Google 2Q25 First Take:

Capital expenditure in the second quarter exceeded expectations, with the annual investment guidance raised again from $75 billion to $85 billion. There is much debate about the positive and negative impacts of AI on Google. Although the long-term risks remain and the changes are full of uncertainties, this adjustment reflects the company's short-term benefits from AI and its firm determination to transform.

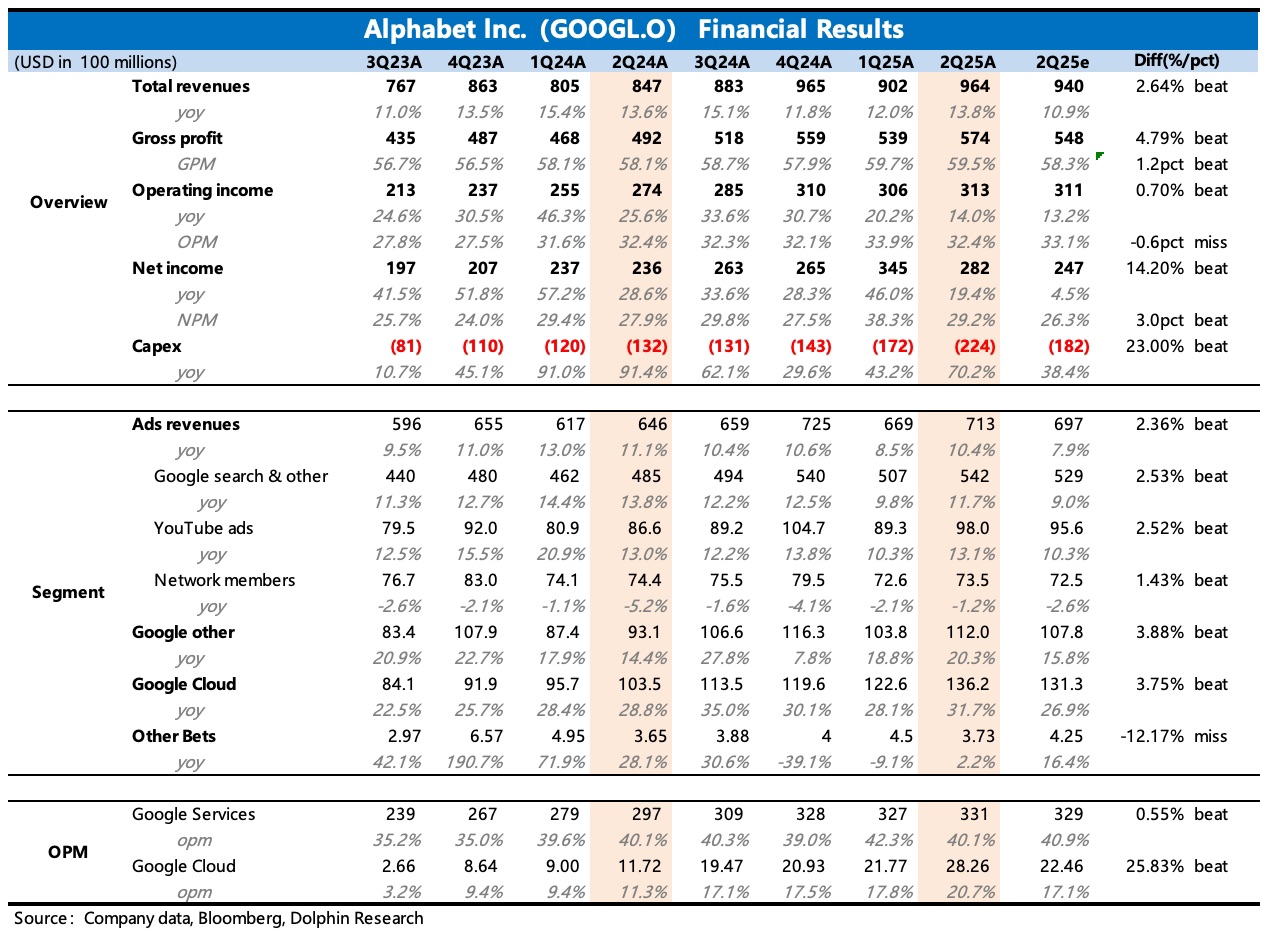

1. Overall performance is acceptable. With a favorable exchange rate (about 1 point), revenue growth is stable but only slightly exceeds expectations (recently, market expectations for Google's performance have increased, and BBG expectations are lagging). Due to $1.4 billion in legal expenses, operating profit margin was affected, but it was actually good after exclusion.

2. As in the previous two quarters, the main source of market expectation changes is the search business.

Previously, due to third-party data platforms and statements from Apple executives, the market had high concerns about Google's search share. However, as institutional research on some advertising agencies showed, the scale of investment in Google search was not significantly negatively affected by tariffs and AI platform competition (the impact of tariffs gradually eased after May, and merchants resumed investment). Market expectations had already risen before the earnings report, leading to a recovery in Google's valuation.

Q2 search actual growth performance +11.7% YoY is still slightly higher than the raised expectations (10-11%). AI + PMax has improved the overall ROAS for commercial searches (such as shopping retail), thus attracting some merchants' budgets.

3. YouTube saw good growth in user time on both CTV and Shorts, offsetting some of the pressure on brand advertising growth, with a YoY increase of 13%.

4. Google Cloud benefited significantly from AI growth, with the current annualized revenue scale reaching $50 billion, expanding by over 30% YoY. Although the market had expectations, the actual performance was still better, with Q2 growth of 31.7% compared to Q1 acceleration, possibly due to some supply improvements. $Alphabet - C(GOOG.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.