Airbnb 2Q25 Quick Interpretation: Airbnb's performance this quarter is relatively decent. Under the market's low expectations, the main indicators generally met or slightly exceeded expectations, and the guidance for the next quarter also met expectations.

However, excluding the favorable exchange rate factors, the trend of Airbnb's night bookings growth rate is still in a slowing trend. Coupled with the market's cautious attitude towards the future prosperity of the hospitality industry, this quarter's performance lacks real highlights and cannot alleviate these concerns.

Specifically:

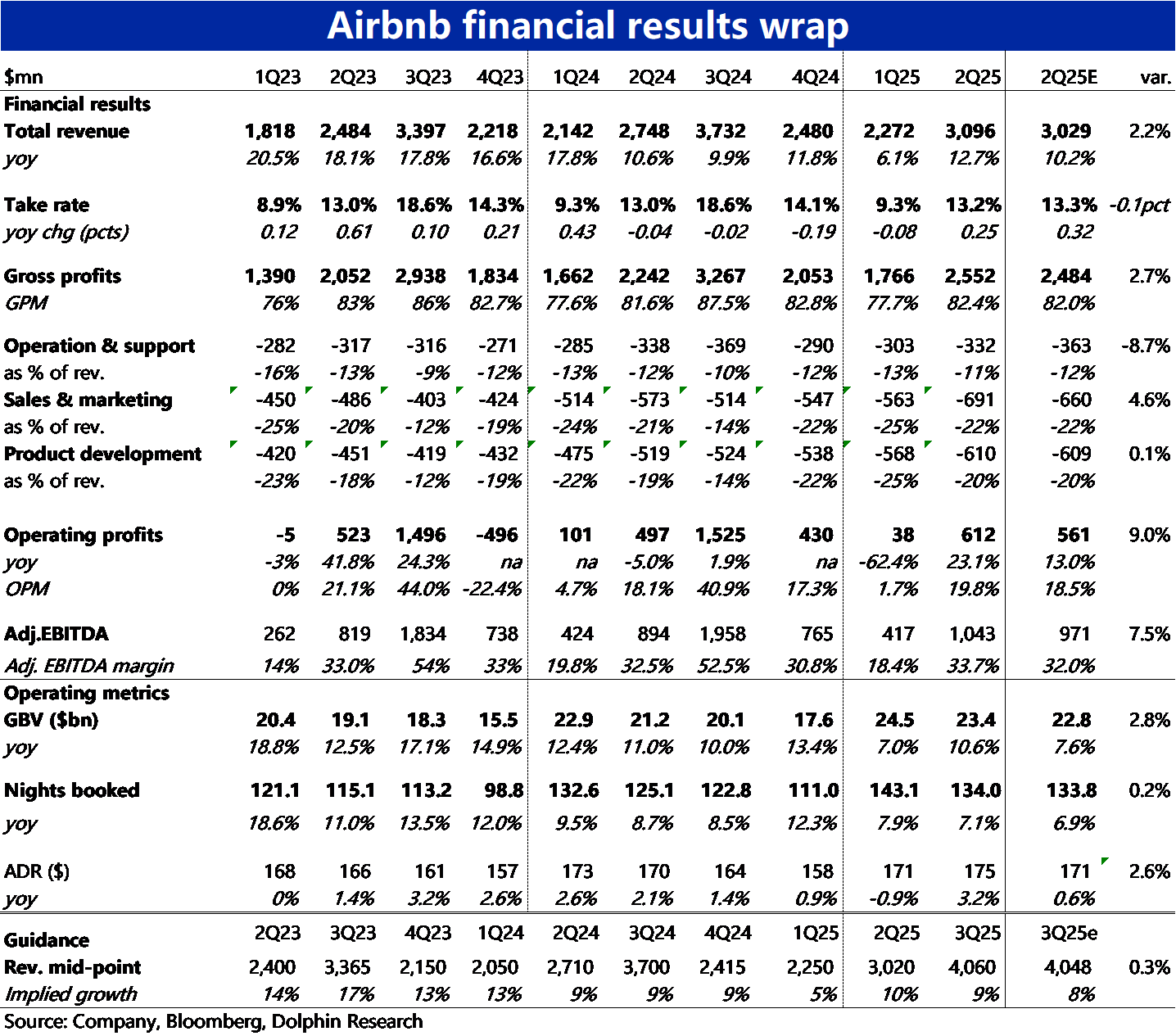

1) Overall performance: This quarter's revenue increased by 12.7% year-on-year (consistent growth rate at constant exchange rates), significantly accelerating from the extremely low base of the previous quarter, returning to normal levels, and slightly exceeding the market's expectation of 10%.

2) Due to a slight expansion of the gross margin by 0.8 percentage points year-on-year, slightly exceeding market expectations. Meanwhile, overall expenses this quarter increased by 11% year-on-year, which is slightly lower than the revenue growth.

With the gross margin expanding and the expense rate slightly decreasing, the operating profit margin increased by 1.7 percentage points year-on-year. The market only expected a 0.4 percentage point increase, so the final operating profit exceeded expectations by about 9%.

3) Looking at the above financial indicators alone, Airbnb's performance this quarter is undoubtedly acceptable. However, in terms of underlying operating indicators, this quarter's GBV increased by 11% year-on-year, seemingly accelerating significantly from the previous quarter. In reality, excluding the favorable exchange rate factors, the growth rate at constant exchange rates for both this quarter and the previous quarter was 9%, indicating no improvement.

The night bookings growth rate this quarter was only 7.1%, further slowing from the previous quarter's 7.9%. It is evident that actual business growth is not optimistic.

4) In terms of guidance, the company expects next quarter's revenue growth to be 8%~10%, which meets market expectations but implies a further slowdown compared to this quarter. The night bookings growth rate is also roughly similar to this quarter, showing no signs of significant improvement.

Regarding profit, the company guides next quarter's adj. EBITDA to exceed $2 billion, but due to increased expenses, the profit margin is actually declining. Compared to $1.96 billion in the same period last year, it does not appear to have much higher growth.

There are many recent earnings reports, with some overlapping. More detailed comments will be released by Dolphin Research later, so stay tuned. $Airbnb(ABNB.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.