After Powell, what will drive the next new high for the US stock market?

Hello everyone, I am Dolphin Research!

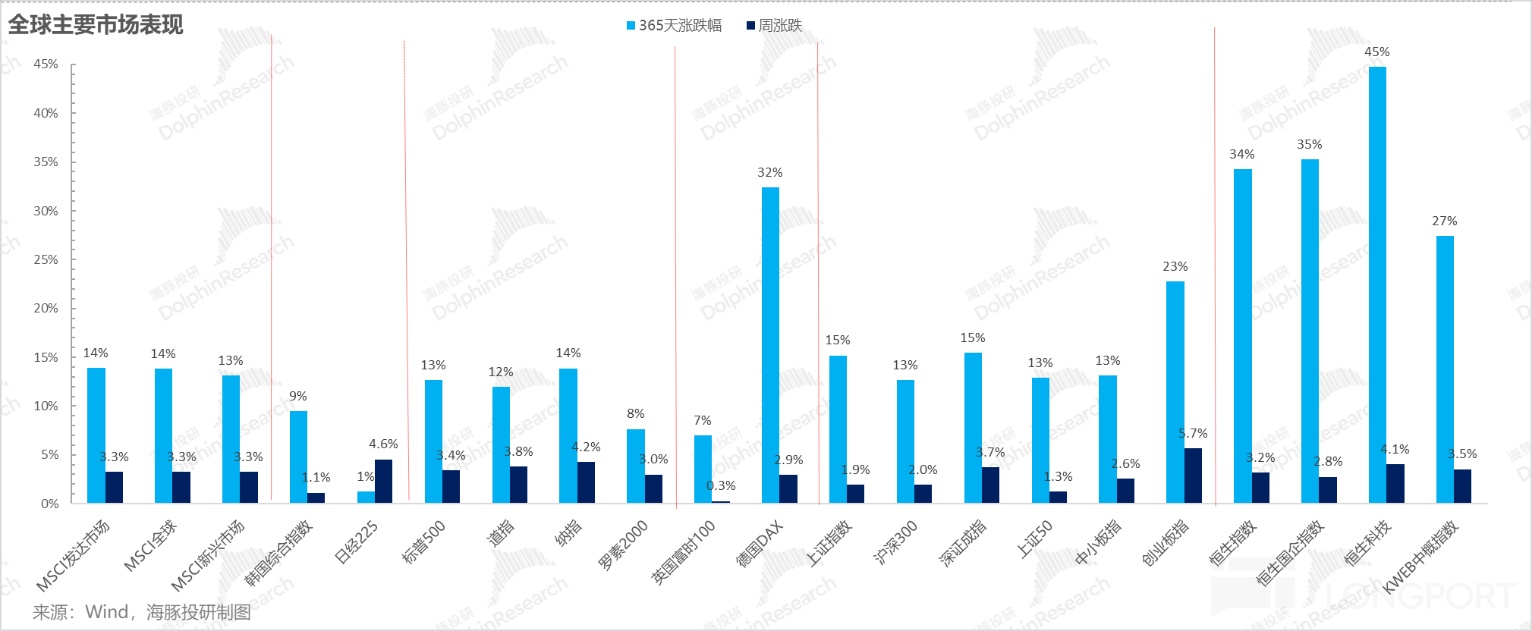

In last week's Strategy Weekly Report, Dolphin Research mentioned that Powell is not the savior, and the short-term upward pressure on U.S. stocks is relatively high. However, the main contradiction in the current market—Powell suddenly loosened his stance at the congressional hearing, resulting in global stock markets rising last week.

At the beginning of this year, with the breakdown of the belief in American exceptionalism, some people shouted "When a whale falls, all things thrive"—as the U.S. market declines and the dollar retreats, non-U.S. funds return to their respective markets, driving other market assets to rise.

But by the end of the first half, although U.S. stocks are no longer the sole leader, it is clear that this whale has not fallen but has reached new highs. The question now is, with American exceptionalism gone and the market already pricing in rate cuts, what else can drive U.S. stocks further up?

1. Rate Cut or No Rate Cut? The Key Contradiction in the Current Market

With American exceptionalism gone and tariff negotiation benefits fully priced in, and the issuance of U.S. Treasury bonds not far away, the economic fundamentals have become crucial. A core contradiction in returning to fundamentals has become very prominent—whether the Federal Reserve will cut interest rates. Why is this issue important?

