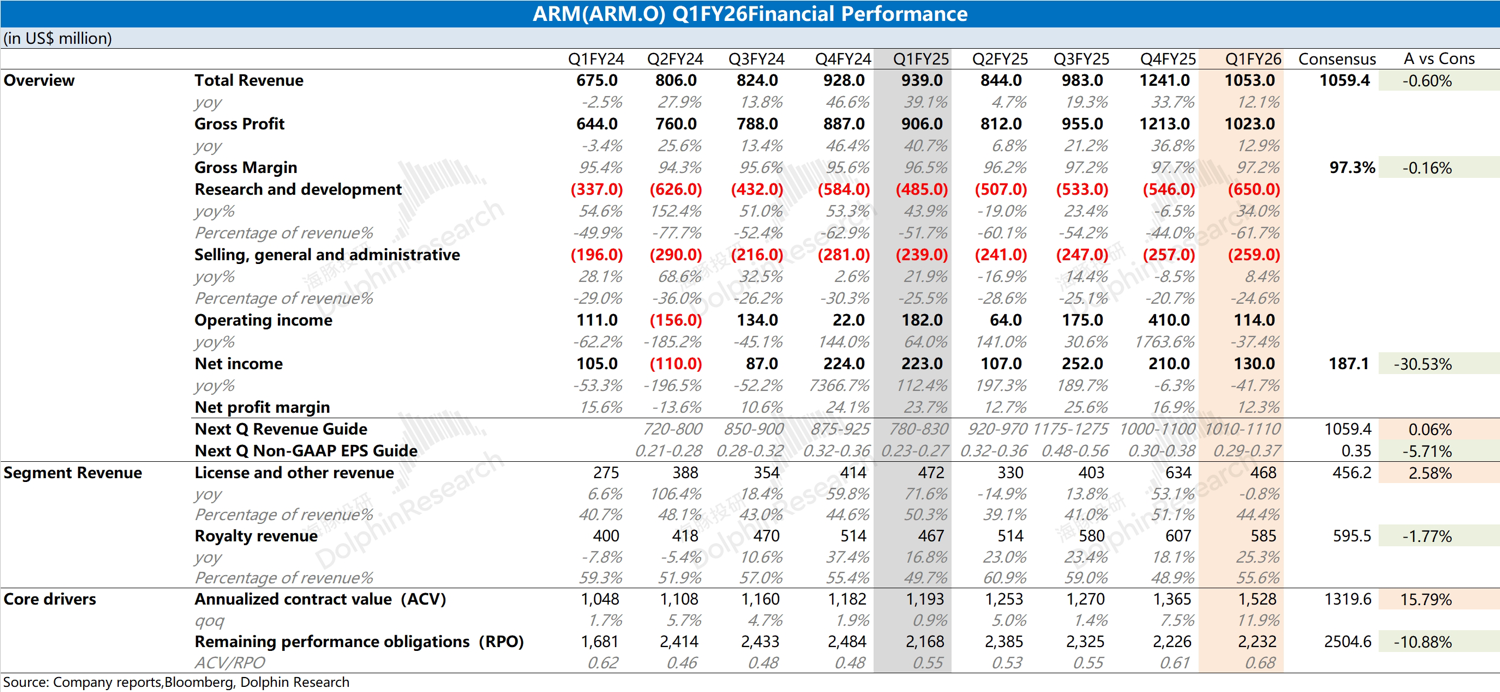

ARM Quick Interpretation: The company's revenue and gross margin are close to market expectations, but there is a significant decline in profits mainly due to a substantial increase in R&D expenses as the company has increased its investment in next-generation technology development.

Looking at specific business segments:

① This quarter's license business revenue was $468 million, showing a decline both year-on-year and quarter-on-quarter. Last quarter, the company recognized approximately $250 million in agreement revenue from the Malaysian government. Although last year also had a relatively high base, the decline is still not a good performance;

② This quarter's royalty business revenue was $585 million, with a year-on-year growth rate of 25%, mainly driven by demand from AI-driven smartphones, data centers, automotive, IoT, and other terminal markets. Among them, the market share of Neoverse chips in hyperscale data centers is expected to reach nearly 50% this year.

Compared to the current performance, the market is more concerned with the company's guidance, annual contract value, and order backlog. Although the company's annual contract value reached $1.53 billion, with a growth rate significantly higher than the company's mid-to-high growth target, the company's guidance and order backlog are relatively flat, especially the remaining unfulfilled orders, which have almost no growth quarter-on-quarter.

The current high valuation given to the company by the market is mainly based on the expectation that the company will digest the high valuation through performance growth. However, the current slowdown in revenue growth and the substantial increase in R&D investment will undoubtedly put pressure on the profit side again.

Although AI demand has a substantial pull on the company, the high valuation also requires the company to continuously deliver outstanding performance to support it. For more detailed information, please continue to follow Dolphin Research's subsequent detailed comments and minutes. $Arm(ARM.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.