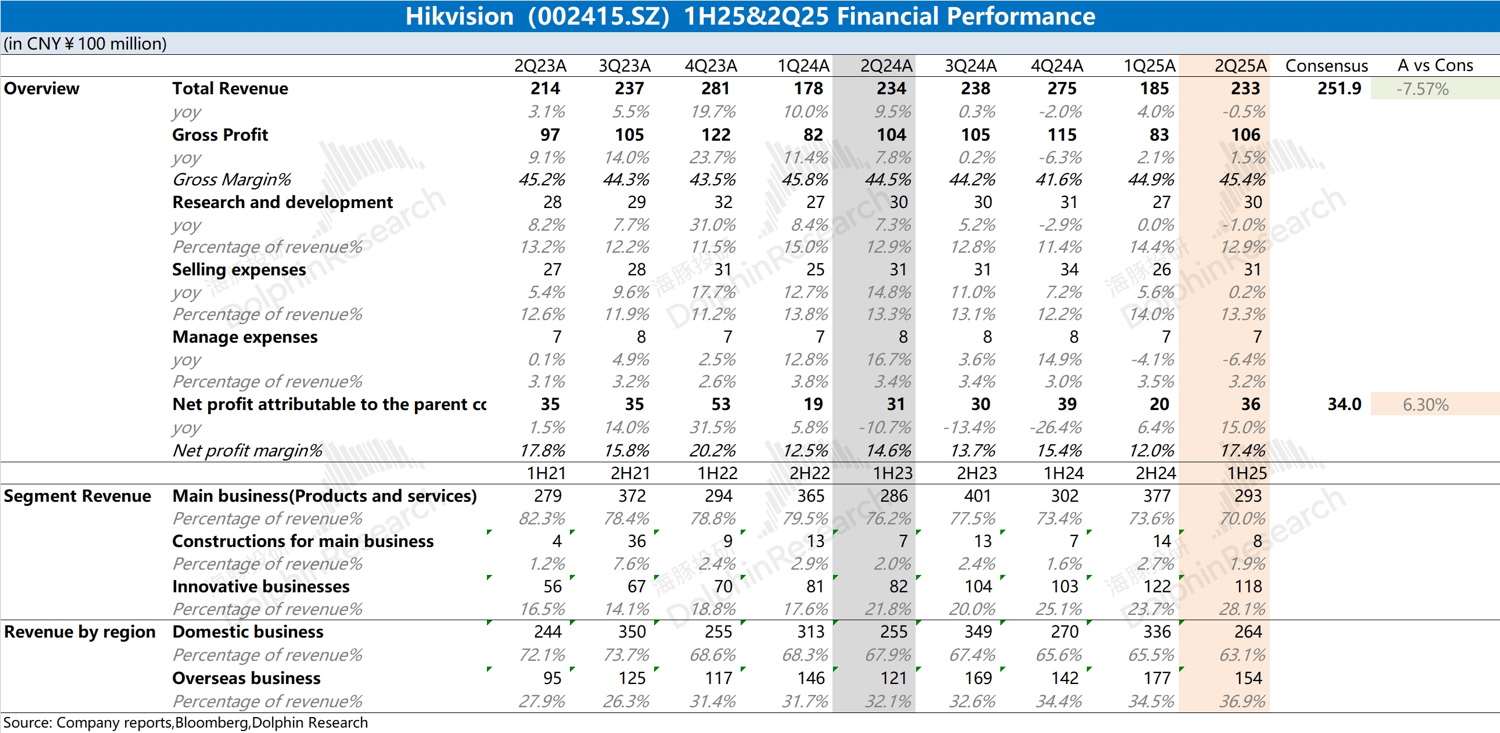

Hikvision Quick Interpretation: The company's performance this quarter remains lackluster. There is no growth on the revenue side, and the improvement in gross margin is mainly driven by the increase in gross margin of security monitoring hardware products, while the gross margin of innovative businesses continues to decline.

Specifically:

① Hikvision's domestic market remains sluggish, with the Public Service Business Group (PBG), Enterprise Business Group (EBG), and Small and Medium Business Group (SMBG) all experiencing varying degrees of decline in the first half, especially the SMBG, which saw a nearly 30% drop;

② Hikvision's overseas market continues to show growth, but the growth rate has fallen to single digits;

③ Hikvision's innovative business revenue maintains double-digit growth, mainly driven by the growth of robotics, smart home, and automotive electronics businesses.

Due to the sluggish performance, Hikvision has initiated layoffs and cost control, with the number of R&D personnel already reduced in 2024. The company continues to control costs, with both R&D expenses and administrative expenses decreasing year-on-year this quarter.

Overall, Hikvision has not seen significant improvement in its business, especially facing tremendous pressure in the domestic market. Although the company has started layoffs and cost reduction, operating expenses have not been quickly reduced.

In the context of relatively sluggish traditional hardware products, software/AI empowerment may bring new opportunities to the company, yet the company has not shown more performance in this area.

For more detailed content, please stay tuned for subsequent specific reviews and related conference call information. $HIKVISION(002415.SZ)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.