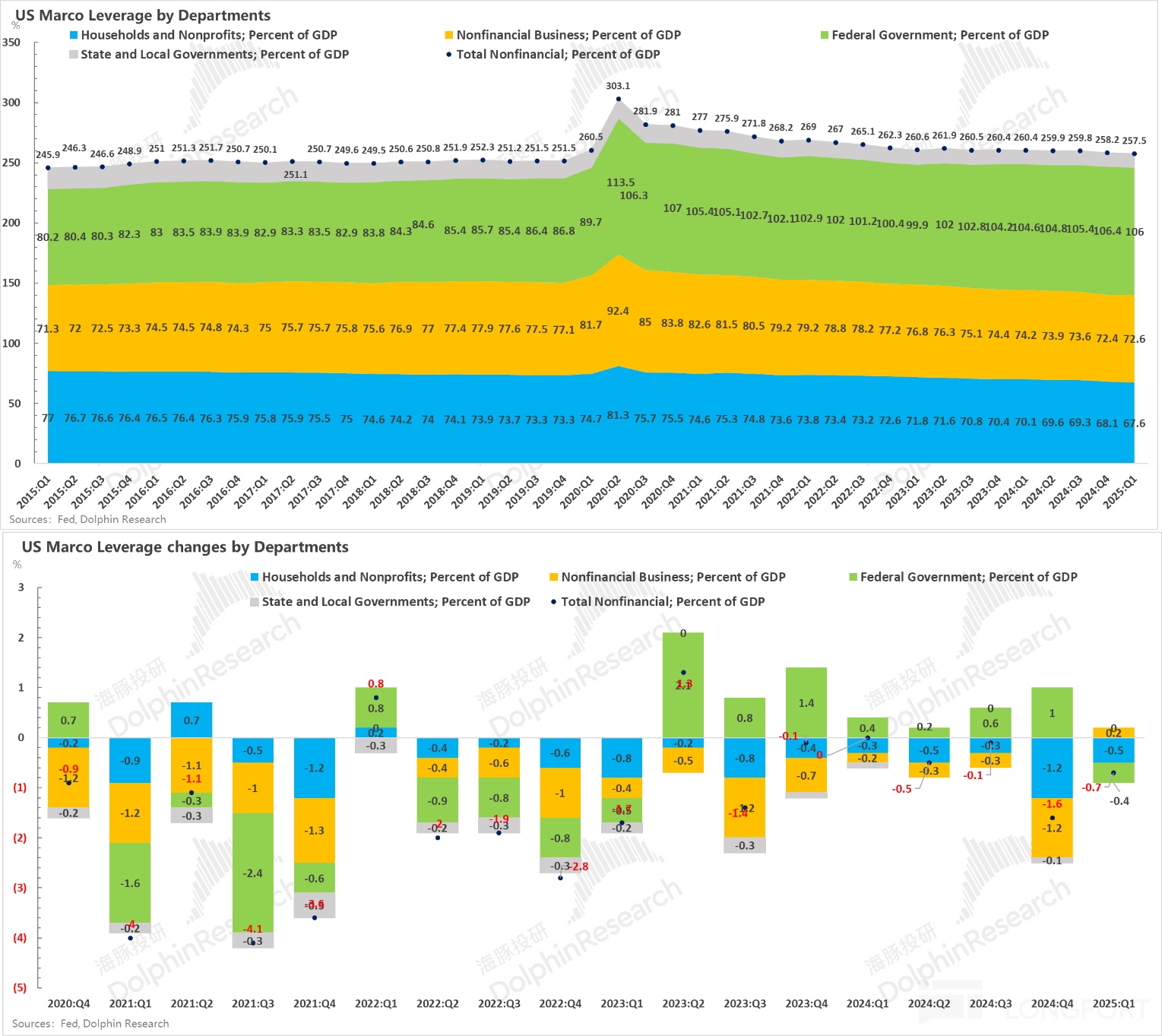

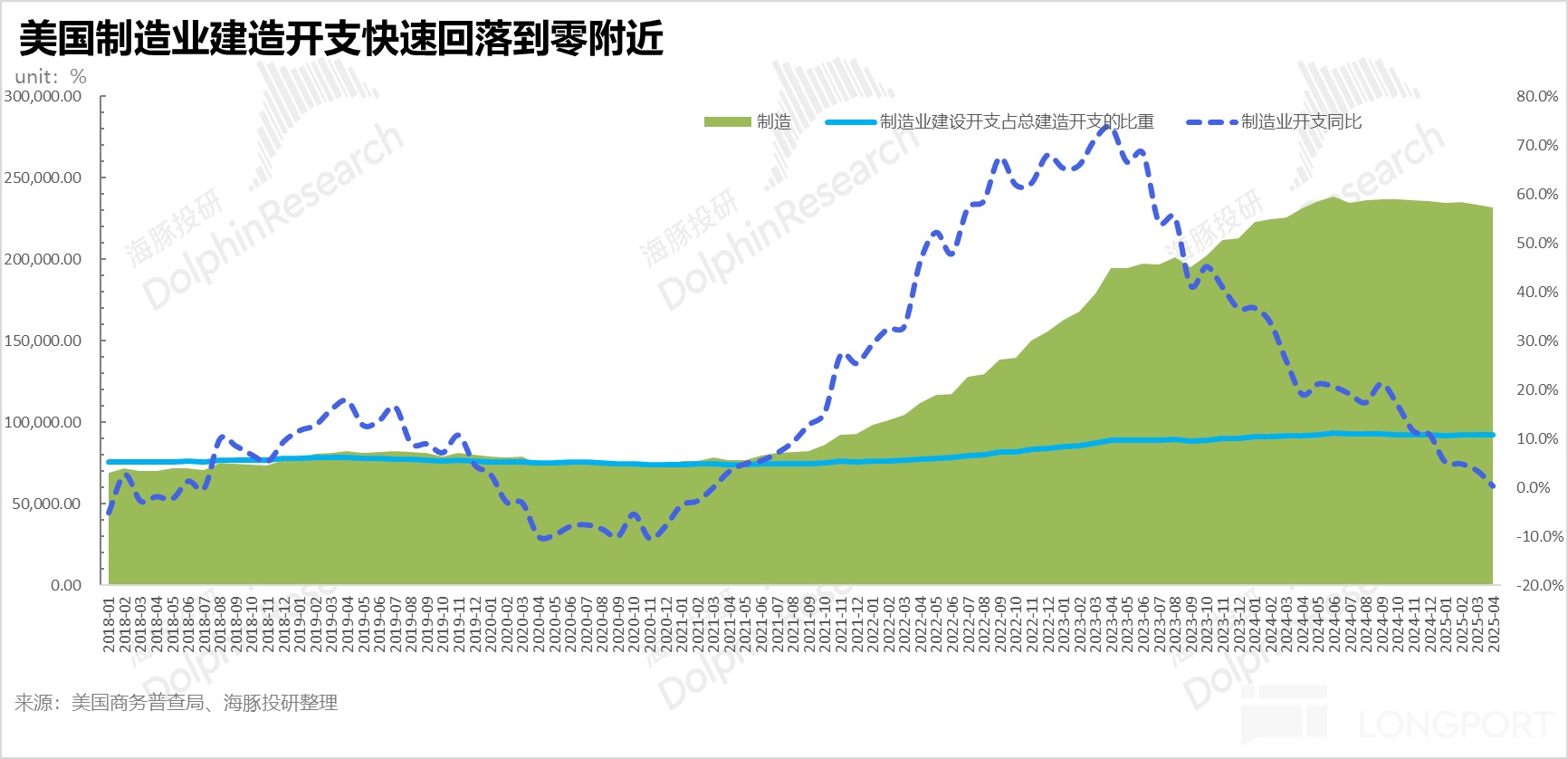

The Trump administration does not follow Bidenomics' approach of leveraging government projects for economic growth. From the results:

a. In the first quarter of 2025, he ended the federal government's consecutive seven quarters of leveraging, and the leverage ratio of the U.S. federal government finally decreased;

b. Under Bidenomics, the manufacturing construction expenditure (manufacturing capacity construction) driven by industrial stimulus bills has also peaked, and has been on a downward trend for the past six months.

Thus, the U.S. economic growth now faces a serious problem: the government has stopped leveraging, so which sector will step up to leverage for economic growth?

For the remaining economic entities, whether it's corporate leveraging or household leveraging, unlike the federal government, they cannot ignore interest rates to issue bonds. These are private actions that require accountability for their decisions, considering market interest rates and corresponding asset long-term return expectations.

