Sea 2Q25 Quick Interpretation: The Southeast Asian 'Little Tencent' has once again delivered strong performance this quarter.

On the growth front, key e-commerce and financial business metrics have generally exceeded expectations. In terms of profit, although the market anticipated a decline in profit margins due to increased expenses, the strong revenue growth led to profit figures slightly surpassing expectations.

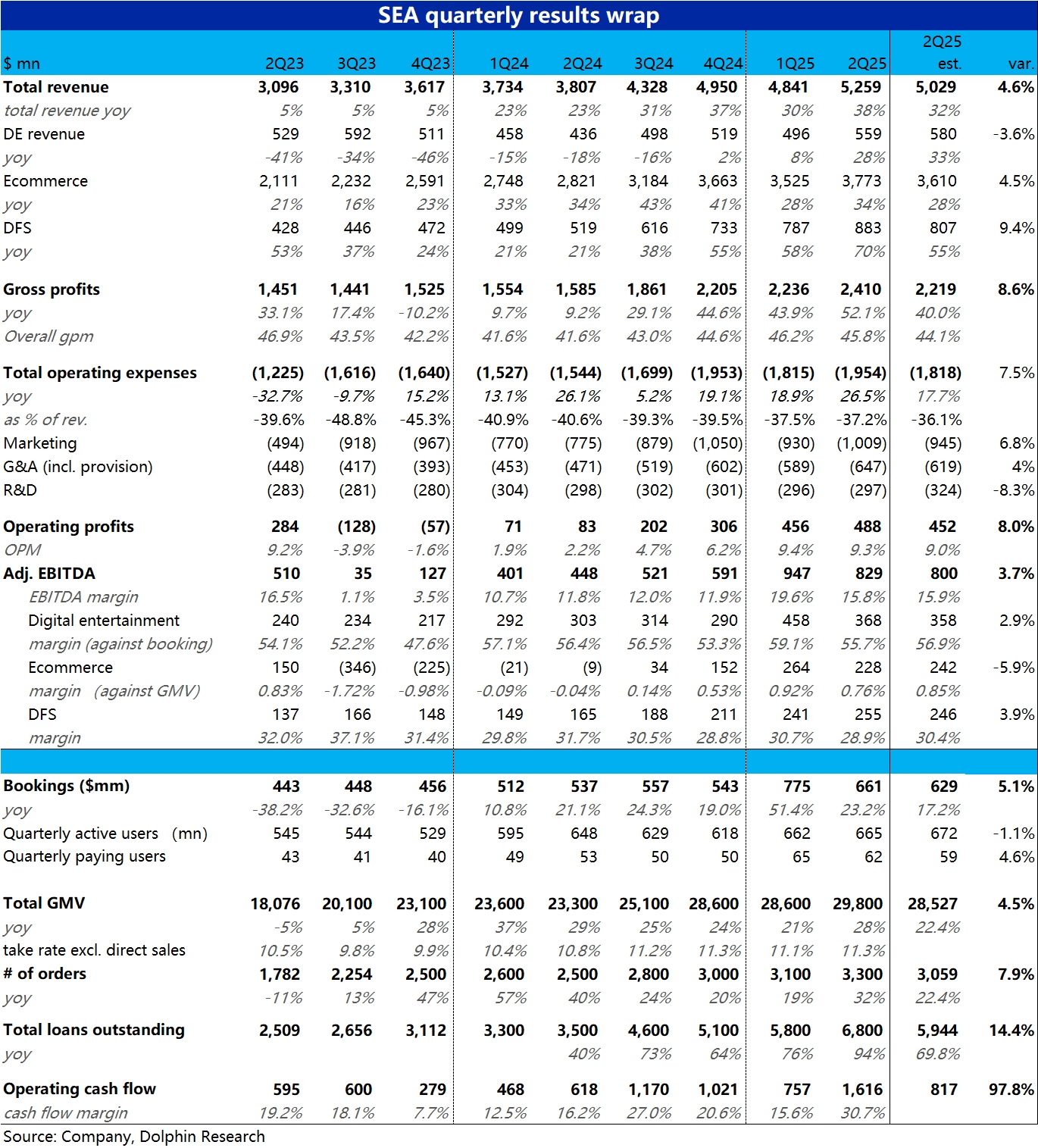

1) Firstly, the most critical e-commerce segment's key metric—GMV—saw a year-on-year increase of 28% this quarter, accelerating by about 7 percentage points compared to the previous quarter. Although some Wall Street firms had anticipated an acceleration in growth this quarter, the actual performance was more optimistic than expected, driven entirely by strong volume growth.

Additionally, with the monetization rate continuing to rise year-on-year by 0.5 percentage points (the rate of increase is narrowing), total revenue from the e-commerce segment surged by 34% this quarter, far exceeding the market expectation of 28%.

2) In the second most important financial business, the core metric of total loan repayment amounted to 6.8 billion. In terms of trend, there was a net increase of about 1 billion quarter-on-quarter, accelerating growth (compared to a 700 million increase in the previous quarter), also showing strong performance. (Bloomberg's forecast of 5.9 billion was significantly underestimated and not of reference value).

Driven by strong loan volume growth, financial business revenue this quarter increased by 70% year-on-year, with accelerated quarter-on-quarter growth, also far exceeding expectations.

3) Following the explosive performance last quarter with the Naruto collaboration, this quarter can be described as a decline within expectations. Active user growth slowed quarter-on-quarter, and paying users decreased by 3 million quarter-on-quarter, with player enthusiasm somewhat exhausted.

However, since market expectations were already low, actual revenue grew by about 23% year-on-year, although it slowed significantly compared to the explosive previous quarter. It was still slightly better than conservative expectations.

4) In terms of expenses and profitability, total operating expenses this quarter increased by nearly 27% year-on-year, significantly higher than both the previous quarter's growth rate and market expectations. This indeed confirmed some Wall Street firms' expectations that the company would increase investment.

Therefore, the overall adjusted EBITDA margin for this quarter decreased to 15.8% quarter-on-quarter, 0.1 percentage points lower than expected. Profit margins in each sub-segment also declined compared to the previous quarter.

However, due to stronger-than-expected growth, the final profit figures were still decent. $Sea(SE.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.