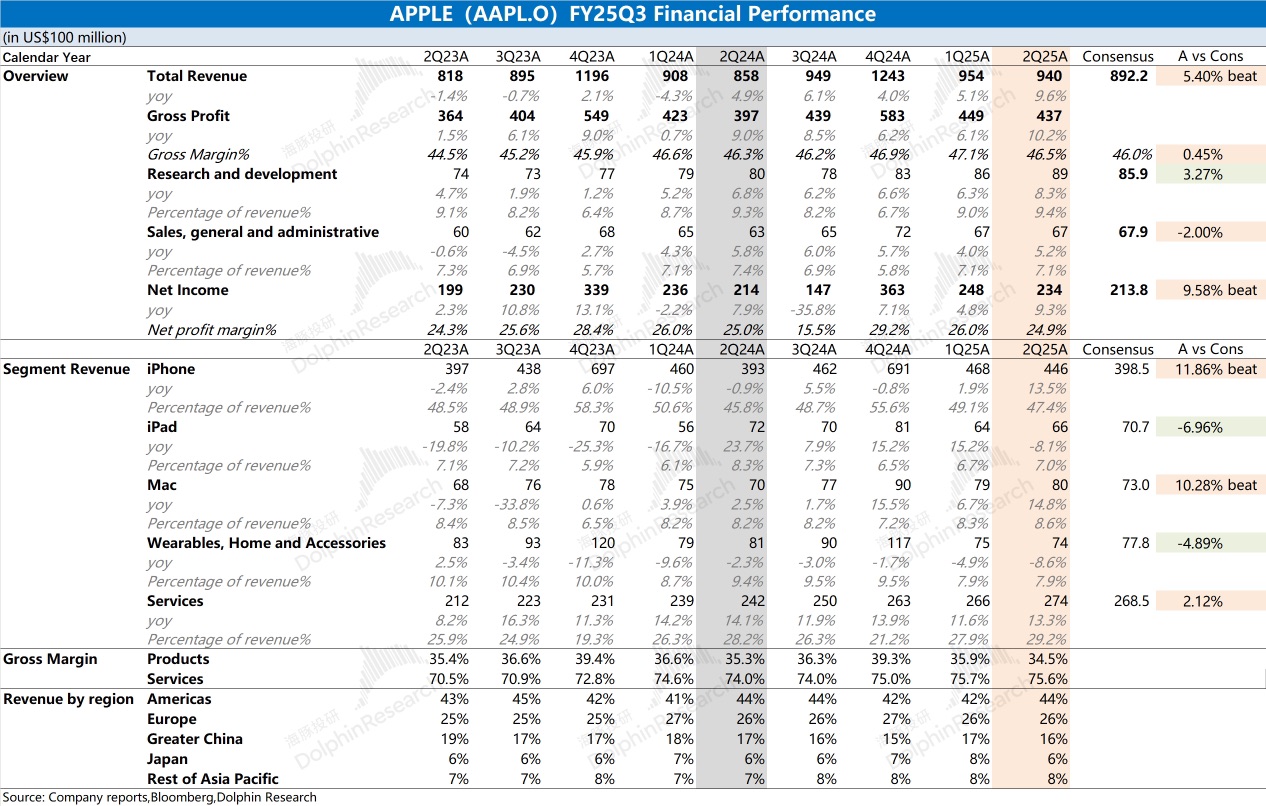

Apple Earnings Quick Interpretation: The company's revenue and gross margin for this quarter significantly exceeded market expectations, with the most unexpected performance driven by the iPhone business. Apple's operating expenses remained stable, and both revenue and net profit for the quarter achieved nearly 10% growth.

Specifically:

① In the hardware business, growth this quarter was driven by pre-purchase demand due to tariff impacts and subsidies in China, with both the iPhone and Mac businesses achieving double-digit year-on-year growth;

② In the services business, despite the challenge posed by the allowance of external links in the App Store in the U.S., the services business still achieved double-digit growth this quarter, indicating that the event had a minimal short-term impact on the company's performance;

③ In terms of gross margin, the company's overall gross margin improved year-on-year this quarter. However, from a product structural perspective, the services business gross margin remained high at 75.6%, while the hardware product gross margin significantly declined to 34.5%, with tariff impacts accounting for approximately $800 million.

Overall, although Apple delivered a solid performance this quarter, further demonstrating the company's strong moat, the market is more eagerly anticipating the company's progress in product innovation and AI business.

If the company fails to bring new breakthroughs to the market, its valuation can only fluctuate within historical ranges. For more detailed content, please follow Dolphin Research's subsequent specific commentary and conference call minutes. $Apple(AAPL.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.