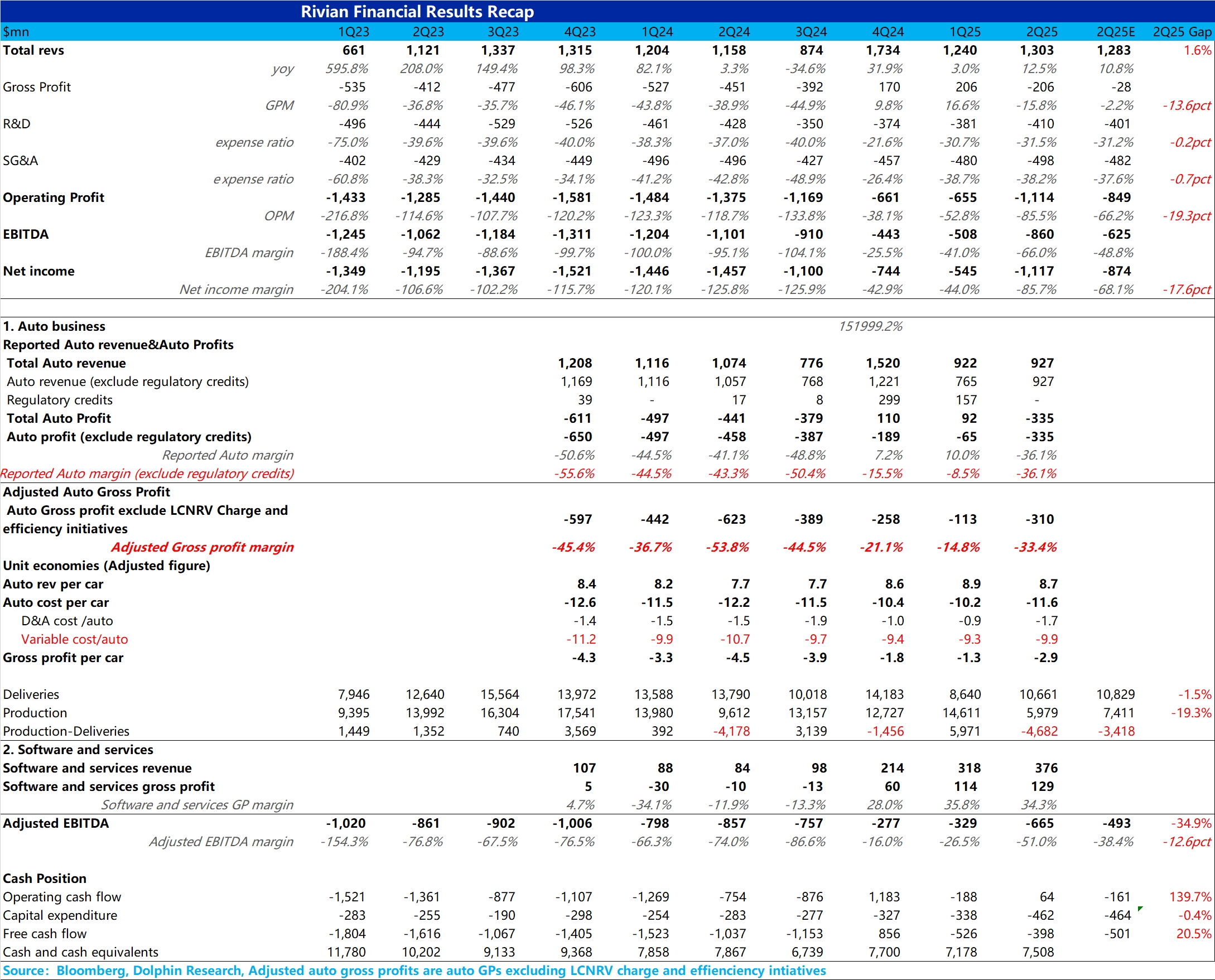

Rivian 2Q25 Quick Interpretation: Overall, Rivian's performance this quarter has once again hit rock bottom.

Although the market had low expectations for Rivian's financial report due to the negative impact of tariffs on production and the decline in regulatory credits, the actual performance was even worse than anticipated.

On the revenue side, it slightly exceeded expectations, possibly due to the quarter-on-quarter growth in software revenue. However, in terms of the crucial gross margin, Rivian had previously narrated a story of continuous quarter-on-quarter improvement in gross margin (driven by factors such as the restructuring of the R1 production line, design adjustments, and renegotiation of the supply chain). Therefore, the positive gross margin in the previous two quarters gave the market some confidence.

But this quarter, Rivian has once again fallen into a deep loss mode, with the overall gross margin plummeting by 32 percentage points quarter-on-quarter to -16%.

In terms of bottom line net profit, this quarter's net profit declined by 570 million to -1.12 billion, which is 240 million more than the market expected. This also led to the adjusted EBITDA (approximately equal to cash burn rate) being 170 million worse than the market expected.

The fundamental reasons for this loss remain:

1) A significant decline in production in the second quarter led to a substantial increase in per-vehicle amortized costs;

2) Carbon credits had virtually no revenue recognition this quarter, and this business is essentially pure gross profit, contributing nothing positive to the gross margin;

3) Tariff factors led to an increase in procurement costs, and there was also an inventory impairment recognized this quarter.

In terms of key outlook, although Rivian reiterated its sales target of 40,000-46,000 vehicles, the IRA subsidy will phase out by the end of the third quarter, so the critical sprint stage and window period for achieving the annual sales target is actually in the third quarter (before the subsidy phase-out).

However, Rivian will continue to halt production at the Normal plant for three weeks in the third quarter to prepare for the launch of the R2, which may prevent it from producing enough vehicles to meet the rush orders during the window period. Therefore, Dolphin Research anticipates that there will be significant pressure to meet this year's sales target.

From Rivian's current valuation perspective, the 2025 P/S ratio is close to 3 times. Although Dolphin Research understands that such a valuation is still primarily supported by high growth expectations brought by the production of the cheaper R2 model next year.

However, given the unfavorable fundamentals for Rivian in the second half of this year, Dolphin Research believes that such a valuation is still too high, and the poor performance this time is expected to lead to a correction. $Rivian Automotive(RIVN.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.