Firstly, for households, the current mortgage interest rate level leads to a high proportion of monthly payments to income, making buying a house without a rate cut a stressful affair. It is unlikely for households to leverage under such circumstances.

From a corporate perspective: In the first quarter, only non-financial corporations were slightly leveraging, but for them to continue or leverage more significantly, policy measures can only involve interest and taxes. Tax cuts correspond to the "Big Beautiful Act," while rate cuts depend on the Federal Reserve's decision.

Currently, Trump's economic policy is clear: impose tariffs externally, reduce taxes internally, cut rates, continue to expand the U.S. debt scale, use time to exchange space, and use market factors (interest rates and tax rates) to guide companies to restore manufacturing investment.

Currently, the key link is stuck on Powell's interest rate policy, with a 4.33% short-term risk-free federal funds rate, making it difficult for market entities to truly leverage.

2. Poor Consumer Spending, Powell Finally Loosened Up

On June 18th, the steadfast guardian of the dollar's "credit," Powell, at last week's congressional hearing, rarely loosened his stance, with a noticeably weaker tone regarding rate cuts.

At the hearing, Dolphin Research summarized the main new key information conveyed:

a. Without changes in tariff policy, given the current U.S. economic data performance, the Federal Reserve should have already cut rates;

b. The current job market is stable, and the unemployment rate is favorable. The Federal Reserve has the confidence to choose not to cut rates now but to observe the impact of tariffs.

c. Whether tariffs affect prices can be observed through the economic data in June and July. (PS: If the impact is minimal, it equates to a lesson learned, and rate cuts will follow);

d. The economic outlook from the June 18th meeting reflects that most members believe tariffs will still affect prices.

However, this change in wording carries a very crucial piece of information—the hearing just passed, and the U.S. May consumer spending data was released, showing very poor results:

In May, consumer spending, which accounts for over 70% of GDP, saw a month-on-month negative growth of 0.28%, the worst month-on-month negative growth in over a year.

From the month-on-month trend, the impact of tariff policy is clearly significant. On April 2nd, before Liberation Day, due to pre-stocking, March consumer spending surged, then stagnated in April, and further declined by nearly 0.3% in May.

From the breakdown, durable goods consumption declined significantly, but the key point is that service consumption, which has been resilient and less related to tariffs, also turned negative. This clearly indicates that even without tariff impact, consumer spending is weakening.

From the current pace: tariff revenue has already been collected, but importers pre-stocked + consumers pre-purchased, and the circulation of goods after tariffs is not much. Currently, in May's prices, only digital 3C products show some tariff-induced price impact, insufficient to shake the overall price level.

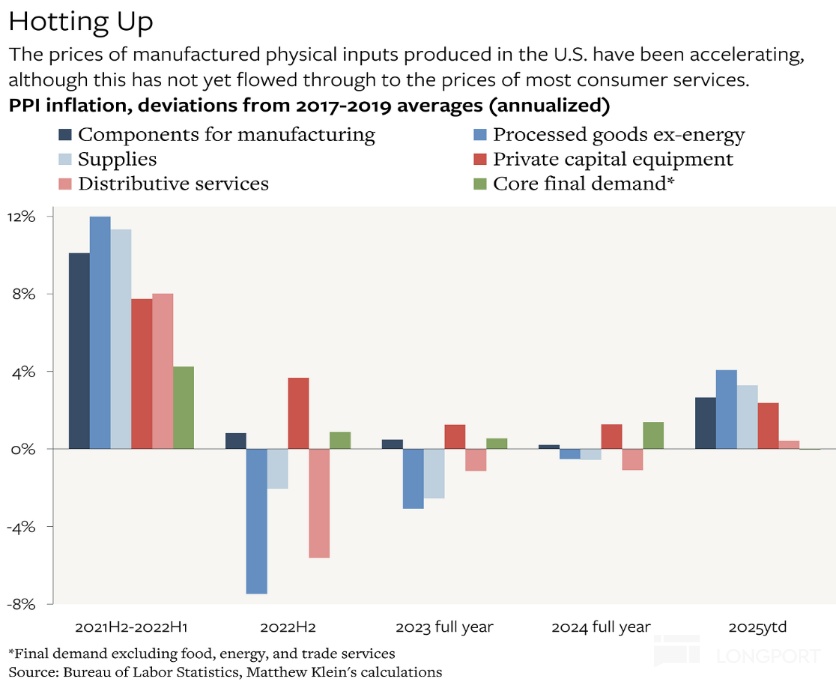

So, the next important question to consider is whether tariffs will truly affect prices and continue to have an impact? From current data, some core PPI projects show an upward trend, but have not yet reached consumer prices.

