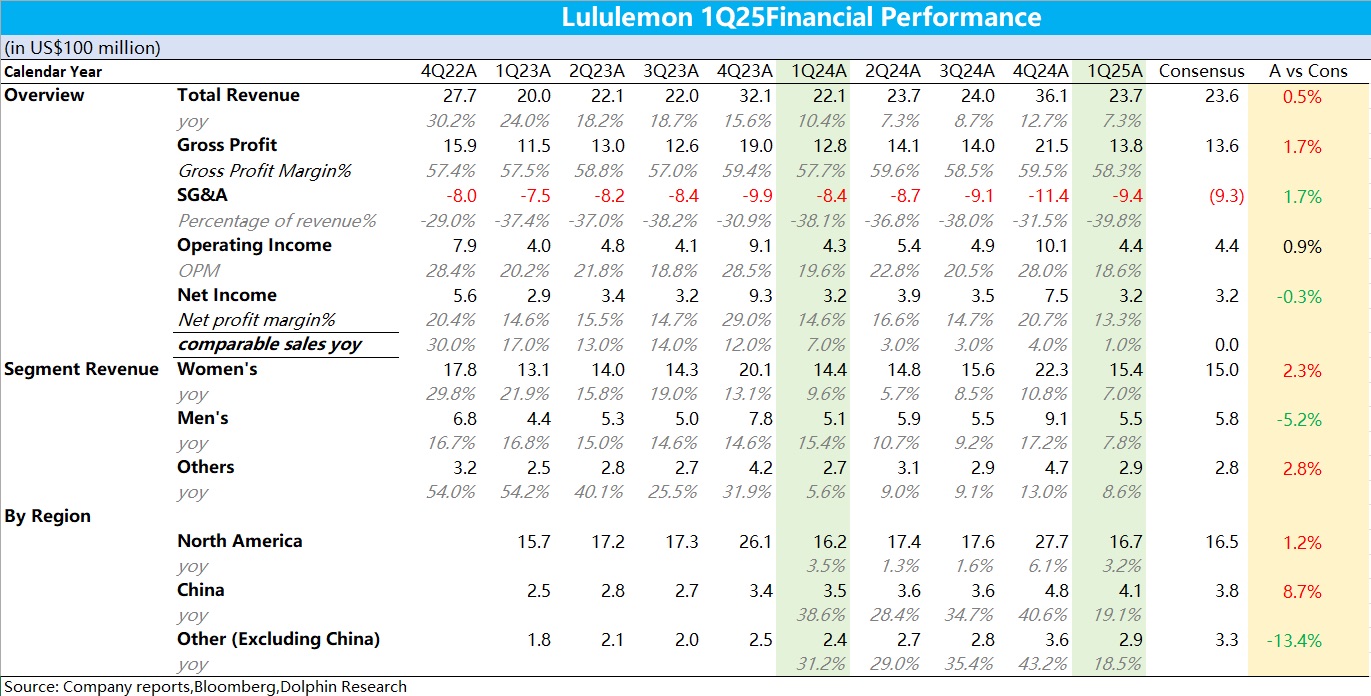

Lululemon 1Q25 Quick Interpretation: Since the company's guidance for the last quarter was already low, LULU's performance this quarter barely met expectations in terms of revenue, approaching the upper limit of the company's guidance. However, increased expenses led to profits falling short of market expectations. From the market's reaction, the 22% after-hours plunge was mainly due to LULU's impaired growth potential and the valuation downgrade it faces as it enters a low-growth phase.

1) Revenue-wise, by category, women's apparel just met expectations, with growth similar to overall revenue. Men's apparel, as LULU's second growth curve, had a low base but only grew by 8% (1% higher than women's apparel), which was below expectations despite the company's claims of heavy investment in this segment. Regionally, both North America (its stronghold) and China slowed as expected. From an expectation gap perspective, other regions outside China also underperformed market expectations due to slowed expansion and macroeconomic pressures.

2) Gross margin saw a slight 1% YoY improvement due to product mix optimization, unaffected by U.S. tariffs effective from April. Expense-wise, Dolphin Research speculates that LULU's international expansion led to higher upfront costs, pushing the three expense ratios to nearly 40%, resulting in both core operating profit and net profit missing expectations.$Lululemon(LULU.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.