Last week, two major giants released their earnings almost simultaneously: $Microsoft(MSFT.US) and $Amazon(AMZN.US). The former saw a significant rise due to Azure's acceleration exceeding expectations for two consecutive quarters, while the latter experienced a sharp decline post-earnings due to AWS's stagnant growth. It can be said that the performance of cloud business is currently the most crucial indicator for Microsoft, Amazon, and Google among these CSPs (without exception).

Regarding AWS's revenue growth failing to accelerate and clearly lagging behind Azure and GCP, Amazon's management avoided addressing competitive issues, explaining that the main bottlenecks remain insufficient computing power, data center space, and power supply.

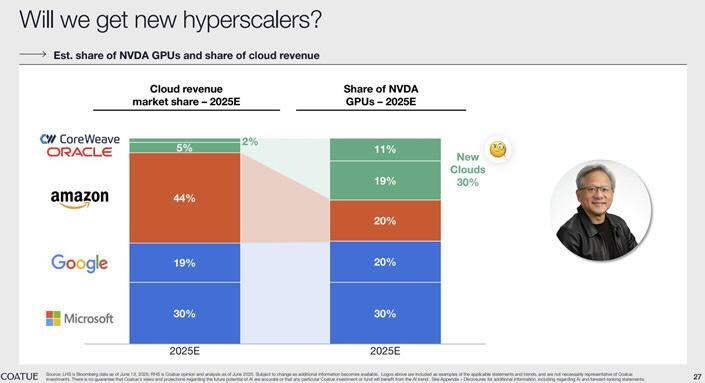

In response to this explanation, Dolphin Research shared an interesting chart. It shows that although AWS is expected to remain the largest player in the IaaS market by revenue size in 2025 (with a 44% share), its share of NVDA GPUs is only about 20%. The ability to secure computing power supply is indeed severely mismatched with its revenue size.

In contrast, the proportion of GPU chips obtained by Azure and GCP is basically aligned with their revenue scale. If the data in this chart is accurate, then the computing power bottleneck is indeed one of the important reasons for AWS's underperformance. Additionally, it can be seen that "small players" like Oracle and Corewave are also beneficiaries in the reshuffling of the CSP landscape in the AI era.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.