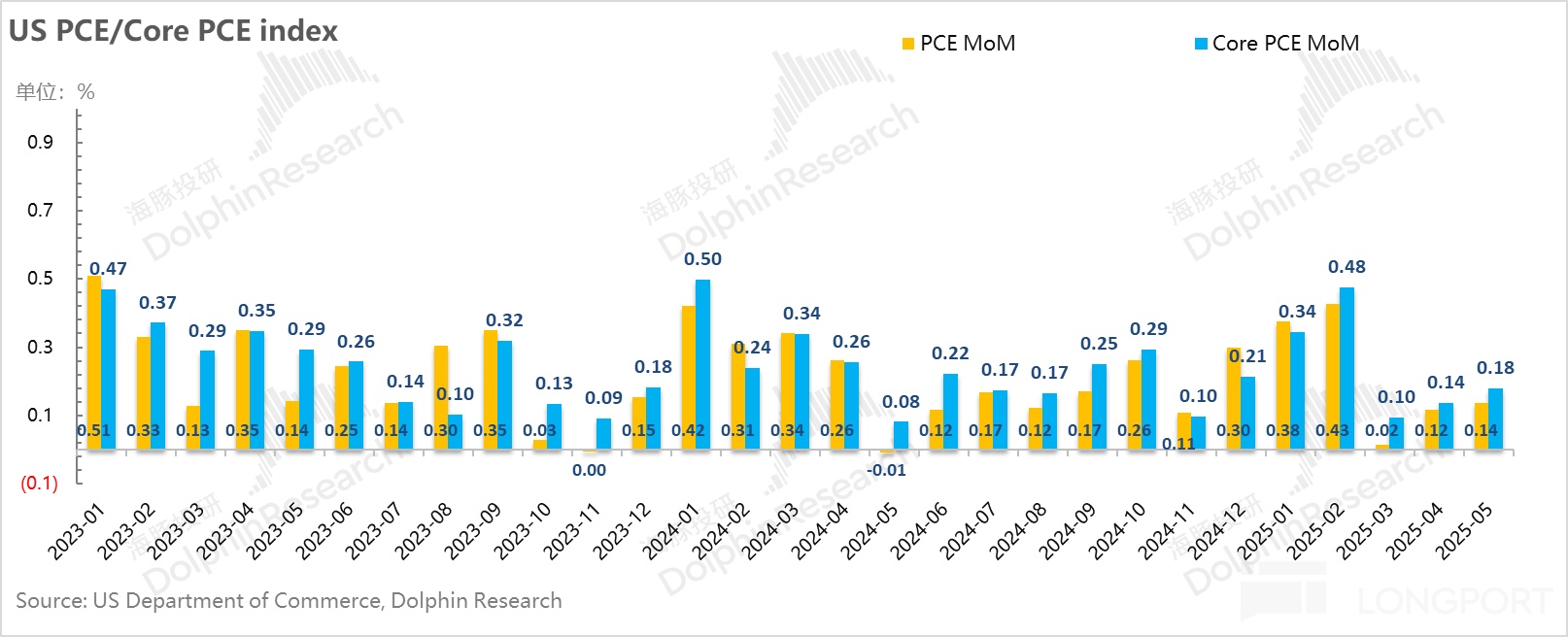

From the Federal Reserve's more concerned core PCE perspective, it has been marginally rising in the past three months. Although the month-on-month rate in May was 0.18%, not high in itself, if the trend continues to rise, it does not support the Federal Reserve's decision to cut rates in September.

Overall, Dolphin Research still tends to believe that the Federal Reserve is currently in a dilemma. Without rate cuts, it is difficult for businesses and households to leverage, but if rates are cut and prices rebound, controlling inflation will be more challenging.

3. Entering the Concentrated Deadline for Tariff Negotiations in Early July

But now the market has already priced in the expectation of a rate cut in September, essentially leaving little safety margin. What other factors might drive the market further up?

