Tencent Music 2Q25 Quick Interpretation: As expected from a leading Chinese stock, TME's Q2 performance remains strong.

Although the revenue mainly exceeded expectations in other online music areas such as advertising and digital album sales, the growth rate of operating expenses slowed down again, demonstrating TME's stable competitive position and efficient internal operations. Ultimately, core operating profit significantly exceeded expectations.

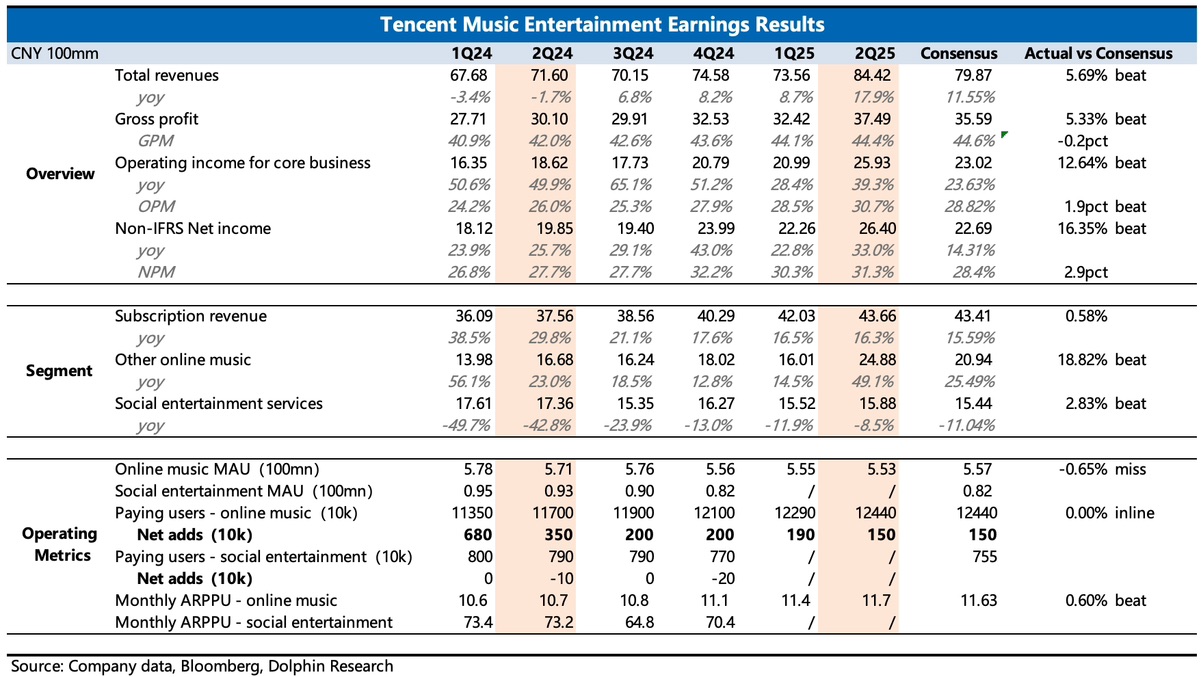

1. Subscription revenue met guidance: In the second quarter, net increase in paid users was 1.5 million (+6% yoy), with an average monthly payment of RMB 11.7 (+9% yoy), jointly driving subscription membership revenue to grow steadily by 16%. As of the second quarter, the overall platform's payment rate continued to increase to 22.5%.

The company's long-term goal is first to match long video platforms at 25%, and then (optimistically) to match global platform Spotify at 40%+.

2. Advertising, concert peripherals, etc. greatly exceeded expectations: Other online music revenue grew nearly 50%. In addition to some deferred licensing from Q1 bringing incremental growth to Q2, current advertising, offline concerts, physical albums, ticket peripherals, etc. all grew strongly.

In the long term, this is beneficial for further strengthening TME's brand in the music industry chain and helps future business extension in the industry chain. However, in the short term, there are occasional factors (such as intensive concerts, album releases by popular singers), which cannot be simply linearly extrapolated.

3. Continued efficiency improvement, profitability still has room for enhancement: Despite stable high revenue growth, the three expenses in the second quarter continued to decelerate, reaching new lows or relatively low levels in recent years from an absolute value perspective. Ultimately, core operating profit was 31%, and adjusted net profit was RMB 2.6 billion, exceeding the guidance and expectations of RMB 2.2-2.3 billion.

Although Q2 gross margin did not improve significantly, in the long term, Dolphin Research still expects cost optimization. Besides the continued optimization of cost structure in the live streaming business, the optimization of copyright costs is a long-term logic for Tencent Music.

4. As of the end of Q2, the company had RMB 20 billion in net cash (cash + short-term investments - long and short-term interest-bearing debt), equivalent to USD 2.8 billion. Compared to the previous quarter, it decreased mainly due to the acquisition of Himalaya. The specific operating situation will be discussed further when consolidated in the quarterly report. $TME-SW(01698.HK)$Tencent Music(TME.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.