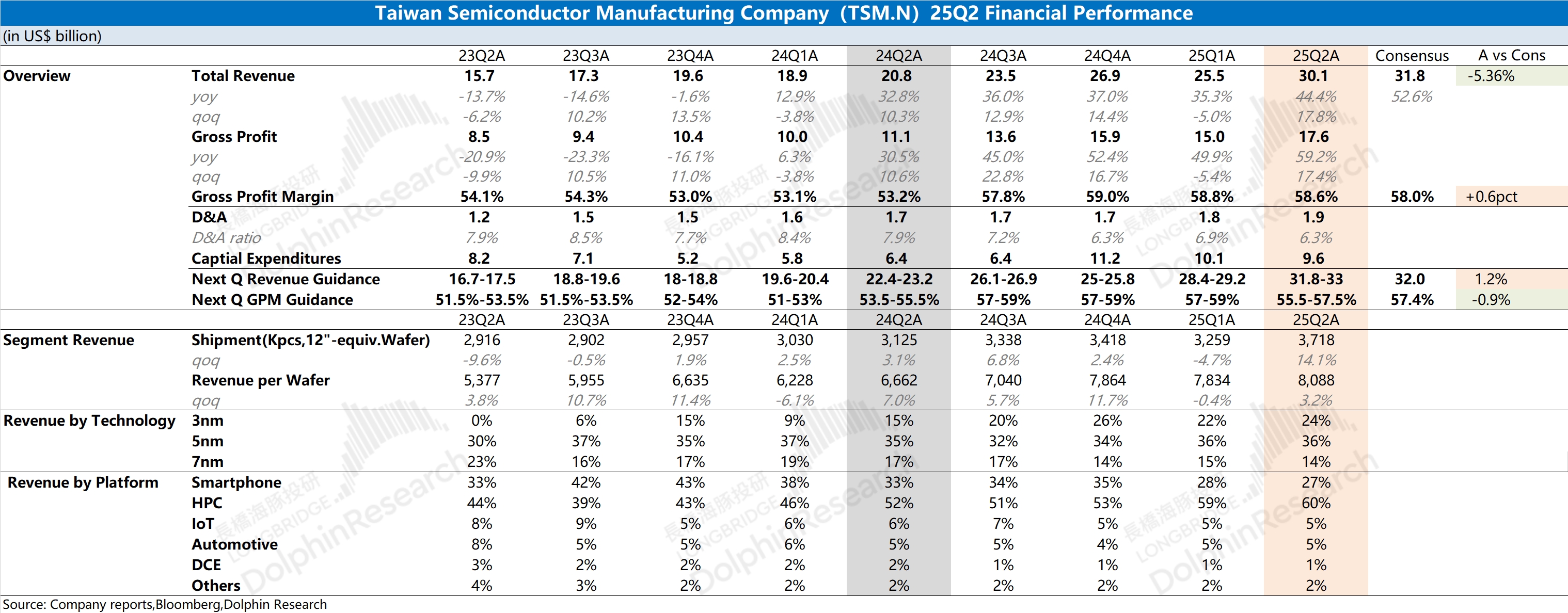

TSMC Quick Interpretation: The company's revenue and gross margin for this quarter both met the previous guidance expectations, with revenue reaching $30 billion, exceeding the upper limit of the company's guidance, partly due to exchange rate fluctuations. From the perspective of the New Taiwan Dollar, the company's quarterly revenue increased by 11.3% quarter-on-quarter, actually falling within the company's revenue guidance range (quarter-on-quarter growth of 11-14%).

Specifically: The company's growth this quarter was still mainly driven by high-performance computing, with its share rising to 60%, which helped maintain full capacity utilization of the company's advanced processes below 7nm. Currently, the share of processes below 7nm has increased to 74%, and with the increase in mass production of the GB series, the revenue share of advanced processes is expected to further increase.

Compared to this quarter's data, the market is more focused on TSMC's guidance and capital expenditure status:

a) Guidance: The company expects next quarter's revenue to be $31.8-33 billion (market expectation is $32 billion), with a gross margin of 55.5-57.5% (market expectation is 57.4%). The revenue side basically meets market expectations, while the appreciation of the New Taiwan Dollar will have some impact on the gross margin, but the overall operation remains stable;

b) Capital Expenditure: Unlike ASML's uncertain statements, the company's capital expenditure still maintains an annual expectation of $38-42 billion.

Although ASML's earnings report yesterday caused a stir in the semiconductor market, TSMC once again demonstrated stable performance. Although the overall demand in the semiconductor market remains weak, the demand in the AI structured market is driving TSMC's continued growth.

With the increase in mass production of the GB series, the release of Apple's new devices, and the subsequent launch of 2nm, TSMC will have the momentum for continued growth from the second half of this year to next year. Dolphin Research will later release a detailed analysis and specific minutes, so please stay tuned. $Taiwan Semiconductor(TSM.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.