Besides the upcoming earnings season for fundamental verification, one macro factor not to be ignored is the U.S. tariff negotiations with various countries:

On July 8th, the 90-day suspension period for reciprocal tariffs with 57 countries will end. If new agreements are not reached, tariff rates will jump from 0% to 20%. At this critical negotiation point, Trump is playing extreme pressure, stating no need for extension, and if not reached, will directly announce new rates.

For key countries, the U.S. and Europe need to reach an agreement by July 9th, or face a 50% high tariff; U.S.-China negotiations on the suspended 24% reciprocal tariff need to reach a new agreement by August 11th, or the 24% tariff will be reinstated; Japan needs to observe the trade agreement reached before the July 20th Japanese parliamentary election.

Overall, this weekend and early next week will enter a dense negotiation deadline period, with potentially many games. Currently, tariff pricing is gradually in the optimistic direction of 10%-15%, and risks need to be noted.

4. Portfolio Returns

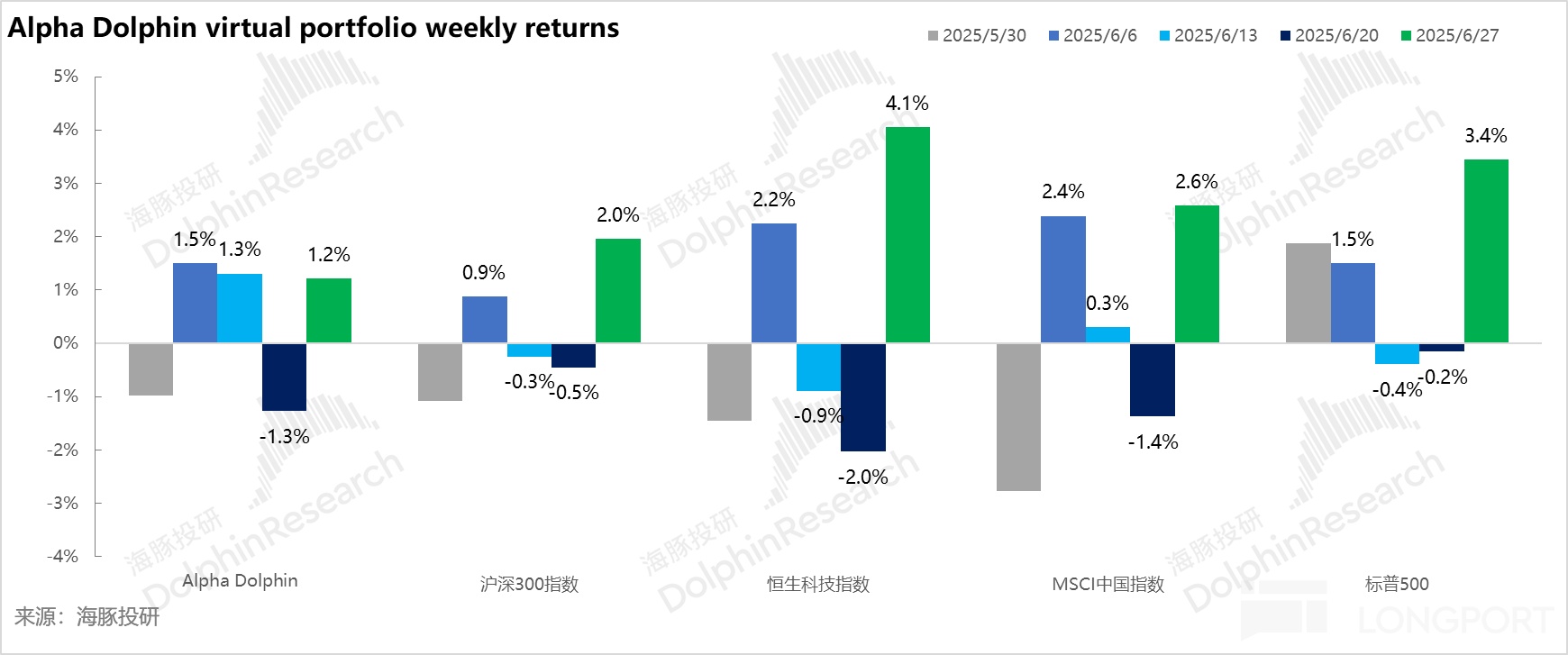

Last week, the virtual portfolio Alpha Dolphin of Dolphin Research did not adjust positions, rising 1.2% for the week, underperforming the observed market—S&P 500 (+3.4%), CSI 300 (+2%), MSCI China (+2.6%), and Hang Seng Tech (+4.1%).

