Microsoft 4Q25FY Quick Interpretation: As the leading company in AI software, Microsoft has delivered an impressive performance this quarter, with various indicators generally exceeding expectations and showing an accelerating upward trend.

As of now, guidance for the next quarter has not been released, so we will first focus on the highlights of this quarter's performance:

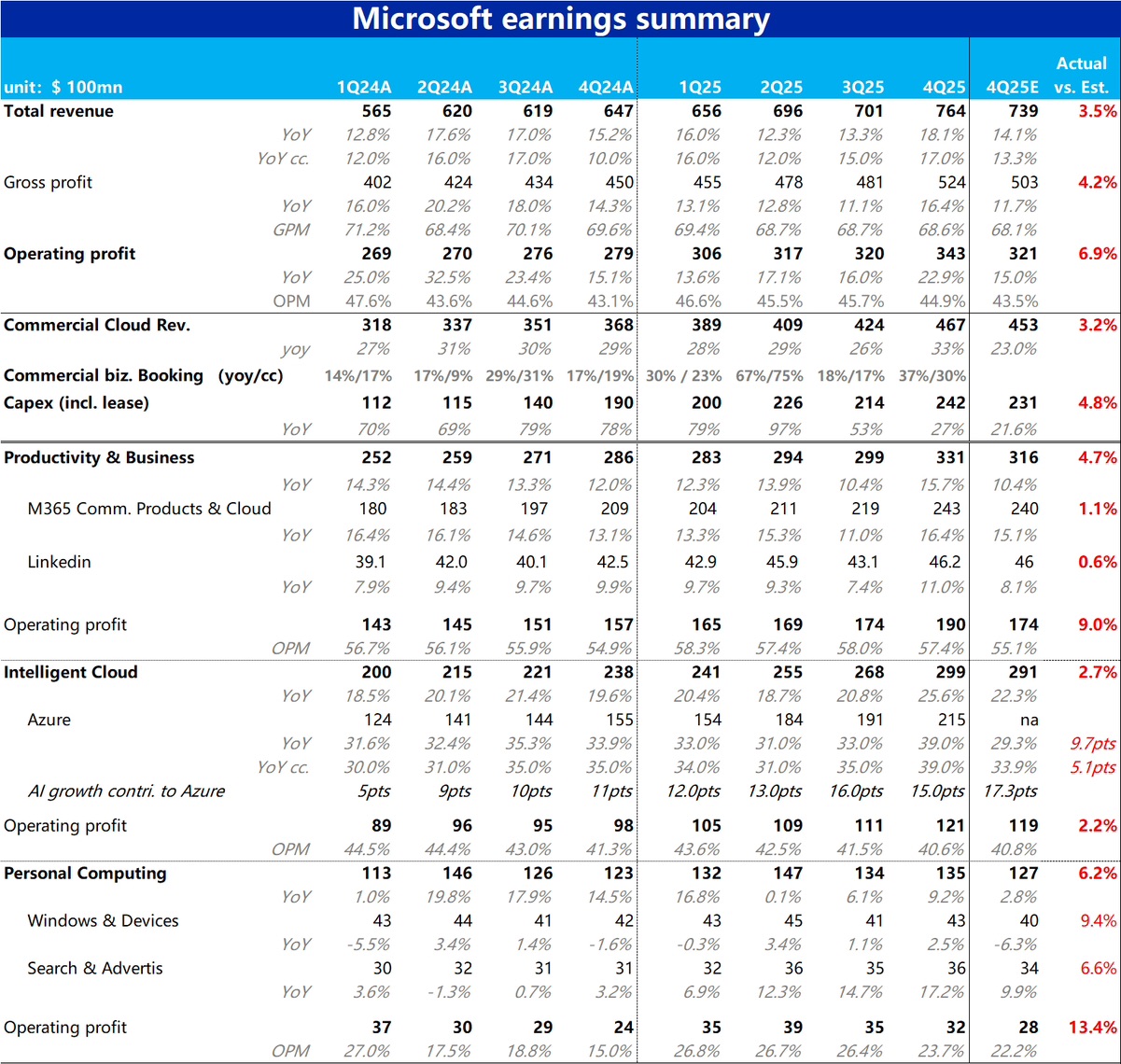

1) In terms of overall performance, total revenue for this quarter increased by 18% year-on-year, significantly accelerating from 13% in the previous quarter. Even excluding the favorable impact of the dollar's depreciation, it still accelerated by 2 percentage points quarter-on-quarter. Operating profit grew by approximately 23% year-on-year, with a noticeable improvement in profit margins.

2) The most concerning sub-business indicator for the market - Azure's growth rate, reached as high as 39% under both variable and constant currency rates this quarter, continuing to accelerate significantly from the previous quarter. The company's guidance last quarter was that Azure's growth rate would remain roughly flat quarter-on-quarter. According to UBS, even buy-side expectations were only around 36% (under constant currency).

The consecutive two quarters of 4 percentage points acceleration demonstrate a strong demand for Microsoft's cloud services, seemingly without any constraints from supply bottlenecks.

3) In terms of forward-looking indicators, the amount of new commercial bookings signed this quarter jumped by 37% year-on-year (30% under constant currency), with a significant increase in growth rate quarter-on-quarter.

The remaining balance of contracts to be fulfilled also reached a new high of $368 billion, a year-on-year increase of nearly 37% (34% in the previous quarter). Both the year-on-year growth rate and the quarter-on-quarter net increase reached historical highs, suggesting that subsequent demand will remain strong.

4) In terms of Capex, including leases, this quarter's expenditure was $24.2 billion, an increase of about $2.8 billion from the previous quarter. This is slightly higher than Bloomberg's consensus expectations but generally in line with the expectations of major investment banks that Dolphin Research has noted. In this regard, it did not continue to significantly increase spending like Google. $Microsoft(MSFT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.