Tesla 2Q25 First Take:

Judging solely from this performance, Tesla's second-quarter financial report performed well, especially in the core automotive business, which exceeded market expectations.

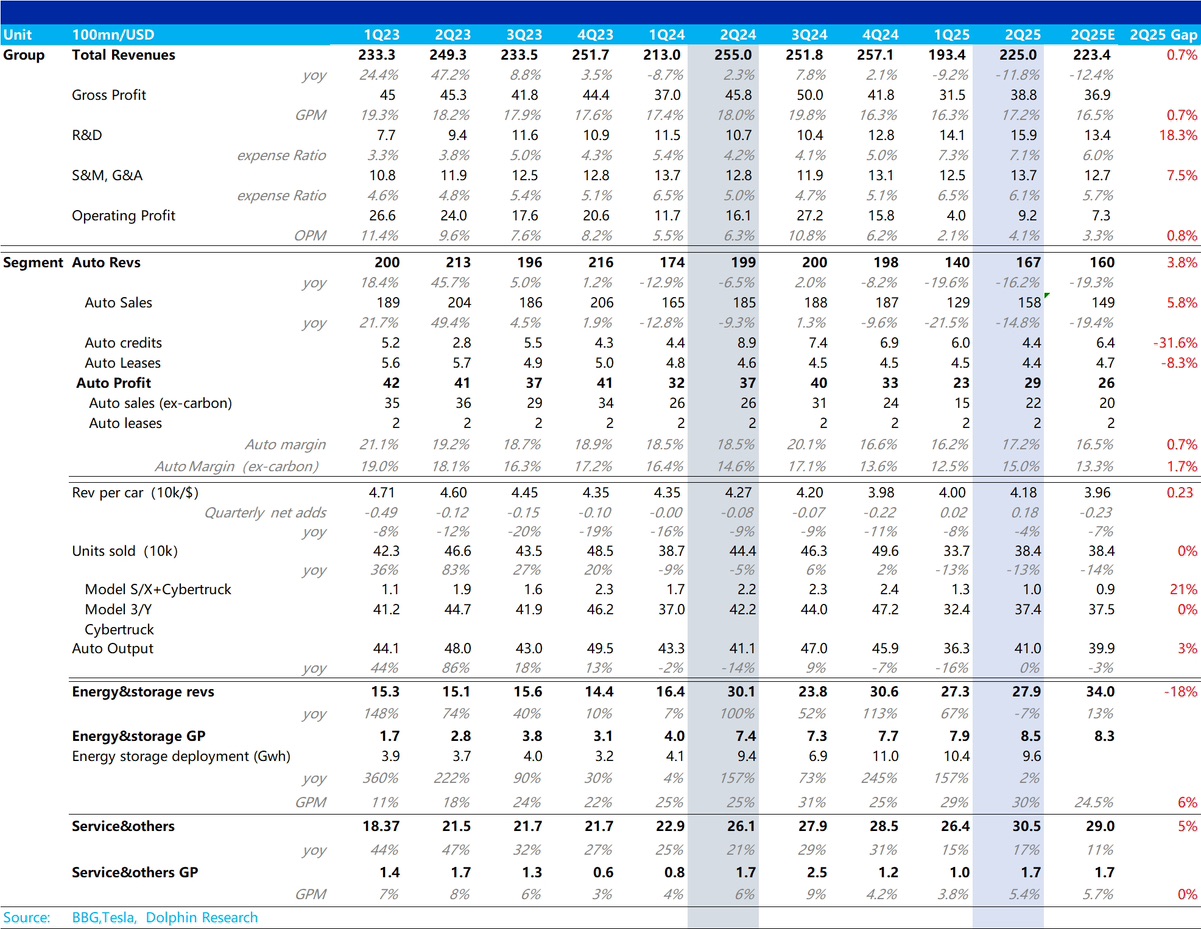

Starting with the top line total revenue, the total revenue of $22.5 billion exceeded market expectations by about $200-300 million. Looking at the various revenue segments:

The energy storage business was impacted by tariffs, and its revenue performance was flat, which was already priced in. The service business continued to grow quarter-on-quarter, performing well. However, the core automotive business showed surprising results.

This time, both automotive revenue and gross margin performed well. Automotive sales revenue was $15.8 billion (excluding regulatory credits and leasing), and the pure vehicle sales gross margin rebounded to 15% (excluding regulatory credits), both exceeding expectations. Finally, it emerged from the worst trough of vehicle sales in the first quarter. Dolphin Research believes this performance is mainly due to the higher pricing of the Model Y Juniper launched in the second quarter, which led to higher vehicle sales prices. Additionally, there were no negative impacts from production halts and ramp-ups affecting fixed amortization costs this quarter.

However, Tesla is clearly a stock priced for the future. Since the first-quarter report, the stock price has reached $330, largely due to the normal progress of the Robotaxi business and the pricing of most of the ambitious Robotaxi and Optimus businesses, which are somewhat decoupled from the performance of the automotive fundamentals.

Therefore, for Tesla, investors need to focus more on future performance:

Currently, in terms of automotive fundamentals, the cheap version of Model 2.5 is still expected to be released, but the progress may be delayed. The biggest bearish factor is the $7,500 subsidy from the US IRA, especially since Tesla's stock price has reached a relatively high level of $330. The market may have relatively stringent requirements for this performance, especially after Musk warned that Tesla's vehicle sales fundamentals would be poor for several quarters, and the progress of Model 2.5 remains unknown.

However, in the ambitious Robotaxi and Optimus businesses, Dolphin Research's investigation suggests that the breakthrough turning point may be at the end of 2025 or early 2026. Currently, these two business logics cannot be falsified in the short term, but given their grand long-term prospects, if this performance sees a pullback, it might be a good entry opportunity. Stay tuned for Dolphin Research's subsequent comments. $Tesla(TSLA.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.