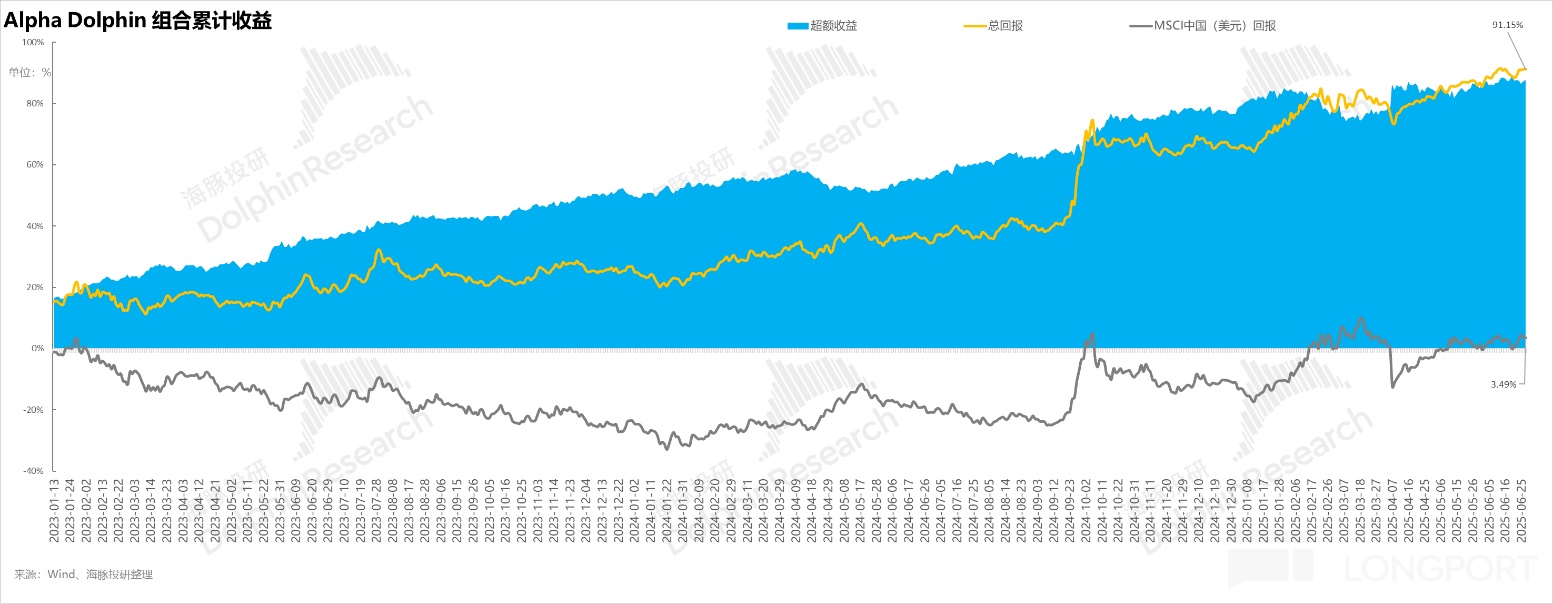

Since the portfolio began testing (March 25, 2022) until last weekend, the portfolio's absolute return is 91.1%, with an excess return of 87.7% compared to MSCI China. From an asset net value perspective, Dolphin Research's initial virtual asset of $100 million has exceeded $195 million as of last weekend.

5. Contribution of Individual Stocks to Gains and Losses

Last week, the Alpha Dolphin portfolio underperformed the U.S. stock index mainly due to the adjustment in gold positions and insufficient equity positions; Dolphin Research explains the specific stocks with significant fluctuations as follows:

