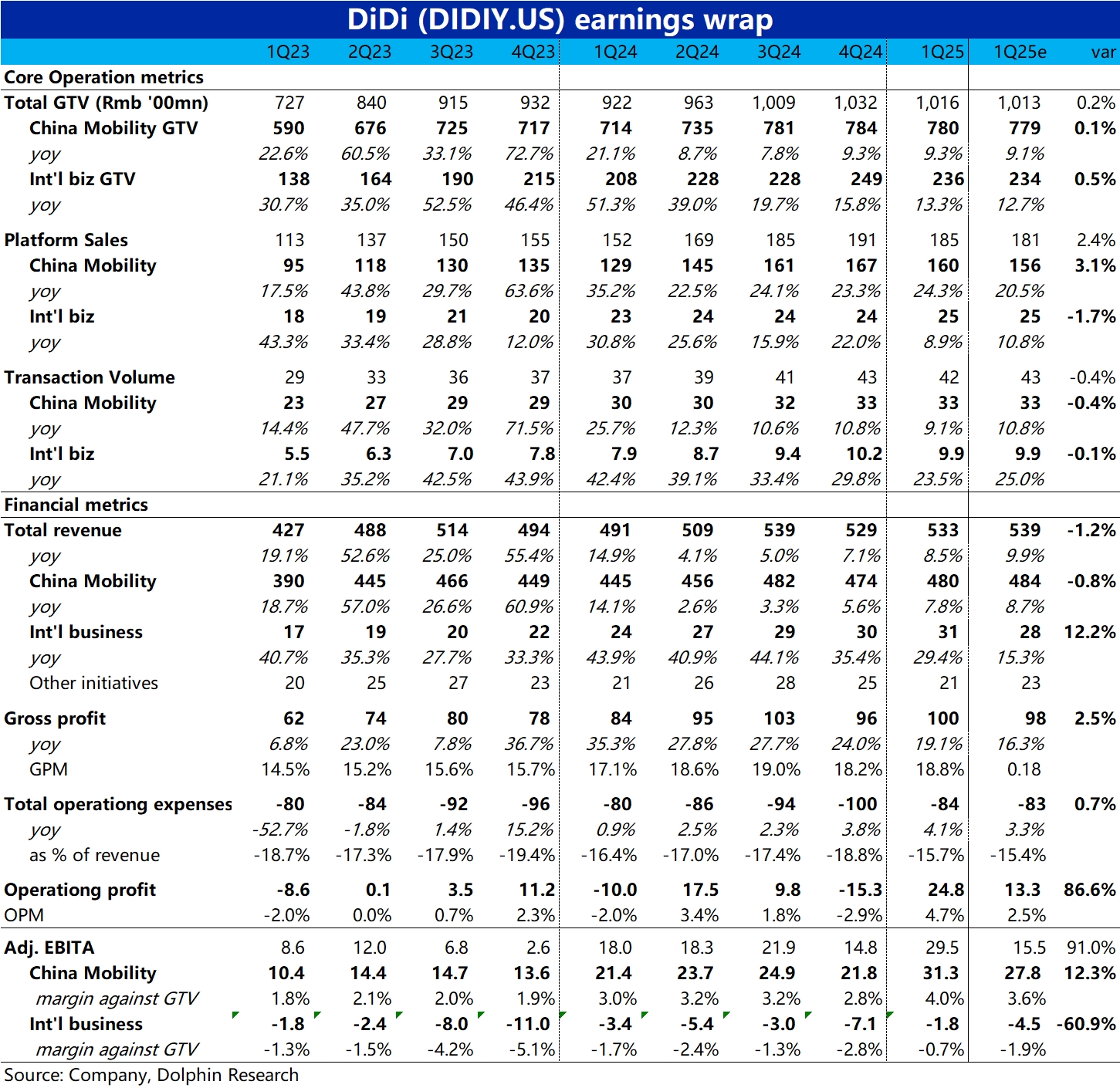

Didi 1Q25 Quick Interpretation: Didi's financial performance this time is generally in line with expectations in terms of growth, while the profit release is quite impressive, both in terms of expectation gap and trend.

1) On the growth side, whether it's core operational indicators like GTV and order volume, or financial indicators like revenue, they are largely in line with expectations, showing stability. The GTV and revenue growth of domestic business remain stable at a high single-digit level.

2) The main highlight is the profit. This quarter, the adjusted EBITA of Didi's China mobility business exceeded 3.1 billion (a record high), 12% higher than expected. The loss of overseas business was less than 200 million, far below the sell-side expectation of a 450 million loss.

In terms of trend, the issues from last quarter—declining domestic business profit and significantly expanding overseas business losses—have both reversed this quarter. The market's response is likely to be positive.

The reason for the profit exceeding expectations is mainly due to the domestic business platform's retained revenue, which increased by 20% YoY despite GTV growth being less than 10%. This indicates an increase in the platform's overall monetization rate. $DiDi(DIDIY.US)

(Note: Since Didi is in the OTA market, there are not many sell-side analysts tracking it, so the market may not have a fully consistent expectation. However, based on this performance, the sell-side expectations were relatively accurate.)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.