Block 2Q25 Quick Interpretation: Overall, Block's performance this quarter is positive, with most core metrics exceeding expectations and showing signs of improvement. Revenue, gross profit, and operating profit, excluding the Bitcoin business, all surpassed expectations.

However, there are a few minor flaws, the most significant being the adjusted operating profit guidance for the next quarter, which fell short of expectations, indicating a further decline in profit margins.

Specifically:

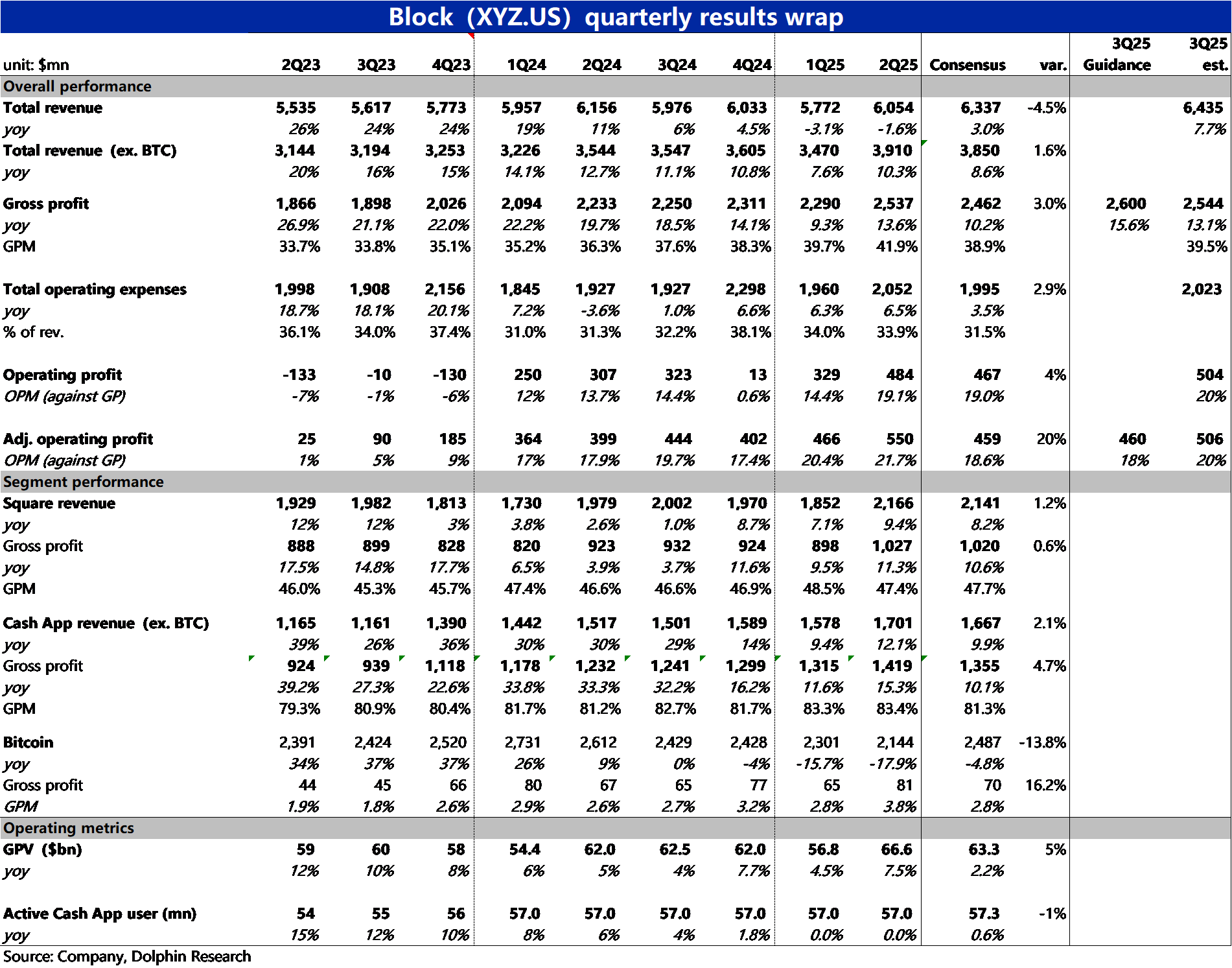

1) In terms of overall performance, total revenue for the quarter appears to have declined year-on-year, significantly underperforming expectations. This is mainly due to the drag from the BTC trading business.

Excluding this business, core revenue grew by 10% year-on-year, slightly exceeding expectations.

2) The most notable metric this quarter, which the market is most focused on, is the overall gross profit of $2.54 billion, exceeding expectations by $74 million, and growing 13.6% year-on-year, significantly outperforming the market expectation of 10%.

Meanwhile, although expenses this quarter were slightly higher than expected, they still only grew by 6.5% year-on-year, which is lower than the growth rate of core revenue.

Therefore, the adjusted operating profit margin continued to rise by 1.3 percentage points quarter-on-quarter, with actual profit exceeding expectations by $100 million.

3) In terms of segment gross profit, the Square segment's gross profit met expectations, mainly due to the strong performance of Cash App.

Excluding the BTC business, Cash App's segment gross profit income grew by 15% year-on-year, accelerating from 12% in the previous quarter.

However, from the perspective of expectation differences, the better-than-expected actual performance was more due to lower expectations.

This quarter, Cash App's actual gross profit margin remained flat at around 83% quarter-on-quarter, but the market expected only 81% (flat year-on-year, significantly declining quarter-on-quarter).

4) In terms of core operating metrics, the total payment volume (GPV) of the Square segment grew by 3.7% year-on-year, slightly exceeding expectations, but the absolute growth is still evidently weak.

The number of active users of Cash App has seen zero growth quarter-on-quarter for two consecutive quarters, meaning that the revenue growth of the Cash App segment is more attributed to generating more from each user.

5) For the next quarter's guidance, the company expects gross profit to grow by 15.6% year-on-year, continuing to accelerate from this quarter and better than expected.

However, as investments also correspondingly increase, the guidance for next quarter's adjusted operating profit is $460 million, down from this quarter and below the expected approximately $510 million. $Block(SQ.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.