SMIC 2Q25 Quick Interpretation: Although the company's revenue and gross margin for this quarter met the previous guidance expectations, both figures still declined quarter-on-quarter.

The management also mentioned that the company was affected by unexpected issues in annual production line maintenance and equipment upgrades, which will have a direct impact on this quarter's performance.

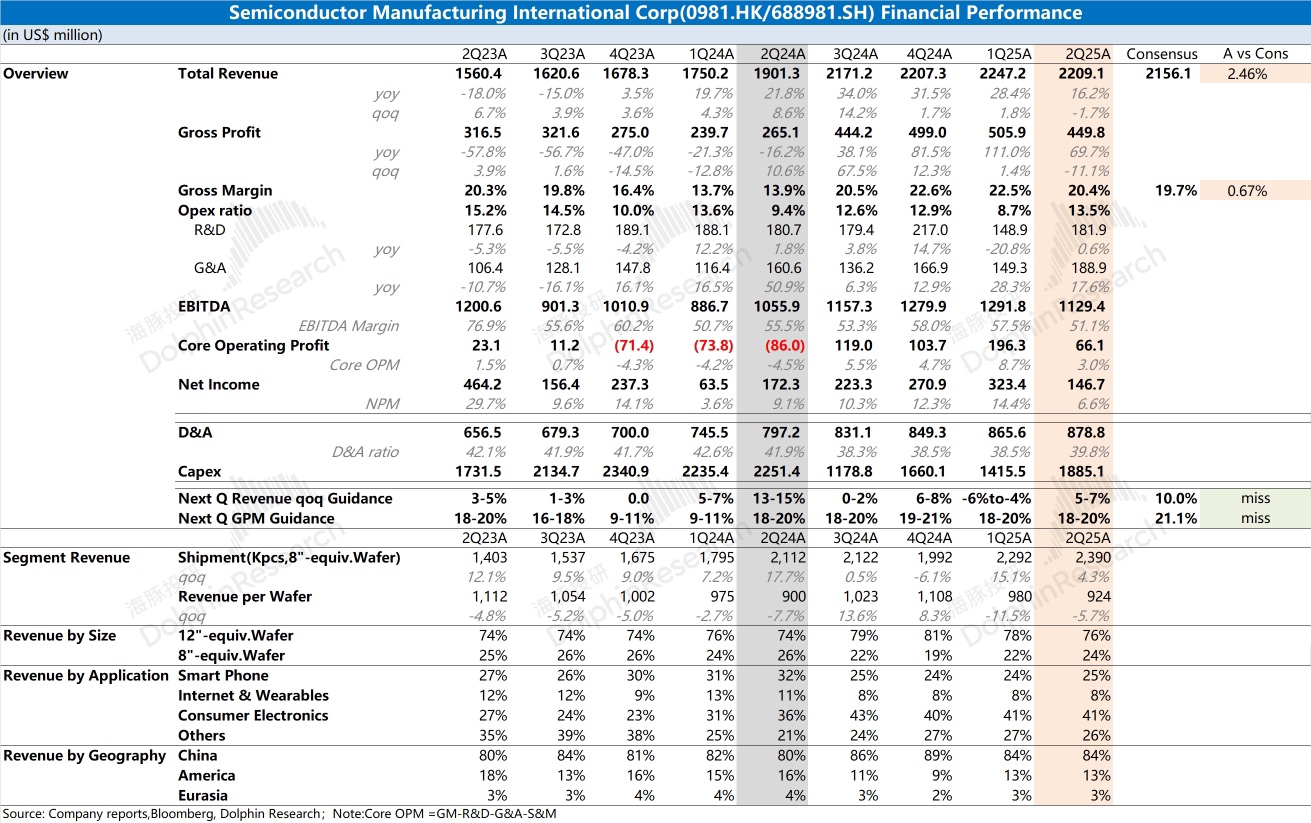

Breaking down the volume and price: SMIC's shipment volume for this quarter was 2,390 thousand wafers (equivalent to 8-inch wafers), a quarter-on-quarter increase of 4.3%; however, the revenue per wafer was USD 924, a quarter-on-quarter decrease of 5.7%. The decline this quarter was mainly due to the decrease in average product price.

Currently, the company's revenue from the China region accounts for 84%, and the performance in various application markets mainly reflects the current demand situation in the downstream of the domestic industrial chain.

Only the mobile business and industrial and automotive business achieved quarter-on-quarter growth this quarter, with the mobile market mainly driven by seasonal stocking in the second half of the year.

However, the performance of the company's mobile business this quarter is still significantly lower than the same period in previous years, indicating that the current downstream demand for the company is quite sluggish.

Compared to this quarter's data, the guidance for the next quarter is more important. However, the company expects revenue for the next quarter to grow only 5-7% quarter-on-quarter, which is below market expectations (10%); the gross margin expectation for the next quarter is only 18-20%, also below market expectations (21.1%). The company's management remains not very optimistic about the business outlook for the second half of the year.

Considering the situation of the industry and peer companies, the current demand in the traditional semiconductor market is very weak.

The recent rise in the company's stock price is mainly driven by events related to U.S. semiconductor tariffs, which has once again heightened market attention on self-reliance, rather than improvements in the industry or the company's operations.

The company is a heavy asset company with options for "self-reliance and technological breakthroughs." Even if the fundamentals are weak, the company's valuation will still be influenced by external events and sentiment (such as Sino-U.S. semiconductor frictions and the company's management's related views). Stay tuned for Dolphin Research's subsequent detailed commentary and earnings call minutes. $SMIC(00981.HK)$SMIC(688981.SH)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.