Robinhood Quick Interpretation: The absolute star stock of the past quarter, with its market value more than doubling in just one quarter. Although the doubling in valuation is not closely related to last quarter's performance, it does not mean that the retail innovation king's Q2 performance was lackluster.

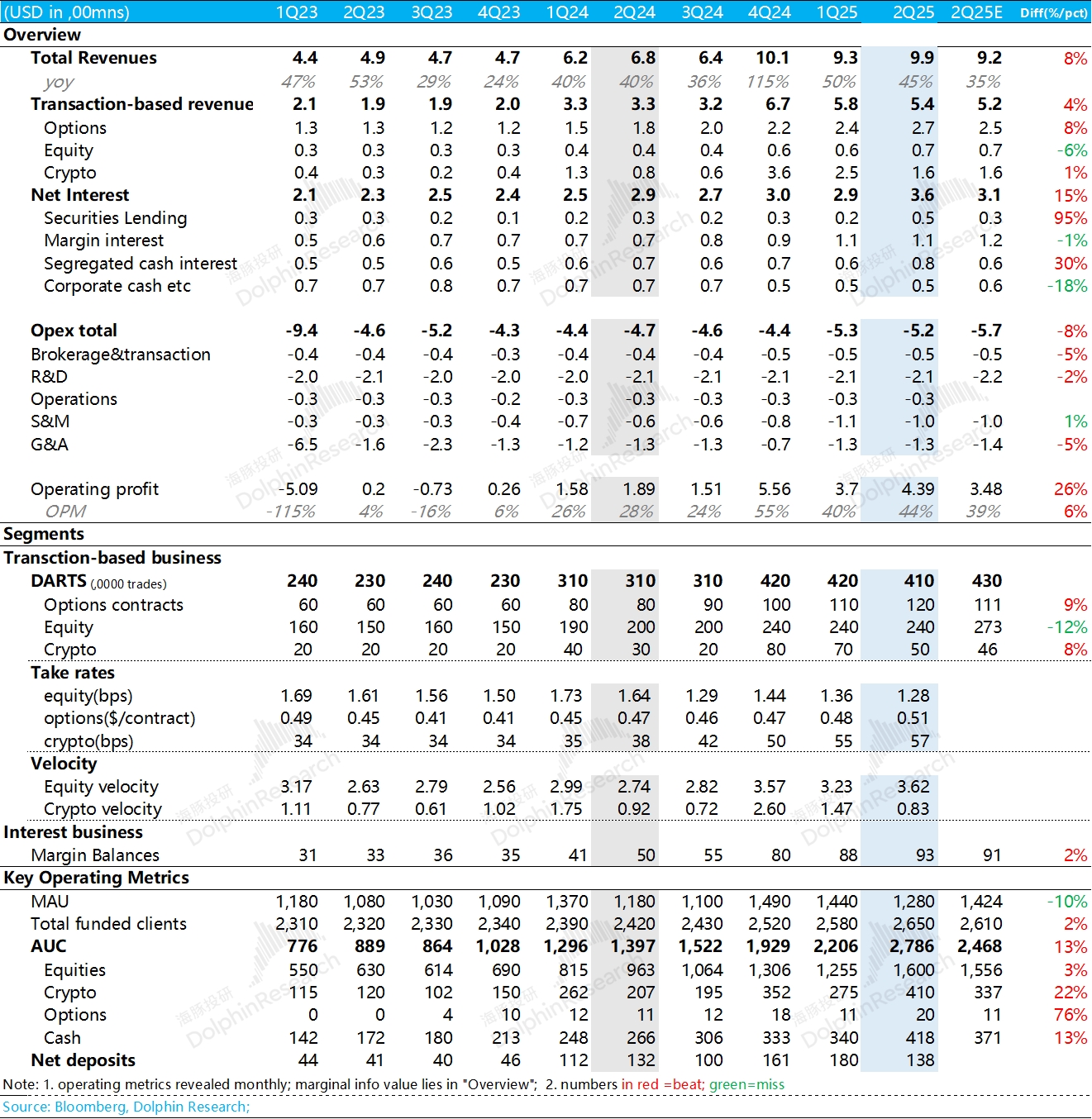

In fact, despite a weakening in endogenous virtual asset trading (with trading volume declining more than the market average), the company exceeded market expectations in revenue by increasing the monetization rate of its trading business (mainly options and virtual currencies) and benefiting from interest-bearing business due to a slower-than-expected rate cut and active securities lending business.

Meanwhile, on the overall expenditure side, R&D and marketing expenses remained cautious; in terms of personnel, excluding employees from mergers and acquisitions, the original number of employees even decreased; ultimately, operating profit reached $440 million.

Of course, valuation is a completely different matter: even if Dolphin Research assumes an operating profit of $500 million per quarter by 2025 (which is actually difficult to achieve, given the $370 million and $440 million in the past two quarters during a virtual asset bull market), the annualized post-tax profit would be $1.8 billion.

The current market capitalization of $94 billion corresponds to a 52X PE on the 2025 post-tax operating profit, nearly double the valuation premium compared to the S&P 500 index (28 TTM-PE); in other words, the stock price expansion over the past quarter has little to do with short-term performance fundamentals and is more about valuation expansion under a change in long-term logic.

This change in long-term logic is related to virtual assets, with Robinhood announcing a series of innovative products such as stock tokens (including primary assets like OpenAI) and perpetual futures for virtual assets at a conference held in France on June 30, directly expanding the imagination space for the future. Within five years, it has once again shown everyone a 'Robinhood' in the brokerage industry that does not follow conventional paths.

This business itself is still in a grand stage of imagination, so the current market pricing directly doubles the market space that HOOD can serve. And in the current situation where stablecoins open up the imagination space for virtual assets, and stock or asset tokens further expand Robinhood's imaginative space, as long as the market remains bullish, Hood is the continuous Alpha stock in the brokerage BETA market. $Robinhood(HOOD.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.