Spotify 2Q25 first take: The second quarter performance was poor, but mainly due to external factors, essentially reflecting the impact of currency headwinds and employer social charges rising with market capitalization, among others. The long-term thesis remains intact.

Although institutions had tuned down expectations early July, in reality, the latest earnings still brought some unexpected temporary pressure.

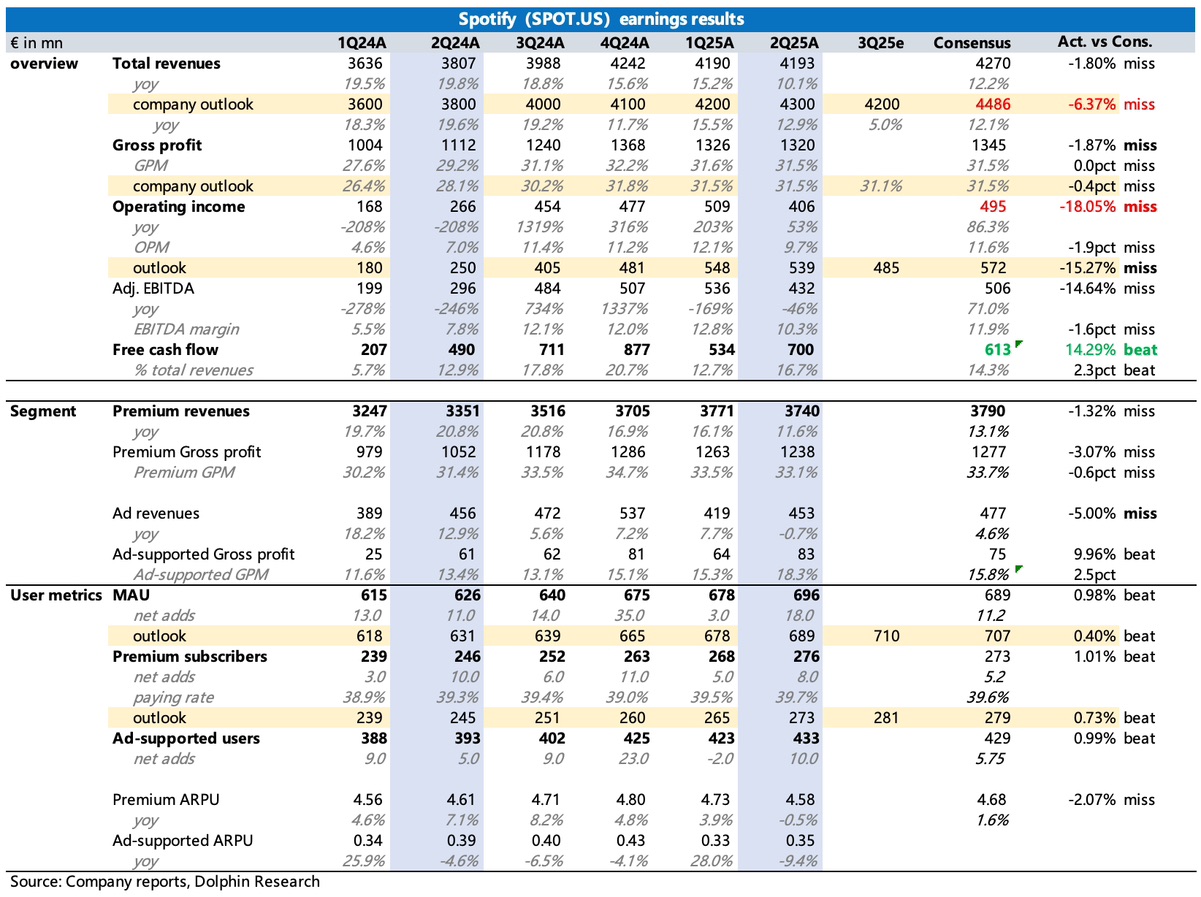

1. Revenue grew by 10%, significantly slowing from the previous quarter, with a 5ppt impact from exchange rates, meaning an original organic growth rate of 15%, slightly above the original guidance of 14.2% organic growth.

The real problem lies in its Q3 guidance —— revenue growht is guided at 5%, even excluding the 5-point currency impact, it is below market expectations, which may be the main point of dissatisfaction.

Driven by a new round of price increases in Europe (initially tested in Belgium, the Netherlands, Luxembourg, and planned to expand in the summer), the market originally had more optimistic growth expectations.

2. User metrics performed well, with both monthly active users and subscription numbers exceeding company guidance and market expectations in the second quarter.

After making adjustments in response to an antitrust lawsuit on Apple's App Store in May, Spotify released a new version that more smoothly provides third-party payment channels. We speculate that this led to significant promotions, aiming at boosting user activity.

3. The dual pressure of revenue and expenses led to a noticeable short-term deterioration in profit margins. The boost from price increases was offset by currency impacts, and the opex back to expansion.

OPex expansion is partly due to the end of an efficiency cycle and possibly due to the combined effects of the new version release, promotional efforts, and employee incentives rising with market capitalization (including Social Charges).

However, with the release of the new version, the potential for improving conversion rates by reducing payment friction is worth continued attention. $Spotify(SPOT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.