Shopify 2Q25 Quick Interpretation: This quarter's performance of Shopify was quite 'explosive,' with all indicators significantly exceeding expectations. Before the earnings release, no sell-side analysts had anticipated such a strong performance. The guidance for the next quarter also exceeded expectations across the board.

Specifically:

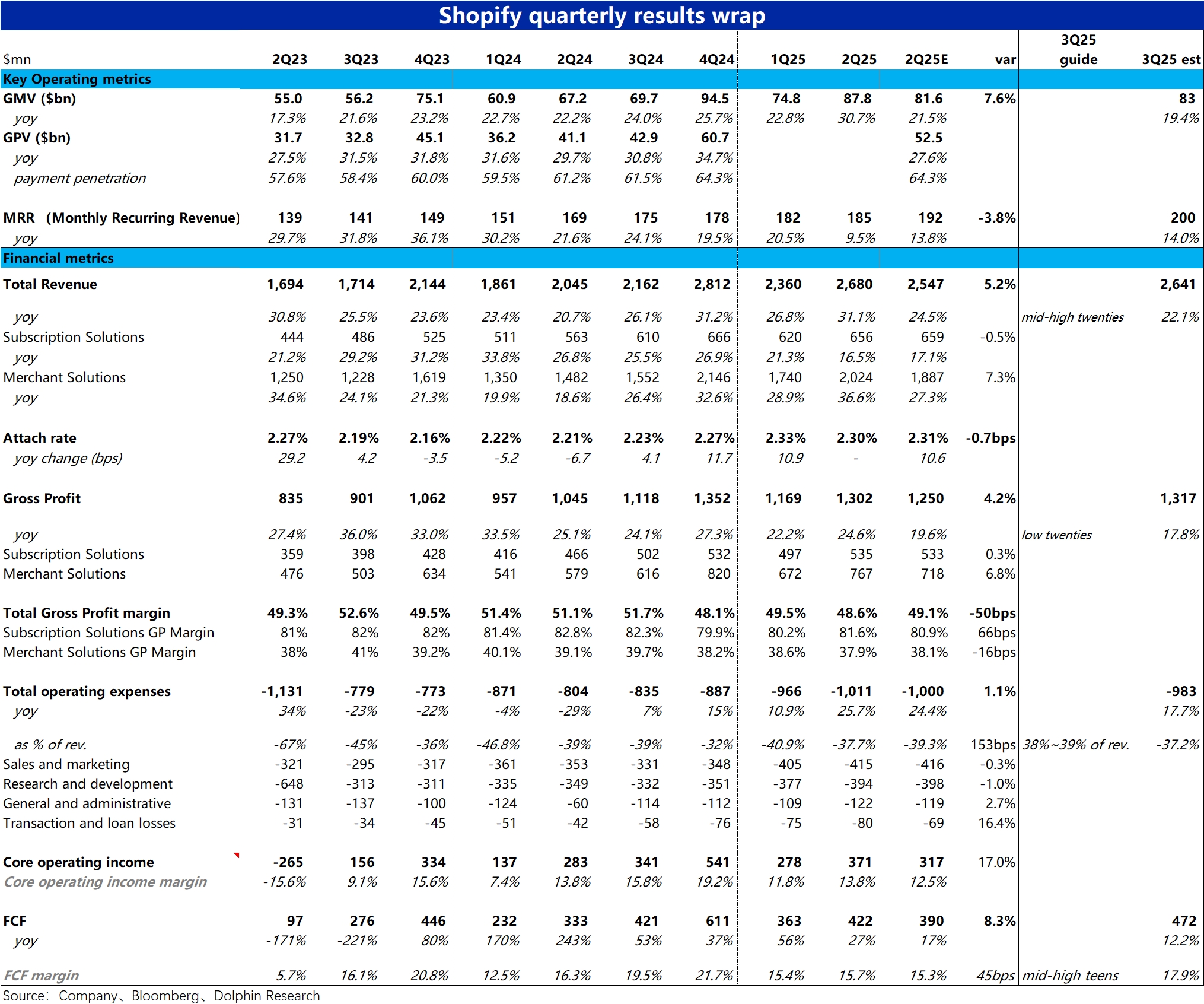

1) The fundamental reason behind all the outperformance is that the GMV within the Shopify ecosystem surged nearly 31% year-over-year this quarter, far exceeding the approximately 23% of the previous quarter and the market expectation of a flat sequential growth rate.

Even after excluding the impact of exchange rates, the GMV growth rate still accelerated by 4 percentage points compared to the previous quarter.

Dolphin Research's preview of Wall Street's performance did not mention any related signals. The focus will be on the management's explanation during the conference call as to why GMV was so strong.

2) Driven by the strong GMV, Shopify's payment volume and merchant services revenue also significantly exceeded expectations, with the magnitude consistent with GMV and not further amplified.

3) The MRR indicator performed 'within expectations' and was weaker than the market expected. This quarter it was $185, up only 9.5% year-over-year, significantly below the expected $192.

However, leading Wall Street firms had already anticipated that the market overestimated MRR due to the free trial initiatives, so the actual performance should not surprise the buyers.

Correspondingly, subscription revenue for this quarter also slightly underperformed market expectations.

4) In terms of profit performance, the gross margin for this quarter declined both sequentially and year-over-year, and was about 50 basis points lower than market expectations. This was mainly due to the increased proportion of low-margin merchant services revenue. The change in the revenue recognition criteria for the PayPal channel also had a dragging effect.

Despite this, due to strong revenue growth, the gross profit amount still exceeded expectations, but the margin of outperformance narrowed from over 7% to about 4%.

5) On operating expenses, actual spending for this quarter was roughly in line with expectations, up about 26% year-over-year. However, due to the actual revenue significantly exceeding expectations and the growth rate outpacing the expense growth rate,

the profit margin continued to expand this quarter. The FCF profit margin was 15.7%, though it narrowed year-over-year, it was still higher than the expected 15.3%.

6) The guidance for the next quarter also exceeded expectations across the board, with revenue growth guidance of 26%~29%, higher than the expected 22%; gross profit growth guidance of 20%~25%, higher than the expected 18%. The FCF profit margin guidance was 16%~19%, roughly in line with market expectations. $Shopify (SHOP.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.