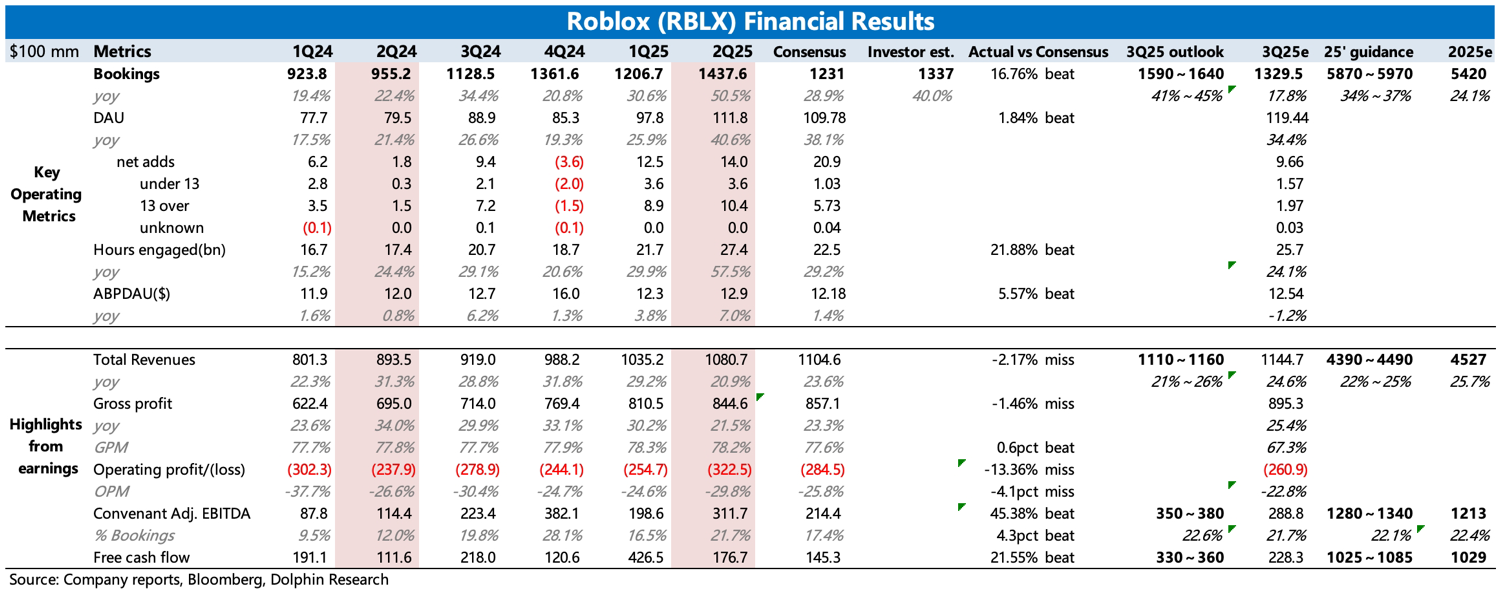

Roblox 2Q25 Earnings Quick Interpretation: The second quarter performance was robust, with overall results exceeding expectations driven by blockbuster hits, confirming Roblox's high growth potential. Although buy-side expectations for some core metrics were much more optimistic than sell-side, Roblox's actual performance was still superior. The following BBG consensus expectations are relatively outdated, and the beat/miss reference is not very meaningful.

1. Most Impressive: Bookings Guidance. The expected Q3 growth rate is 41-45%, and the full year is 34%-37%, showing very strong growth. This is mainly driven by two blockbuster hits in the first half, "Grow a Garden" and "Steal a Brainbot," which not only brought an incremental revenue increase in the hundreds of millions (estimated 100-200 million) but also significantly boosted platform user activity:

Consequently, it increased player engagement and willingness to pay for other games on the platform—excluding "Grow a Garden," total spending by users on other games in the second quarter increased by 36% year-on-year, and 75% of "GG" users played at least one other game on the same day, leading to a record high repurchase rate across the platform.

Although buy-side expectations were also high, with Q3 and full-year growth rates both over 35%, Roblox's guidance is evidently more aggressive.

2. Platform Ecosystem Expansion: Breaking the Circle of Non-Child Users + Enhanced Stickiness. The second quarter DAU exceeded 110 million, with a net increase of 14 million players quarter-on-quarter, 75% of whom were over 13 years old. However, "Grow a Garden" significantly boosted user time, with average time per user increasing by 12% year-on-year. If estimated by a DAU/MAU stickiness ratio of 20%, it implies that overall traffic in the second quarter may have approached 600 million, suggesting that the management's goal of 1 billion is no longer a fantasy.

3. Profit Sacrifice for Developers: Short-term Profit Sacrifice. The second quarter continued to foster a healthy economic ecosystem by providing more development tools while increasing revenue sharing for developers, especially high-quality game developers.

In July, the platform launched a new creator incentive program, allocating 35% of the revenue from users purchasing Robux to developers participating in the incentive program, whereas normally it is just over 20%.

However, this also slowed the pace of short-term loss reduction, with GAAP operating losses expanding to over 300 million in the second quarter, and the loss rate approaching 30%. Nonetheless, the current strategy of sacrificing profits to developers to improve a healthy ecosystem is very correct, as it is conducive to driving longer-term endogenous growth, and thus the market's tolerance for short-term losses is relatively high. $Roblox(RBLX.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.