Uber 2Q25 Quick Interpretation: Overall, this quarter's performance is stable, with few surprises or disappointments.

The biggest flaw is that the Mobility ride-hailing business slightly underperformed market expectations in terms of actual order value, which dragged down the revenue and profit of this segment. Other indicators generally met or slightly exceeded expectations.

Specifically:

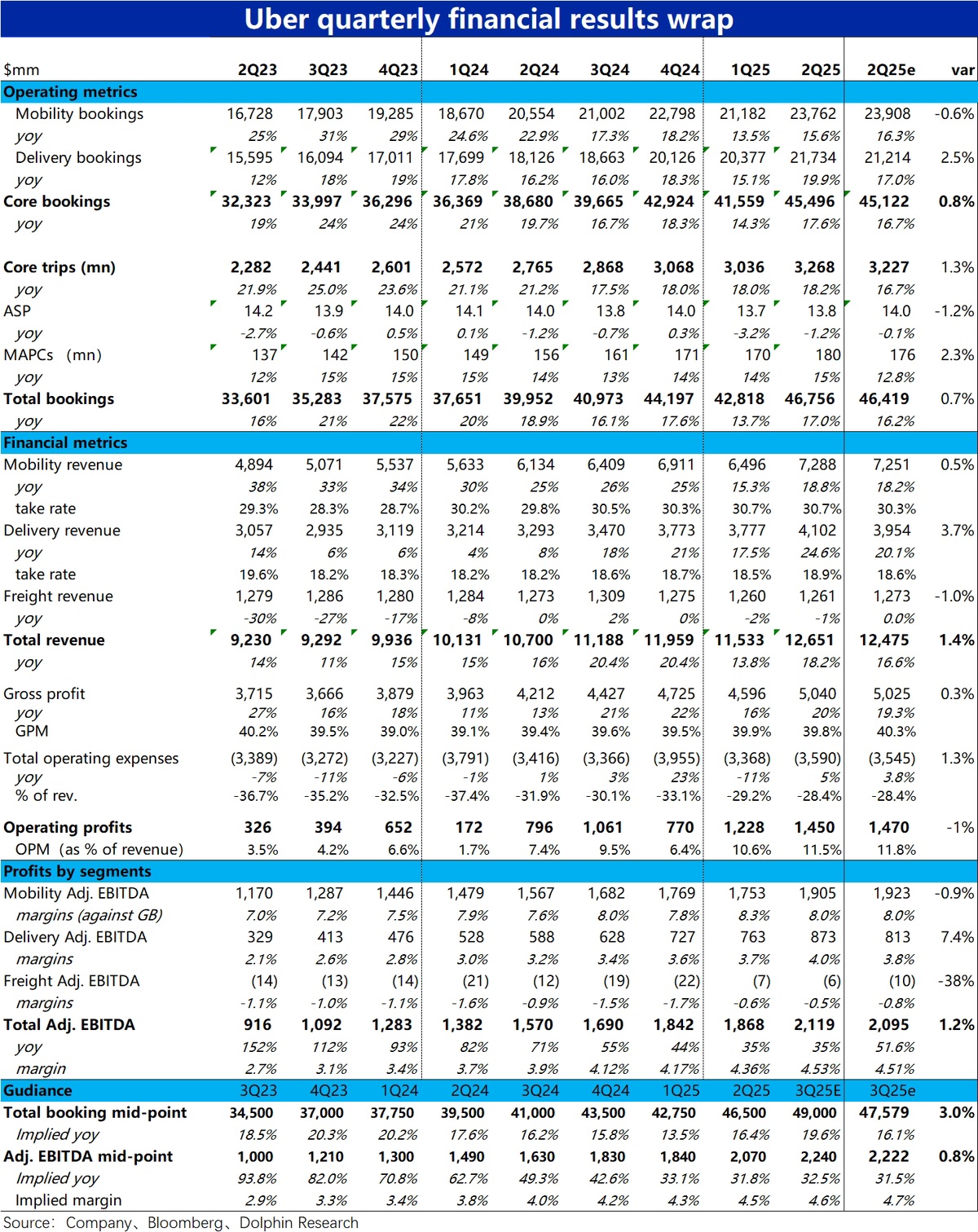

1) The ride-hailing business order value grew by 15.6% year-on-year, slightly below the expected 16.3%. Although the nominal growth rate appears to have improved quarter-on-quarter, excluding the impact of exchange rates, the order value grew by 18% at constant currency this quarter, which is a slowdown from the previous quarter's 20%.

This is somewhat disappointing for a market that originally expected strong growth in ride-hailing this quarter.

2) In contrast, the Delivery business, which the market had low expectations for, performed beyond expectations.

This quarter, the order value grew nearly 20% year-on-year, significantly accelerating from the previous quarter's 15% and clearly outperforming market expectations. Excluding exchange rate effects, the real growth rate also accelerated by 2 percentage points quarter-on-quarter.

3) Due to the offsetting expectations between the ride-hailing and delivery businesses, total revenue for the quarter basically met expectations, with a slight increase of 1 percentage point in growth rate at constant currency quarter-on-quarter.

However, the gross margin slightly decreased by 0.1 percentage points quarter-on-quarter, and total expenses were slightly higher than expected (by 1.3%).

This resulted in the final operating profit being 20 million lower than expected. Although the gap is small, in a market expecting outperformance, merely meeting expectations is certainly not considered good.

4) For the next quarter's guidance, the company indicates a midpoint of total order value growth of about 19% year-on-year, which is significantly better than the market's expectation of 16%.

However, this guidance includes a 1 percentage point tailwind from the acquisition of the Trendoy delivery business. Excluding this impact and exchange rate factors, the actual growth midpoint is 18%, the same as this quarter.

The profit guidance (adj. EBITDA) is 2.24 billion, which is basically in line with market expectations. The implied midpoint of year-on-year growth is 32.5%, slightly slowing from this quarter's 35%.$Uber Tech(UBER.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.