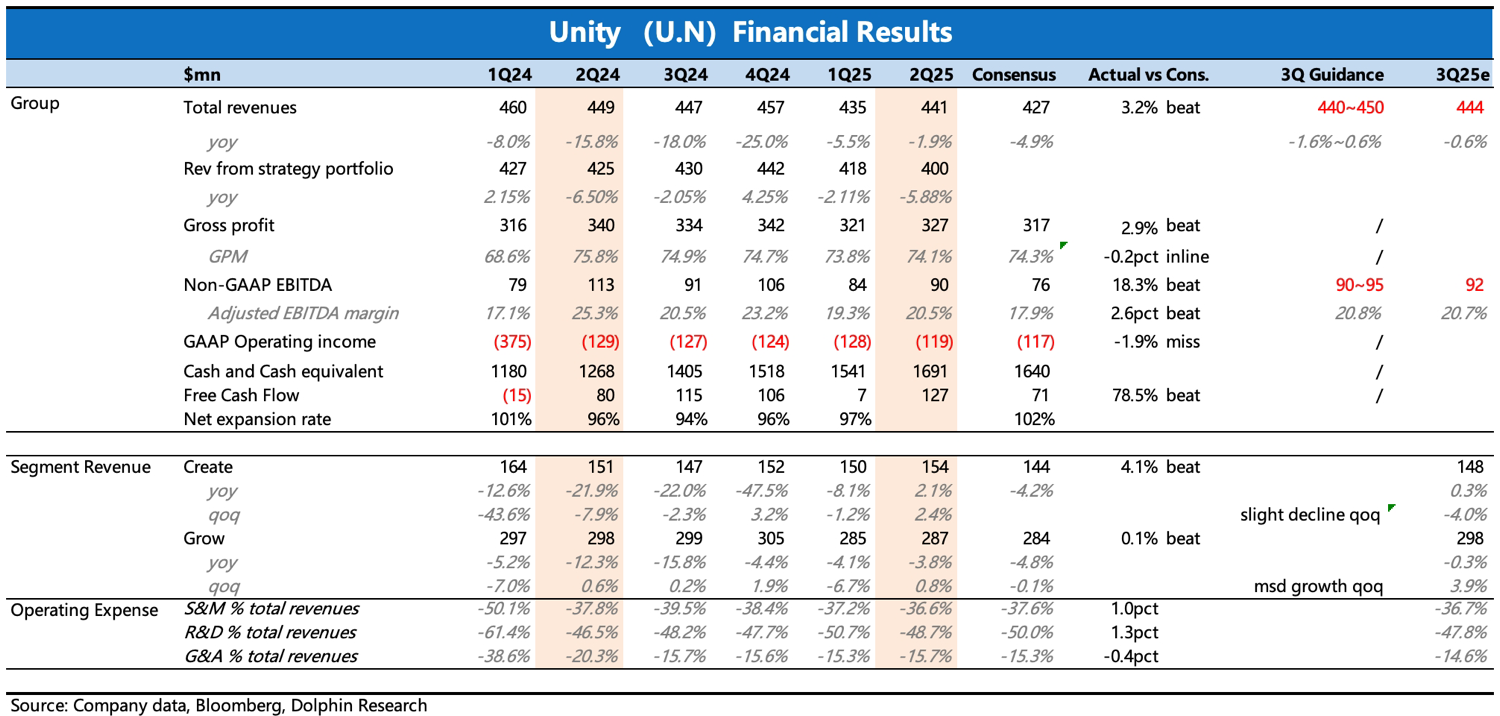

Unity 2Q25 Quick Interpretation: The second quarter performance slightly beat sell-side expectations, while the guidance was basically inline.

Since there was more positive feedback from Vector only at the end of the quarter, the guidance is more critical.

Given that there was already a significant increase in expectations due to Vector channel feedback before the earnings report, buy-side expectations should be noticeably higher. Therefore, when combined with the already priced-in buy-side expectations, the overall result may still slightly underperform expectations.

However, the good news is that the trend of improving performance is gradually becoming evident, and the operational turning point is basically clear:

1. Grow revenue declined by 3.8%, with the rate of decline slowing. The guidance for the next quarter indicates a mid-single-digit sequential growth, implying an acceleration in advertising improvement.

In the second quarter, advertising revenue already accounted for half of Grow, with strong performance during the period. The Q2 performance was mainly driven by endogenous growth brought about by the recovery of the casual gaming industry.

Vector was fully launched in the second quarter, and customers only provided clear positive feedback at the end of the quarter. Channel feedback indicated a 10-20% sequential improvement in advertising conversion rates.

2. Create revenue grew by 2%, with a one-time licensing income of $12 million during the period.

The main driving force for the growth of the engine business is Unity 6 and price increases. In the last quarter, 43% of old customers had already upgraded to Unity 6.0, and it is expected to exceed 50% in the second quarter. The previous official target was to reach 70% by the end of 2025. Pay attention to the discussion of related progress in the conference call.

The guidance for the third quarter indicates a slight sequential decline, implying a year-over-year flat or slight increase, which is basically in line with expectations.

3. EBITDA margin slightly increased by 1 percentage point sequentially, reaching 20.5%, with the guidance for the next quarter implying a continued slow improvement in profitability.

Currently, it is still in the critical period of the initial launch of products like Vector. Although the three expenses in the second quarter are still declining year-over-year, the short-term optimization space for expenses is expected to be limited. Future margin improvement will rely on the release of advertising monetization to naturally enhance the company's overall profitability.

Additionally, the performance of forward-looking operational indicators such as the number of customers and remaining contract value was not disclosed in detail in the earnings report. It is expected to be revealed in the conference call. Judging from the net increase trend of deferred revenue, operational indicators are also expected to be on an improving trend, which will be discussed in detail in the subsequent commentary. $Unity Software(U.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.