Applovin 2Q25 Quick Interpretation: The second quarter performance remains strong with high growth, but it is basically in line with expectations, especially regarding the guidance for Q3, where some institutions slightly raised their expectations before the earnings report.

For Applovin, which consistently exceeds expectations, an inline performance is actually inadequate and is unlikely to boost the stock price, which has already risen nearly 30% after the Q1 earnings report.

Does this indicate that Applovin's glory is fading and it has passed its peak? Dolphin Research believes that it is too early to draw such a conclusion.

The second quarter is still a closed testing period for e-commerce, hindered by insufficient personnel allocation, resulting in slow penetration of target customer groups, and the e-commerce advertising automation system has not yet been fully launched.

In the past half year, Applovin's e-commerce advertising penetration has mainly focused on medium and large merchants, and the company is planning to lower the GMV threshold to expand participation among small and medium-sized e-commerce clients.

Therefore, at the initial stage of small and medium-sized merchants and the launch of the automated delivery system, there is likely to be a small growth peak. Currently, most expectations are that this system will be launched in the second half of the year, especially at the end of the third quarter and the beginning of the fourth quarter.

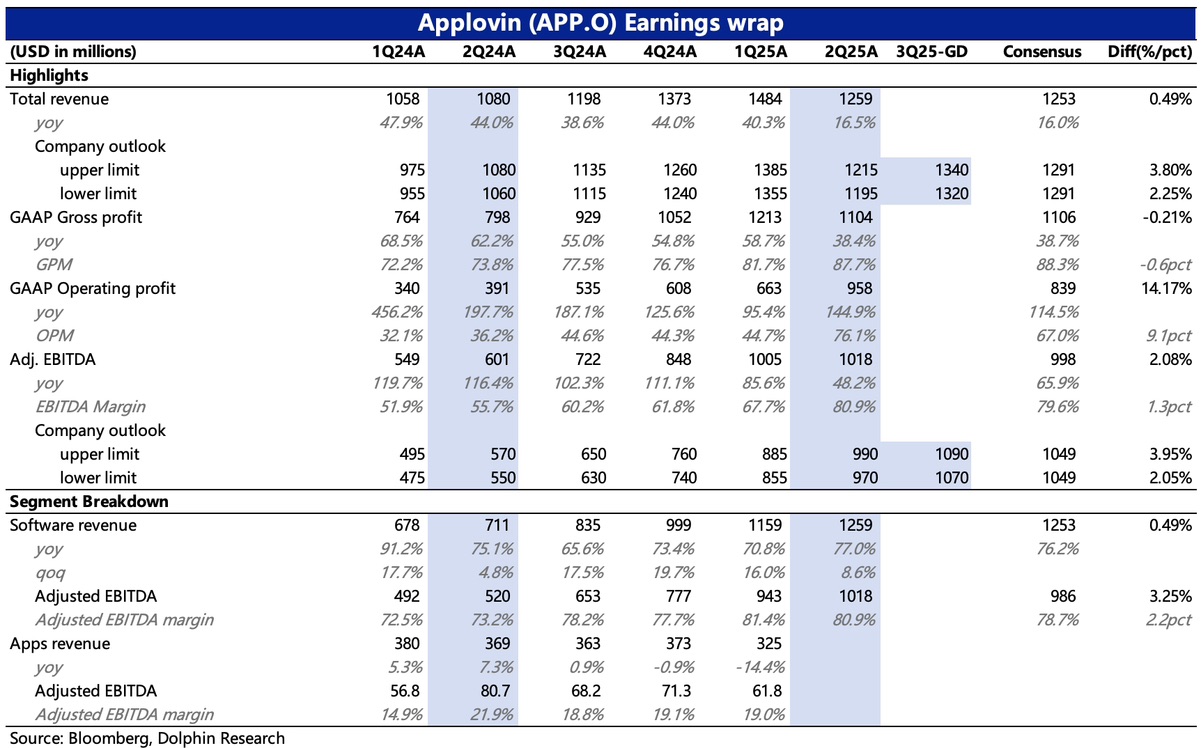

1. This quarter, the proprietary app business was divested and sold, thus the company's revenue is basically composed of advertising, with total revenue of $1.26 billion, a year-on-year increase of 77%.

2. Since the proprietary app business included approximately $25-30 million in internal purchase fees, after divestment, this part of the cost becomes incremental advertising revenue.

Excluding this part, the intrinsic growth rate of Applovin's advertising represents 73%, a quarter-on-quarter increase of 6%, which is basically in line with the company's guidance of a quarter-on-quarter growth expectation of 4-5%.

3. With only advertising revenue remaining, the operating profit margin quickly increased to 76%, and the EBITDA profit margin level exceeded 80%.

4. The guidance for the third quarter shows that the advertising growth rate will slow from 77% this quarter to 59%, a quarter-on-quarter increase of 5.7%; the 81% EBITDA profit margin remains stable quarter-on-quarter, but considering the research and development and sales expenses related to e-commerce advertising will expand with business growth, future profit margin improvement is expected to be limited. $AppLovin(APP.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.