has concerns about its impact on Tencent's profit margins. Although Dolphin Research believes that during the AI innovation period, investing in long-term growth is more valuable than maintaining short-term profits, the reality is that Tencent has not stopped enhancing its core business profitability.

Q2 operating profit of core businesses grew by 29% year-on-year, with strong momentum, and the profit margin was 34.5%, continuing to improve by nearly 2 percentage points quarter-on-quarter, with cost and expense optimization each contributing about 1 percentage point.

Gross margin mainly benefited from the increased proportion of high-margin businesses like games and advertising, and the strategy of focusing on developing evergreen game IPs has also led to higher monetization efficiency of new games in recent years.

As for expenses, growth was mainly reflected in server bandwidth and equipment depreciation brought by AI, as well as the cost of R&D personnel, but overall they remain relatively controllable.

5. Investment and Buyback: Second-quarter Capex was 19.1 billion, down 30% quarter-on-quarter, likely due to the impact of the H20 ban. Previously, with the lifting of the H20 supply ban, Tencent reportedly immediately placed new orders, so subsequent investment is expected to continue growing.

Second-quarter buybacks increased, but overall remained within the budget framework of 80-90 billion, flexibly adjusted with market value fluctuations. $TENCENT(00700.HK) $Tencent(TCEHY.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.