6. Asset Portfolio Distribution

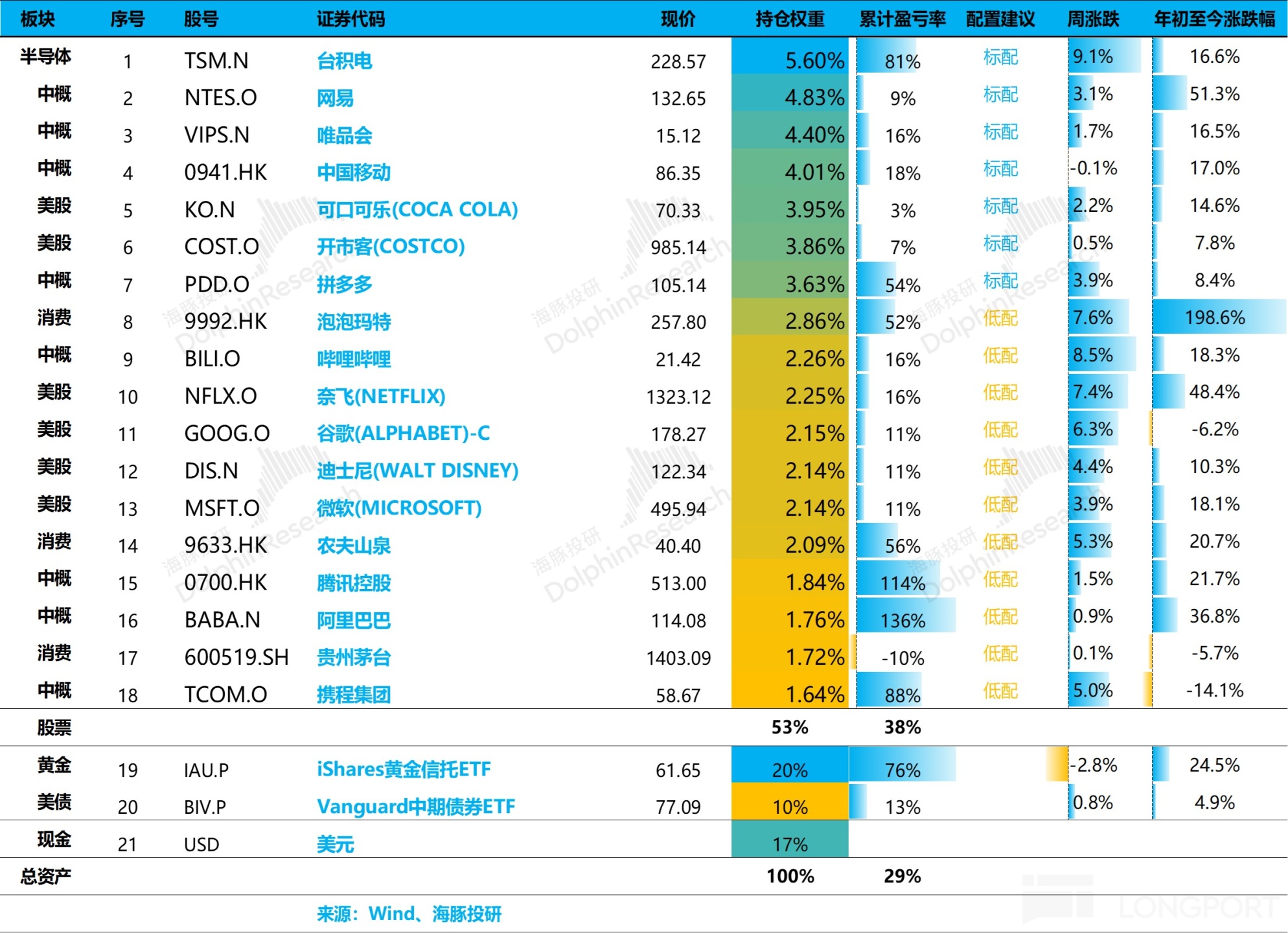

The Alpha Dolphin virtual portfolio holds a total of 18 stocks and equity ETFs, with 7 standard allocations and the rest underweight. Assets outside of equity are mainly distributed in gold, U.S. Treasury bonds, and U.S. dollar cash, with the current equity assets and defensive assets like gold/U.S. Treasury/cash approximately at a 53:47 ratio.

As of last weekend, the Alpha Dolphin asset allocation distribution and equity asset holding weights are as follows:

<End of Text>

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure

For recent weekly reports of Dolphin Research portfolio, please refer to:

"Can Trump Still 'Toss' U.S. Stocks to New Highs?"

"U.S. Stocks Fall, Hong Kong Stocks Feast: How Far Can Hong Kong Stocks' Structural Revaluation Go?"

"This is the Most Down-to-Earth, Dolphin Investment Portfolio Starts Running"

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.