Nio 1Q25 Quick Interpretation: Overall, Nio's performance once again missed market expectations, but it was still within Dolphin Research's expectations. Compared to the terrible first-quarter performance itself, the market will pay more attention to whether the second-quarter guidance can show a marginal improvement trend, especially after the facelift of Nio's main brand's best-selling 5566 model and the official delivery and ramp-up of the Firefly model in April.

First, let's talk about the first-quarter performance:

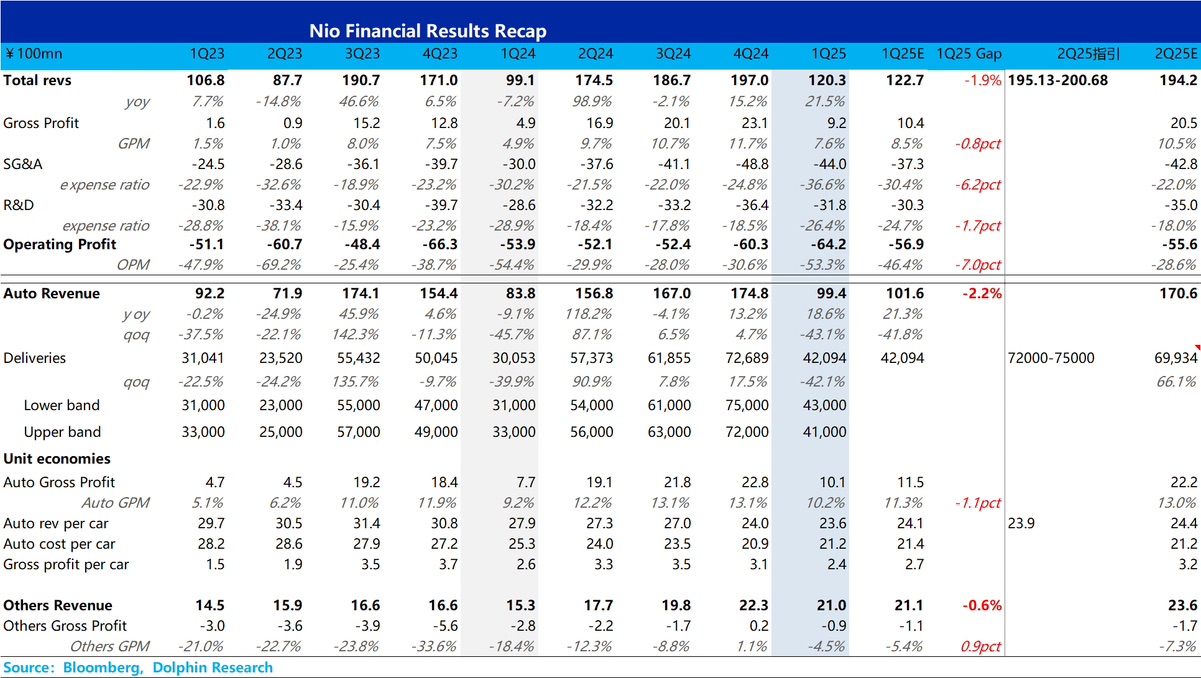

The sequential decline in revenue per vehicle was due to increased discounts on old inventory and the negative drag from the model mix, with the L6 accounting for a higher proportion. Dolphin Research believes that the market's expectation of flat sequential revenue per vehicle this quarter was unreasonable in the first place.

As for the gross margin on vehicle sales, Nio had already communicated that this quarter's gross margin would be around 10% (after the 4Q24 earnings call), mainly due to lower unit prices and a 42% sequential decline in sales volume, which increased the per-vehicle depreciation cost.

In terms of selling and administrative expenses, the last earnings call mentioned that the first-quarter adjustments would not take effect so quickly and would start to show results in the second quarter. Therefore, the 700 million difference between the operating profit and market expectations this quarter (600 million due to selling and administrative expenses not yet adjusted and 100 million due to the miss in vehicle gross margin) is still acceptable, mainly because the stock price has already fallen to a relatively low level.

So let's focus on the second-quarter guidance: second-quarter deliveries of 72,000-75,000 vehicles, equivalent to June deliveries of 25,000-28,000 (April and May deliveries were both 23,000), showing continued marginal improvement, which is a good short-term positive. In terms of revenue guidance, although the implied vehicle selling price is about 239,000, falling short of the market's expectation of 244,000, this is not a big issue given the increasing proportion of the low-priced Firefly model. After all, at this stage, the most important thing for Nio is still sales volume—with sales comes hope for survival. Nio's second-quarter marginal improvement is highly certain, and short-term trading opportunities can be considered.$NIO(NIO.US)$NIO-SW(09866.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.