Amazon 2Q25 Earnings Quick Interpretation: Amazon's performance this quarter was generally decent, with both revenue and profit exceeding expectations. However, core metrics were mixed, with retail performing well but AWS being somewhat disappointing.

Despite the earnings, the stock price fell, which Dolphin Research believes is mainly due to concerns about the future prospects of the retail business, in addition to AWS's underperformance. Specifically:

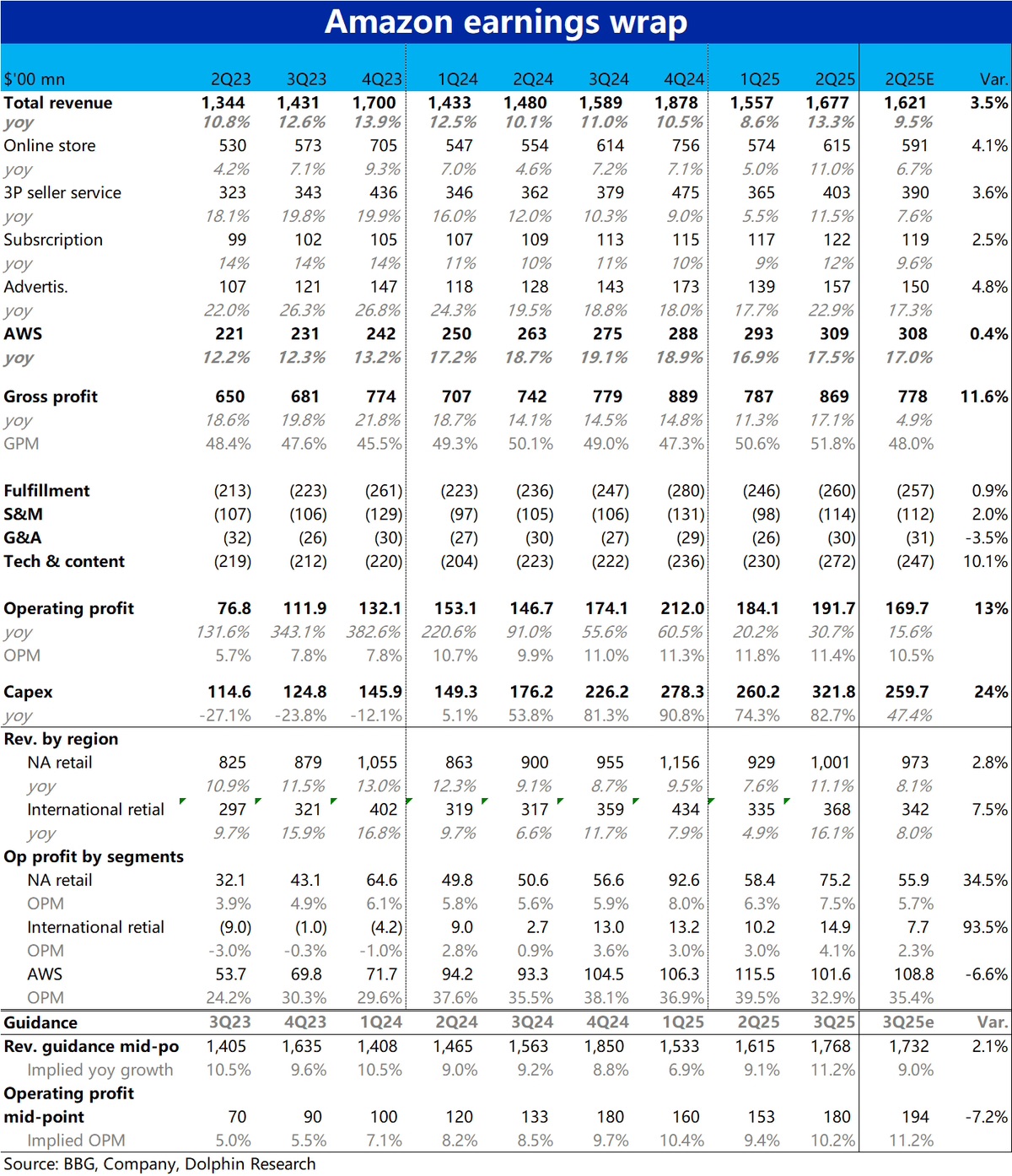

1. General Retail Business Performed Well: Partly due to favorable exchange rates, the revenue growth rate of the general retail business accelerated significantly from 7% to 12% quarter-on-quarter. Meanwhile, the operating profit margins of North American and international businesses did not remain flat or narrow as the company had previously guided. In fact, they continued to rise significantly, with actual operating profit reaching $19.2 billion, far exceeding the expected $17 billion.

2. AWS Disappointed: Due to the strong growth performance of Azure and GCP, AWS's growth rate is considered the single most important metric by the market. However, the actual growth rate of 17.5% did not accelerate significantly quarter-on-quarter and was only roughly in line with expectations. According to major Wall Street firms, insufficient computing power supply remains a major bottleneck for AWS. Additionally, the unexpected significant narrowing of AWS's profit margin this quarter is also unfavorable.

3. Are There Hidden Concerns in Future Guidance? Looking solely at the financial guidance provided by the company for the next quarter, there are no major flaws. The midpoint of the revenue guidance is slightly better than expected, although the midpoint of the profit guidance appears significantly lower than expected. However, Amazon's actual profit is generally referenced to the upper end of the guidance range, which is $20.5 billion.

It can only be said that the guidance does not offer many surprises. The issues are more in the qualitative outlook, as the market generally believes that the impact of tariffs will become more significant in the second half of the year, leading to increased product costs and consequently weaker retail growth.

Management also stated in the conference call that if costs rise due to tariff impacts, it is currently uncertain whether these additional costs will be borne by consumers, merchants, or the platform, which reinforces this concern. Dolphin Research has not yet seen the full transcript of the conference call and will focus on more qualitative judgments within it. $Amazon(AMZN.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.