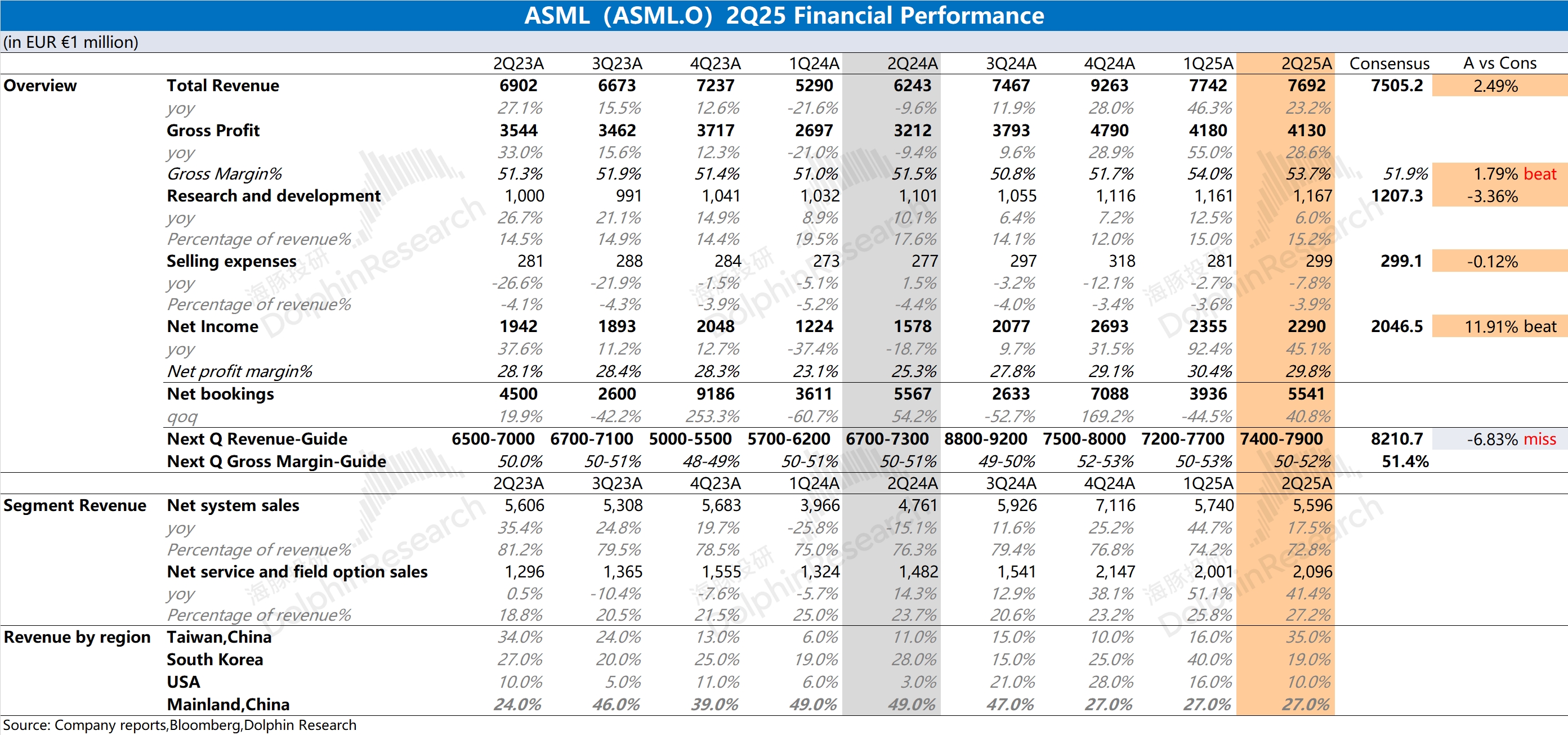

ASML Quick Interpretation: The company's revenue and gross margin for this quarter met market expectations, with the gross margin exceeding expectations most notably due to: a) increased service revenue from equipment upgrades and b) the negative impact of tariffs being weaker than anticipated.

Compared to this quarter's data, the market is more concerned about the company's order situation and guidance for the next quarter. The company reported orders of 5.54 billion euros this quarter, showing a significant rebound from the first quarter's 3.9 billion euros, and this figure is also significantly better than market expectations (4.5-4.8 billion euros), indicating that downstream customers' cautious expectations under tariff impacts have somewhat eased. However, ASML's guidance for the next quarter remains low, with the company expecting revenue of only 7.4-7.9 billion euros, showing no significant quarter-on-quarter improvement.

Although the order data suggests some easing at the downstream customer level, the current market still has concerns about ASML, mainly due to three reasons: 1) the uncertainty of U.S. tariffs, which will continue to impact customer capital expenditures; 2) Samsung and Intel are still in a budget-tightening phase; 3) potential risks in the Chinese region.

Overall, ASML's operations this year will mainly rely on TSMC, Micron, and SK Hynix, and this performance does not eliminate market concerns. Further attention is needed on the company's management communication. Dolphin Research will later release detailed analysis and specific minutes, so stay tuned~$ASML(ASML.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.