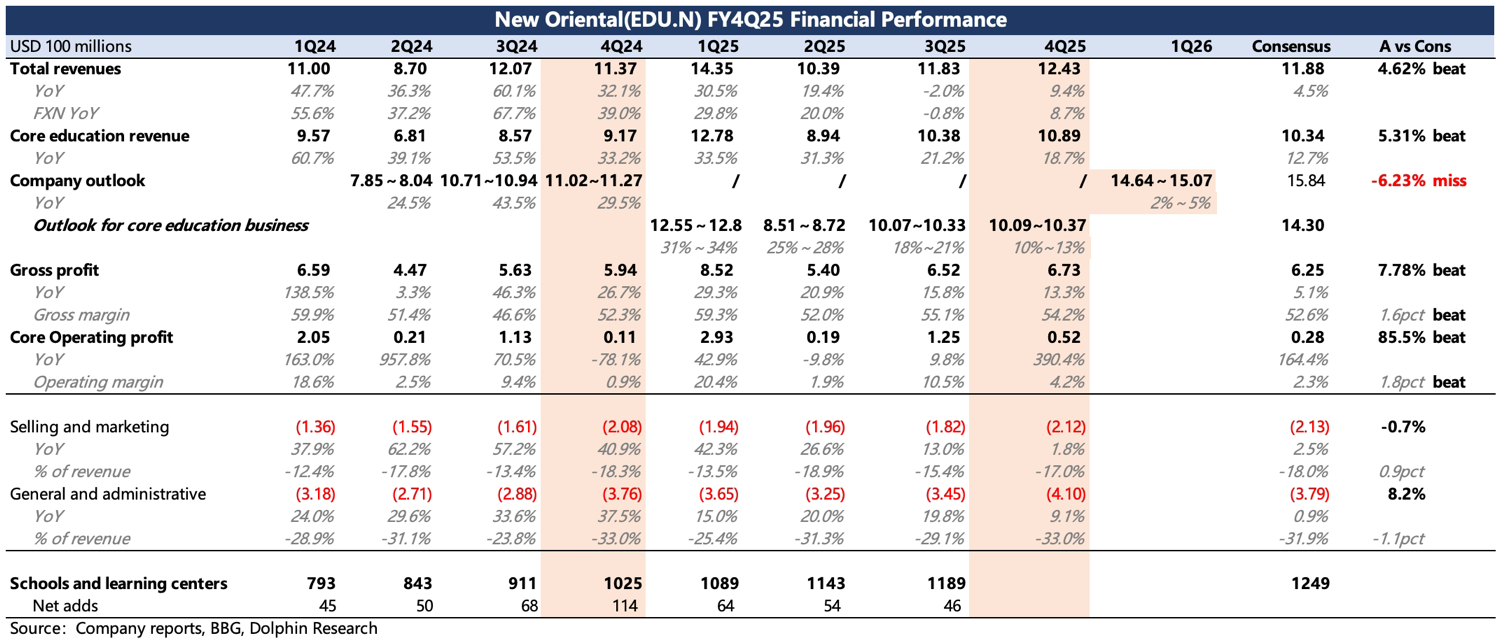

New Oriental 4Q25FY Quick Interpretation: The major pitfall in this performance lies in the guidance, including revenue guidance for the next quarter and the entire fiscal year 2026, both weaker than market expectations, possibly due to the management's cautious conservatism.

This time, there is no separate guidance for education revenue, so the extent of the drag from e-commerce still needs to be explained by the management in terms of detailed business conditions.

However, in the short term, it will undoubtedly hit market confidence again. The only consolation is that the progress in cost reduction, efficiency improvement, and increasing shareholder returns has exceeded expectations. As with the feeling from the last quarter, although New Oriental's current valuation is not high, until the fundamental concerns are resolved, we can only look at the valuation opportunities of the 'dividend bottom'.

1. Guidance 'bomb': Current performance exceeds guidance and expectations. However, management's revenue growth guidance for 1Q26 and the entire year 2026 is below expectations—next quarter growth rate of 2-5%, and nearly 5-10% growth for the year, while the market still expects a normal increase of over 10%.

2. Where are the concerns?: Since the total revenue expectation is given this time, it is difficult to clearly determine which specific area has issues. Dolphin Research speculates that it is mainly study abroad and live-streaming e-commerce.

Dolphin Research has always been conservative about e-commerce expectations, and both 4Q25 and 1Q26 are still in the pain period of the year-on-year base after Dong Yuhui's breakup (down 30%), with Q4 performance also below expectations.

We are mainly concerned about the study abroad business (which has a greater impact on the group's valuation in our model).

This quarter's study abroad performance (test preparation growth rate of 15%, consulting growth rate of 8%) is actually not as bad as we expected. But after tariffs, escalation of confrontation, and visa approval slowdown, all have suppressed the demand for studying in the United States. Consulting demand often leads test preparation, indicating short-term future pressure on study abroad business demand.

3. Other businesses temporarily stable: Other businesses, apart from the above, are performing normally for now. However, it is worth noting that the growth rate of enrollment in quality training has significantly declined again, possibly due to the impact of holiday misalignment, so the growth this season mainly relies on the increase in customer unit price.

4. Efficiency improvement within the group: Q4 profitability performance, after excluding the impact of goodwill impairment, is actually slightly above expectations, with a Non-GAAP operating profit margin of 6.6%, an increase of 3 percentage points year-on-year. Last quarter, management also made statements about improving input efficiency and optimizing cost expenditures. $NEW ORIENTAL-S(09901.HK)$New Oriental EDU & Tech(EDU.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.