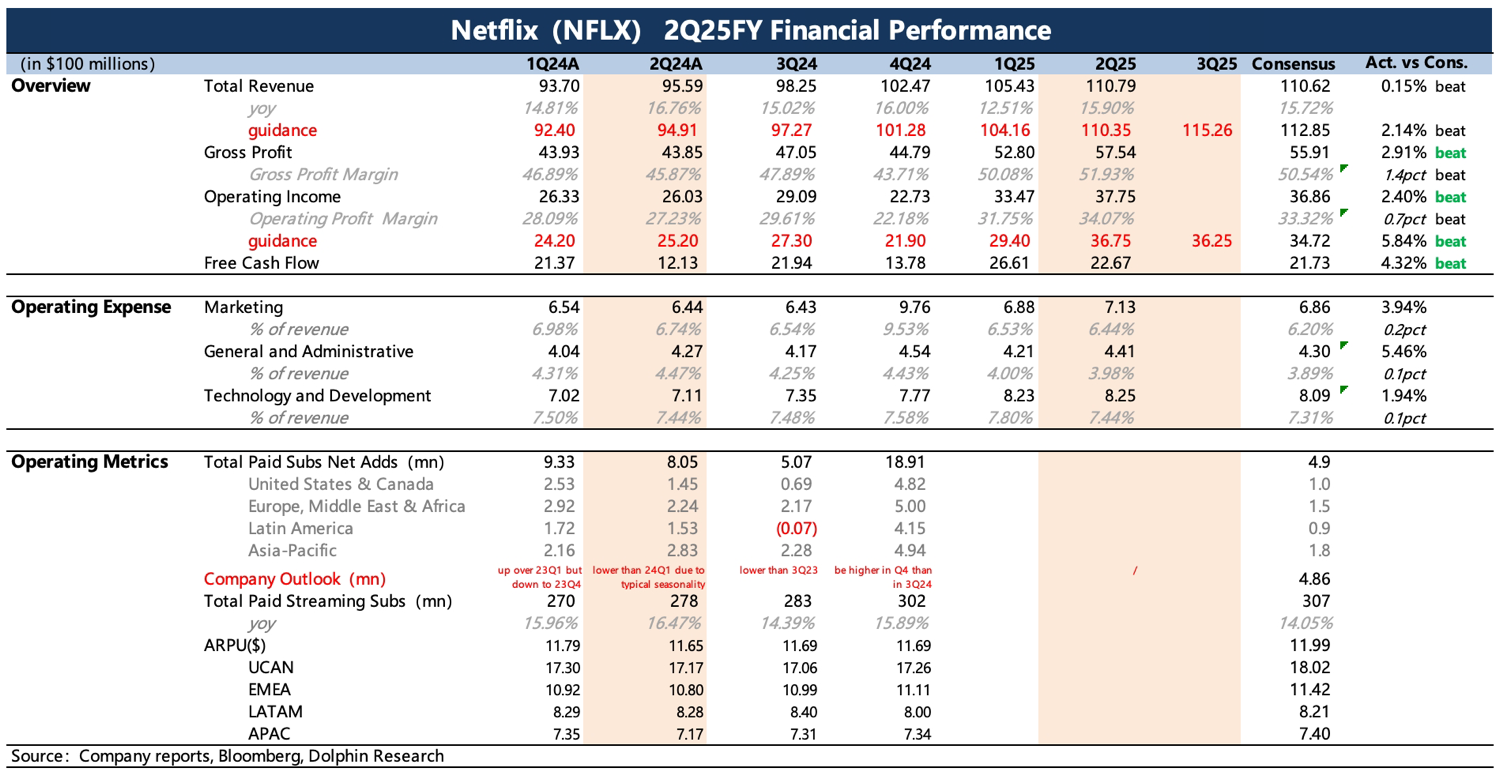

Netflix 2Q25 Quick Interpretation: The overall performance in the second quarter was quite good, maintaining its usual "stability." Revenue grew by 16%, and profit increased by 20%, mainly benefiting from the price hikes in core regions at the beginning of the year and the boost in subscriber numbers from the release of "Squid Game 3" at the end of the quarter.

Confident in a wave of strong content in the second half of the year, the company has raised its guidance for the third quarter and the full year.

(1) The full-year revenue for 2025 has been raised from $43.5 billion to $44.5 billion, to $44.8 billion to $45.2 billion, with a growth rate of 15% to 16%, exceeding the market consensus (~$44.5 billion).

(2) The operating profit margin for 2025 has been increased from 29% to 29.5% (based on the exchange rate at the beginning of the year), and if calculated at the current exchange rate, the profit margin approaches 30%, which is basically in line with expectations.

However, most of the indicators for the current performance were within expectations. Although the new guidance exceeded the current market expectations, the action of raising guidance was also unanimously anticipated by investors. Referring to historical situations, the extent of the earnings beat this time is not high enough. Therefore, under the sentiment of valuation concerns, the market reaction appears somewhat muted.

Netflix is currently valued at $542.3 billion, and in the short term, to drive this over $500 billion market cap, it indeed requires more impressive results. Therefore, it is more appropriate to understand Netflix's valuation premium from the perspective of long-term stable growth. $Netflix(NFLX.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.