In early April, when the market was in turmoil due to the Sino-US trade war, Dolphin Research mentioned that $NVIDIA(NVDA.US)'s competitive barriers were unaffected, and with the B series GPUs ramping up in the second half of the year, there was hope for the stock to rise from below 100 to 160.

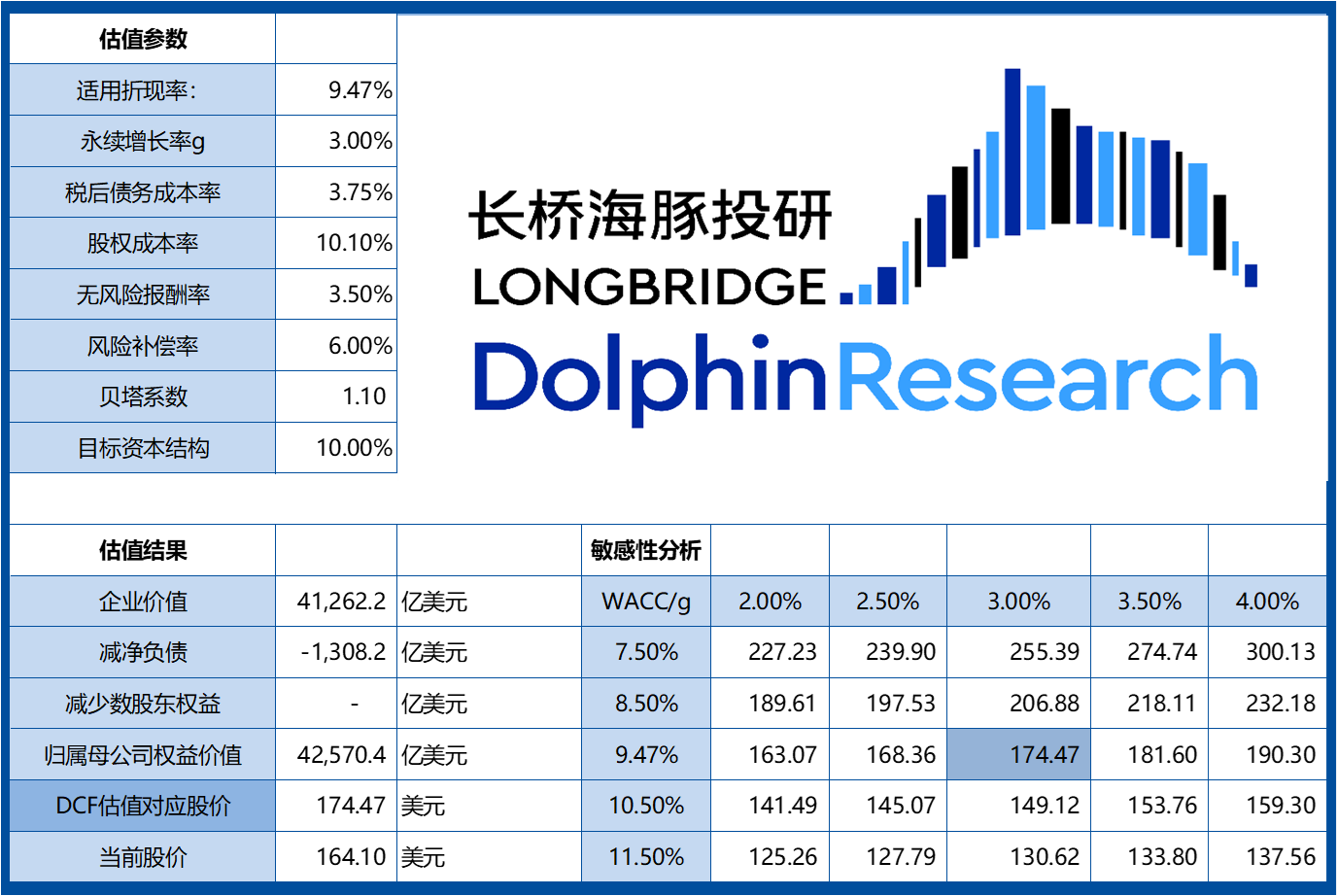

After the last quarter's earnings report, Dolphin Research reminded again that NVIDIA's range-trading had ended and an upward trend would resume, targeting $160 (4 trillion). Now that NVIDIA has reached 4 trillion, the next question is where it will go from here. In the past few days, Dolphin Research has recalculated using their model.

First, the answer: moving from $90 to $160 is the high-certainty part, which can be considered an opportunity arising from the market's mispricing. However, moving from $160 to $180 is estimated to be more challenging. If performance continues to develop optimistically, this possibility exists, but the risk-reward ratio will be significantly less favorable. Especially if it reaches $200 without fundamental support, the market cap will be quite inflated, making it difficult to maintain stability.

Why is this the case?

First, moving from $160 to an optimistic scenario of $180 or even $200 requires pricing in additional computing power demand in new scenarios such as sovereign AI, enterprise AI, and humanoid robots, beyond just the cloud service providers' TAM. However, government projects take time to materialize, and even though humanoid robots have a promising future, expecting them to contribute meaningfully within two years is likely overly optimistic.

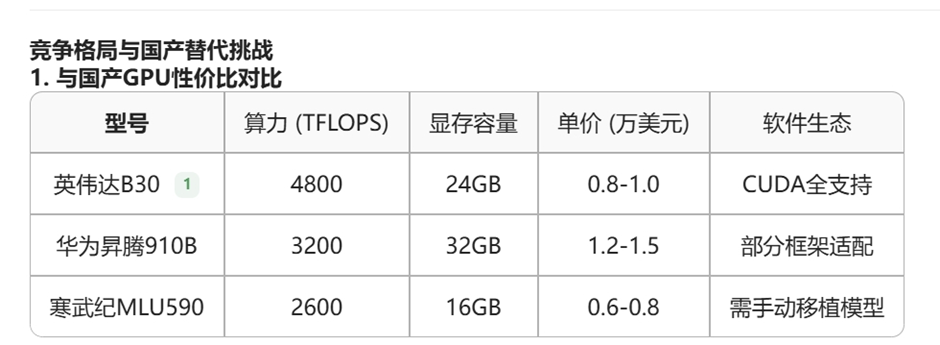

Second, due to the ban, NVIDIA has essentially estimated its revenue from the Chinese market as zero, but in reality, its Chinese business has not been reduced to zero. There are already special editions of the B series, B20, B30, and B40. Although the memory is significantly cut down, major companies have still placed orders, but this has already been reflected in the stock price.

Overall, for the stock price to move towards $200, a grander computing power narrative such as sovereign AI and humanoid robots needs to quickly materialize. It's not impossible, but the risk-reward ratio for capturing this part of the gain is not very high.

https://longportapp.cn/zh-CN/topics/30139163?channel=t30139163&invite-code=276530&app_id=longbridge&utm_source=longbridge_app_share&locale=zh-CN

https://longportapp.cn/zh-CN/topics/28963990?app_id=longbridge&utm_source=longbridge_app_share&channel=t28963990&invite-code=032064&locale=zh-CN&community_badge=1&profile_following_followers_activities=1

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.