Stellantis is gone, is hydrogen fuel cell vehicles still worth sticking to?

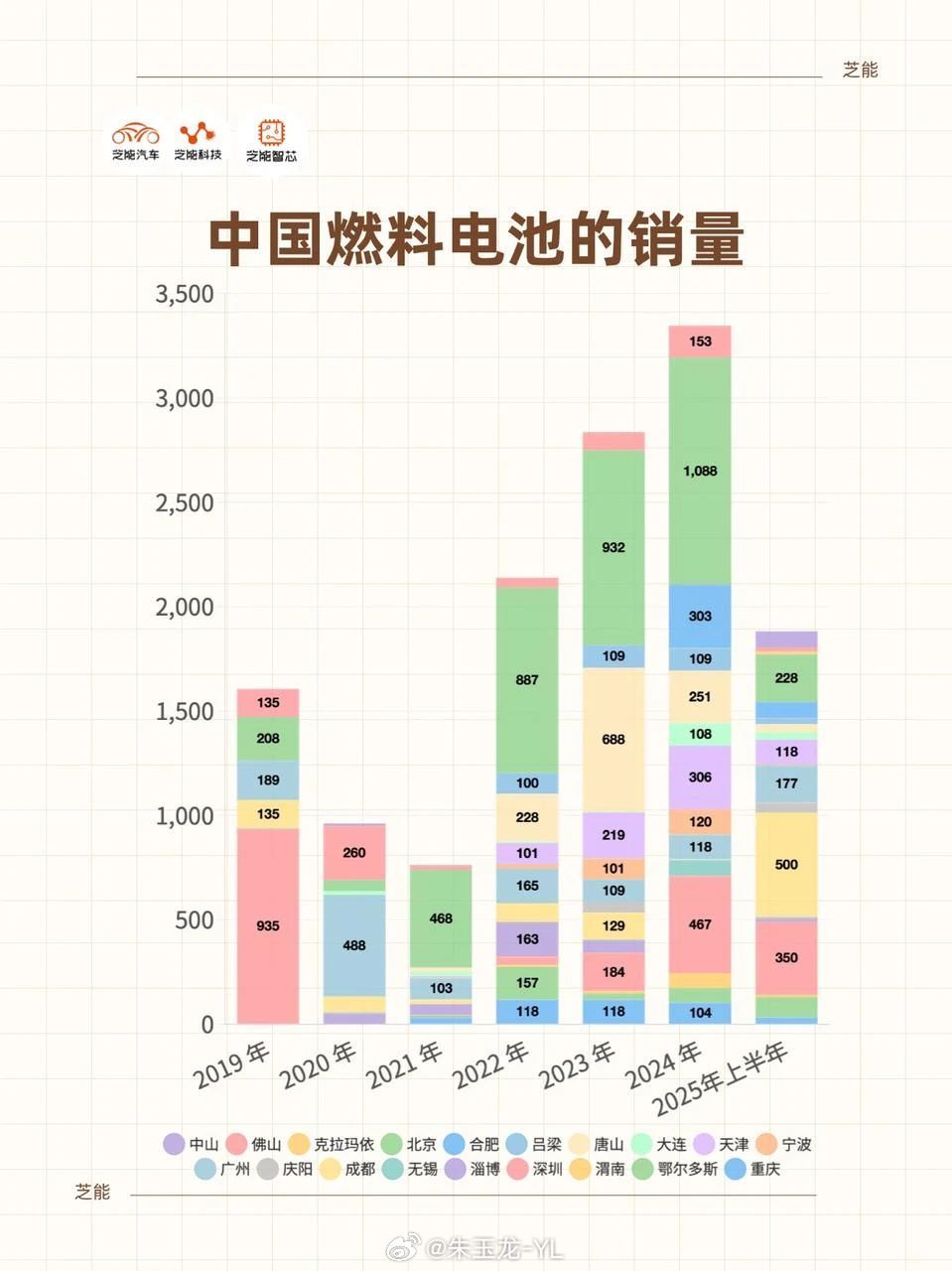

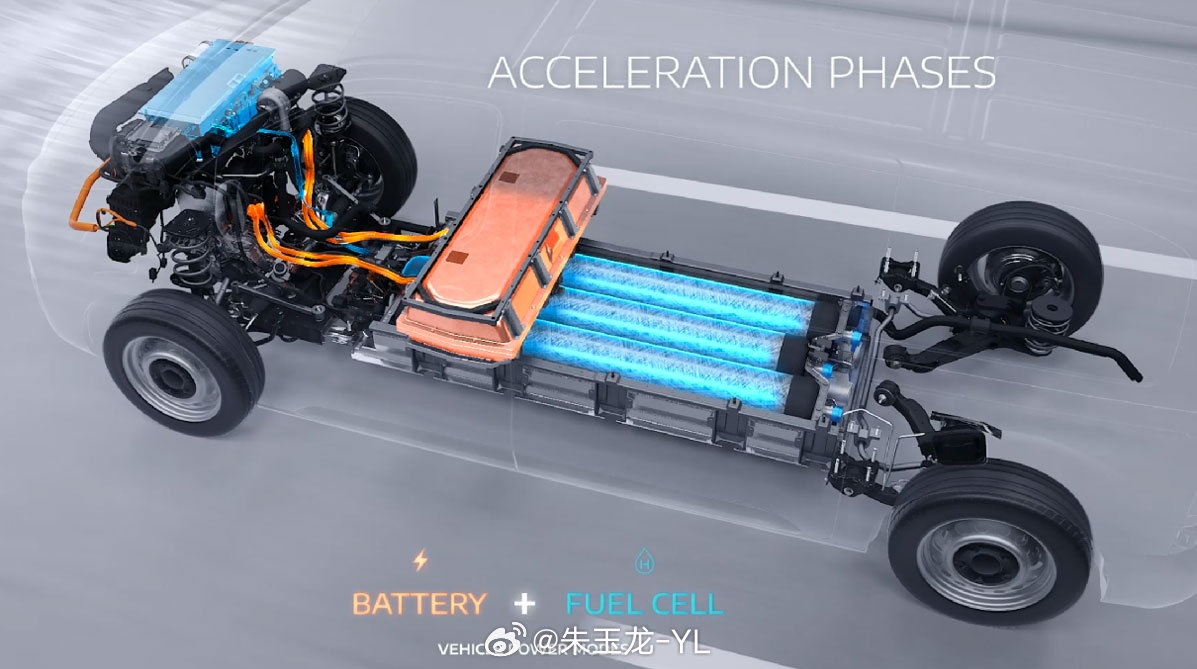

Stellantis, the world's fourth-largest automaker, has just announced its withdrawal from hydrogen fuel cell passenger vehicle development. Europe has always insisted on its diversification, but now it seems that the entire application of fuel cells in passenger vehicles has been labeled as 'unfeasible'. Now, only Toyota, Honda, Hyundai, and BMW are still holding on to hydrogen passenger vehicles—the so-called 'Big Four of Hydrogen Fuel'—and none of them are in it for profit. It's more about technological reserves and brand image. The reality is that Hyundai has delayed the new Nexo, and Honda has scaled back its hydrogen fuel product line.Why is Stellantis pulling out? Simply put, hydrogen fuel cell vehicles face 'three major mountains':The cost of building hydrogen stations is much higher than building superchargers, and operations are still losing money;Hydrogen is ridiculously expensive, with prices in the U.S. rising to $36 per kilogram. Filling up a Mirai costs $200, enough to buy 20 cups of coffee at Starbucks!Not to mention the 'user experience' surprises like long queues, freezing, and refueling failures.On the technical side, it's not reassuring either. Fuel cell range has already exceeded 800 kilometers, but so what? If you can't even refuel with hydrogen, what's the point of going far? You might as well drive less and charge faster. The safety issues of hydrogen stations are already an unsolvable problem.The worst part is the resale value. A new car costs over $30,000, but a used one is only worth $2,000. If it weren't for Toyota's $15,000 hydrogen card subsidy, this car probably wouldn't even make it out of the driveway.So, should China still stick to hydrogen fuel cell vehicles? The answer is: It's hard to say. Our strategy has always been commercial vehicles, targeting heavy trucks, sanitation, and cold chain logistics—areas where electric vehicles can't compete and diesel vehicles are too polluting. But recently, even these areas are being challenged by pure electric vehicles. The 'comfort zone' of hydrogen fuel cell vehicles seems to be constantly disrupted by pure electric. Behind this is also the state subsidies—a hydrogen heavy truck can receive over a million yuan. The problem is, after 2025, these subsidies will start to be phased out. Whether the industry can sustain itself by then will depend on whether the supply chain can stand on its own.Stellantis' exit is due to the lack of a closed commercial loop. If China's hydrogen fuel route wants to survive, it must shift from 'relying on policy support' to 'relying on market vitality.' It's not just Stellantis that's leaving—we might be next.The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.