Sharing an interesting chart:

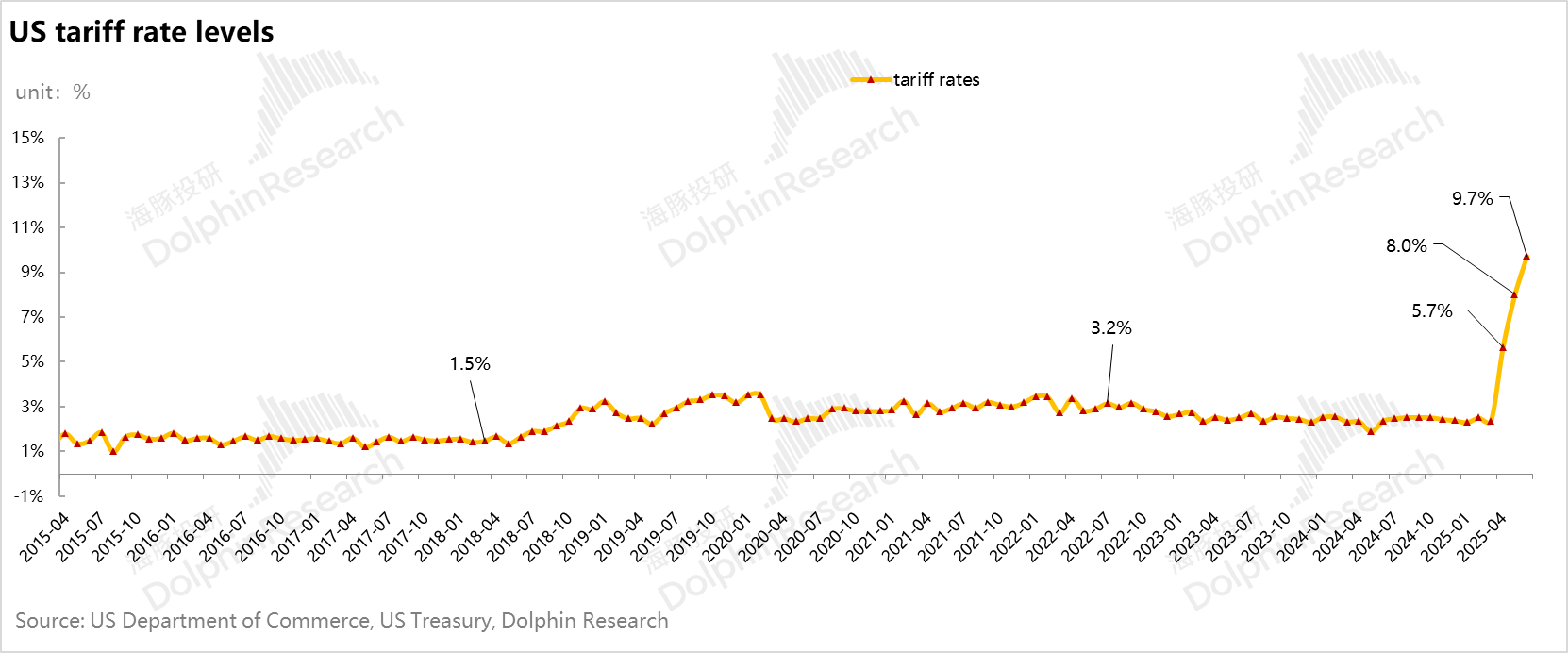

By comparing the monthly import value of the U.S. government with the tariff revenue announced by the U.S. Treasury each month, we can observe the following trend in the actual comprehensive tariff rate of the U.S.:

Before 2018, the U.S. comprehensive tariff rate was basically within 1.5%. After 2018, through the trade war with China, the U.S. comprehensive tariff rate was raised to around 3%. Since April, it has been rising steadily, and by June, the U.S. tariff rate should have increased to around 10% from this level.

According to this trend, it is estimated that the subsequent average U.S. tariff rate should stand at about 15%.

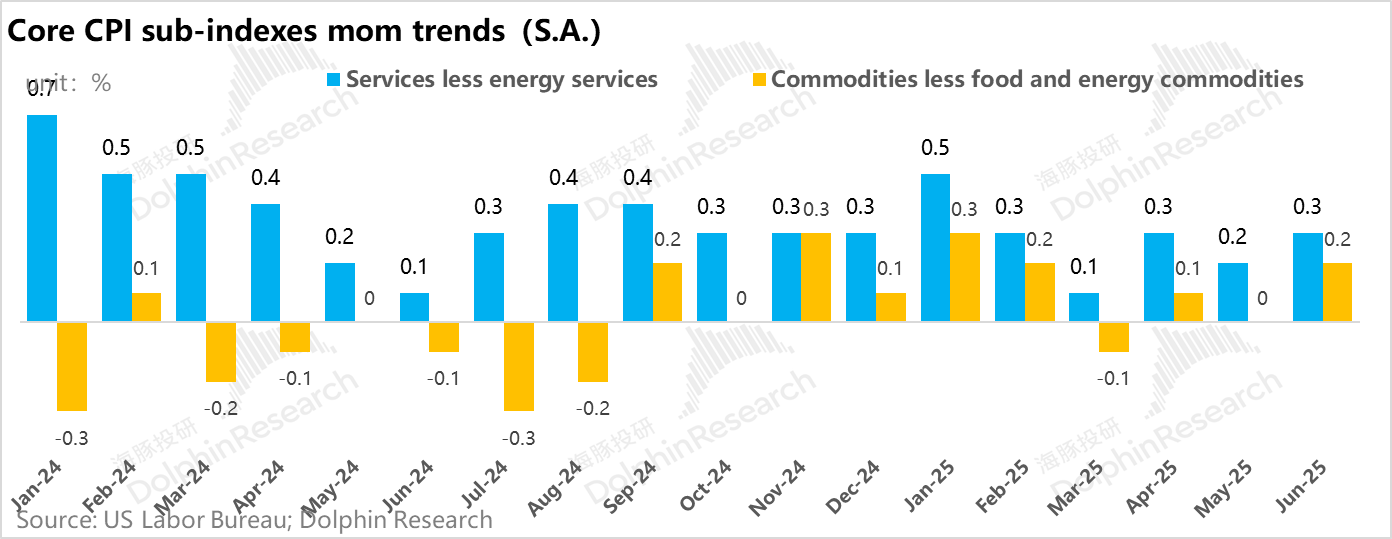

The remaining key issue is whether prices will rise: According to the June CPI figures, due to the exaggerated decline in automobile prices in goods prices, the month-on-month increase in housing costs in service prices has slowed to a 0.2% month-on-month growth rate. The core CPI month-on-month is 0.23%, and the price increase is basically under control.

Since the tariffs were implemented in April, if there is a 2-3 month cost transmission period, by September (when the August CPI data is released), the impact of tariffs on U.S. domestic prices should be evident.

If the month-on-month increase in core prices can be controlled within 0.25% (annualized year-on-year 3%), then the Federal Reserve's benchmark interest rate of 4.25%-4.5% still has room to decline.

Is it possible that Trump is conducting a large-scale social experiment to see to what extent tariffs can affect U.S. prices, but not too significantly, allowing the current high interest rates to have room to fall, while also using additional tariffs to offset the fiscal deficit?

This massive debt could be managed by: a. reducing interest costs through lower interest rates; b. reducing the fiscal deficit with additional tariff revenue; c. raising inflation but keeping it within a tolerable range, with residents bearing part of the massive debt?

If this scenario occurs, it would basically be a path to a soft landing.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.