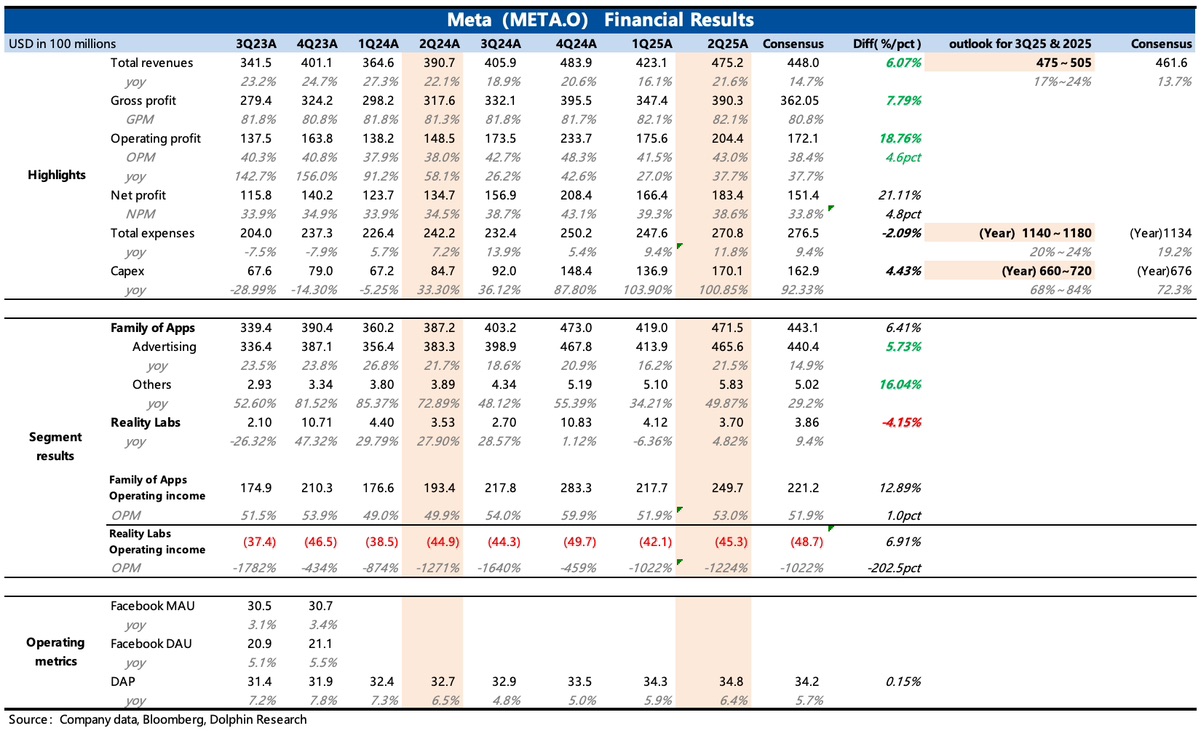

Meta 2Q25 Earnings Quick Interpretation: The second quarter performance was very impressive, with a focus on revenue exceeding expectations and only a slight upward adjustment in the annual guidance for total expenses. This will significantly alleviate recent market concerns about potential impacts from tariffs, EU antitrust litigation, and aggressive talent acquisition, which have pressured profit margins.

1. Advertising revenue grew by 21.5%, significantly exceeding expectations. From the perspective of advertiser surveys, not only is the impact of tariffs minimal, but Advantage+ and Reels continue to drive intrinsic growth in advertising.

Although the company indicated that the EU antitrust lawsuit (requiring the removal of 'pay to remove ads' product constraints and limiting Marketplace functionality) would impact the third quarter, the total revenue growth forecast remains high at 17-24% (including a 1 percentage point currency tailwind).

Breaking down volume and price, there was a certain acceleration in the expansion of ad impressions in the second quarter, implying further penetration of Reels among users. The growth rate of ad prices slightly slowed, possibly due to the lower pricing of Reels, while also indicating that the external macro environment and competitive landscape have not changed much, which remains advantageous for Meta.

2. Total operating expenses for the second quarter and the full year were not as high as the market expected. Since the second quarter, especially after the underperformance of the highly anticipated Llama 4, Zuckerberg seemed to be spurred into aggressively hiring talent at high salaries, coupled with high growth in depreciation expenses, raising market concerns about uncontrolled spending.

In reality, the situation in the second quarter was manageable, and this year's guidance was only slightly raised by about $1 billion at the lower end.

Ultimately, with impressive revenue, profits exceeded expectations. The operating profit margin of App services increased by 3 percentage points year-on-year, reaching 53%.

3. As for capital expenditures, they continued to double year-on-year in the second quarter, but were not excessively 'overspent'. After Google's bold investment of tens of billions, the market is also watching other giants' Capex plans. In reality, Meta only made a slight upward adjustment, increasing from $64-72 billion to $66-72 billion.

The reason is that Meta's logic for investing in AI differs from Google's. Meta focuses more on internal business improvements rather than directly generating pure incremental demand like Google's cloud services, which are more affected by downstream demand. Therefore, in the short term, Meta will also pay more attention to ROI. $Meta Platforms(META.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.