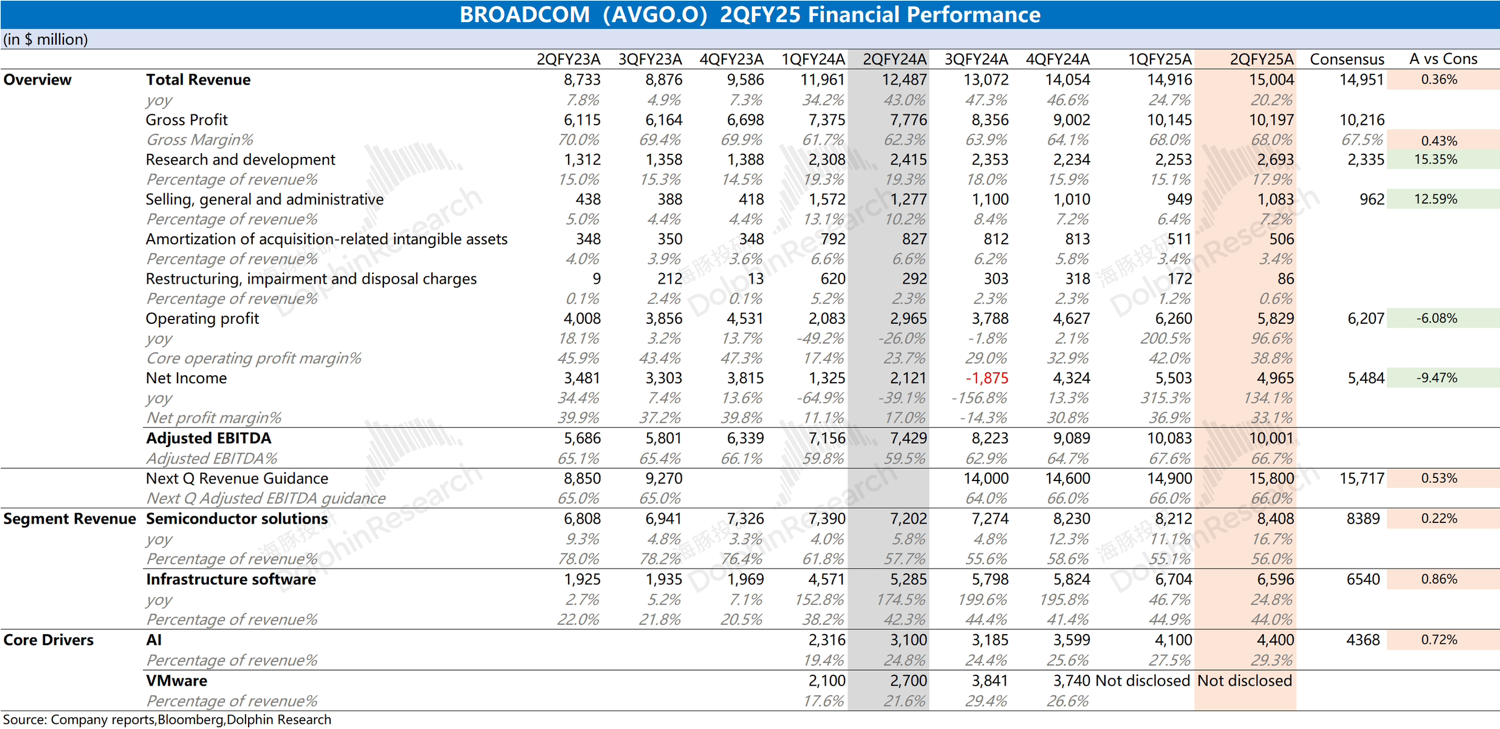

Broadcom AVGO Quick Interpretation: The company's earnings report was generally in line with expectations. Revenue growth was as expected, while the profit side fell short of expectations due to increased expenses, primarily from higher equity-based compensation costs this quarter.

1) Revenue: The semiconductor business generated $8.4 billion, up approximately $200 million sequentially, mainly driven by growth in the AI business. The software business generated $6.6 billion, down $100 million sequentially. As the integration of VMware's financials nears completion, the company no longer discloses specific business revenue performance separately.

For the AI business, which is the market's primary focus, the company reported $4.4 billion in revenue this quarter, largely in line with market expectations. The sequential growth slowed, mainly due to Google's TPU being in a generational transition phase. However, with the ramp-up of TPUv6 production, the company expects AI revenue to accelerate, projecting next quarter's AI revenue to reach $5.1 billion.

2) Expenses: After completing the financial integration of VMware, the company has been streamlining and reducing expenses. The increase this quarter was primarily due to higher equity-based compensation costs, up approximately $440 million sequentially. Excluding this increase, core expenses rose slightly, and profits were largely in line with market expectations.

Overall, Broadcom's earnings report was solid. For the next quarter, the company expects revenue of $15.8 billion, in line with market expectations, driven by increased shipments of Google's TPUv6. With VMware's integration complete, the AI business is the company's key focus, and the market is looking for more upside surprises.$Broadcom(AVGO.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.